2025 401(k) Contribution Limits: A Comprehensive Guide

Related Articles: 2025 401(k) Contribution Limits: A Comprehensive Guide

- 2025 Chevy Equinox: A Fuel-Efficient SUV With Enhanced Performance

- 2025 Jeep Grand Cherokee: A Comprehensive Overview

- Project 2025: A Vision For The Future Of Video

- The 2025 Mustang Engine: A Detailed Overview

- The Chevrolet Impala SS: A Legacy Of Performance And Style

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 401(k) Contribution Limits: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 401(k) Contribution Limits: A Comprehensive Guide

2025 401(k) Contribution Limits: A Comprehensive Guide

Introduction

A 401(k) is a retirement savings plan offered by many employers in the United States. It allows employees to save for retirement on a tax-advantaged basis. Contributions to a 401(k) are made pre-tax, which reduces the employee’s current taxable income. The money in a 401(k) grows tax-deferred until it is withdrawn in retirement.

The Internal Revenue Service (IRS) sets limits on how much money employees can contribute to their 401(k) plans each year. These limits are adjusted annually for inflation. For 2025, the contribution limits for 401(k) plans have increased.

2025 401(k) Contribution Limits

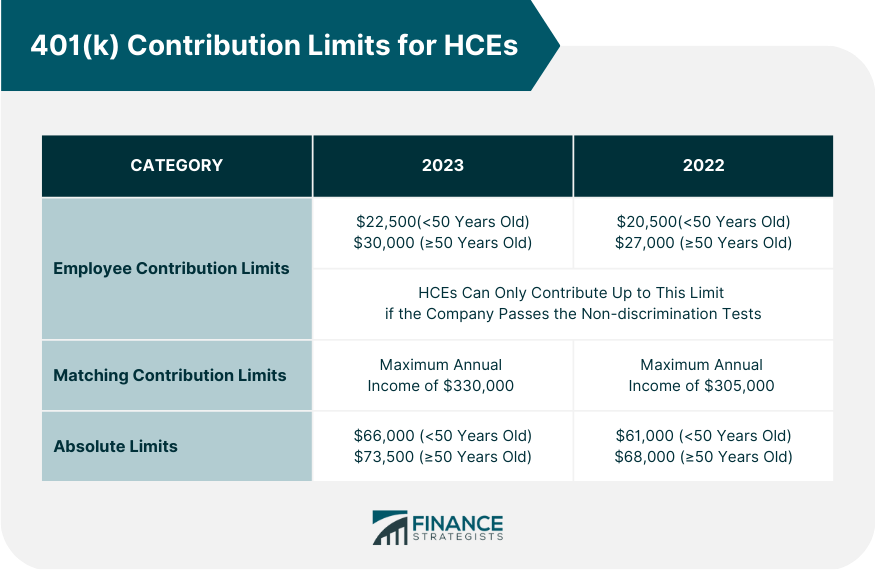

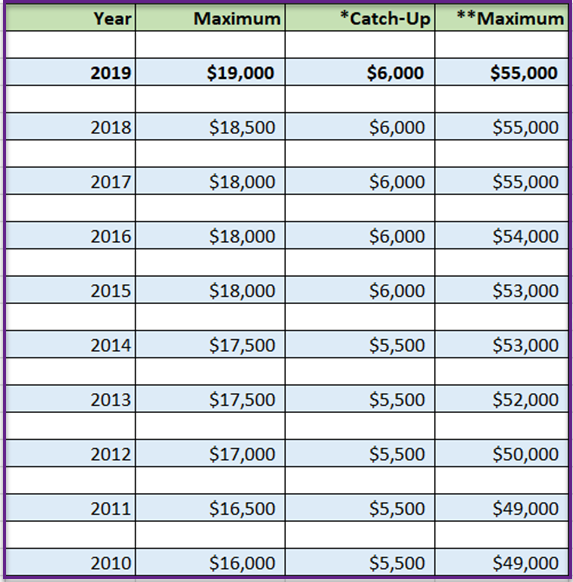

- Employee Elective Deferrals: The maximum amount that employees can contribute to their 401(k) plans in 2025 is $22,500. This is an increase of $1,000 from the 2024 limit.

- Catch-up Contributions: Employees who are age 50 or older by the end of the calendar year can make catch-up contributions of up to $7,500 in 2025. This is an increase of $500 from the 2024 limit.

- Employer Contributions: Employers can also contribute to their employees’ 401(k) plans. The maximum amount that employers can contribute in 2025 is $66,000. This is an increase of $1,000 from the 2024 limit.

Eligibility for 401(k) Plans

To be eligible to participate in a 401(k) plan, you must be an employee of a company that offers the plan. You must also be at least 21 years old and have worked for the company for at least one year.

Tax Benefits of 401(k) Plans

Contributions to a 401(k) plan are made pre-tax, which reduces your current taxable income. This means that you will pay less in taxes now. The money in your 401(k) grows tax-deferred until it is withdrawn in retirement. This means that your money has more time to grow, which can help you reach your retirement goals faster.

When you withdraw money from your 401(k) in retirement, you will pay taxes on the withdrawals. However, the tax rate you pay in retirement is likely to be lower than the tax rate you pay now. This is because most people’s income is lower in retirement than it is during their working years.

Investment Options for 401(k) Plans

Most 401(k) plans offer a variety of investment options, such as:

- Stocks

- Bonds

- Mutual funds

- Target-date funds

- Stable value funds

You can choose the investment options that are right for you based on your risk tolerance, time horizon, and retirement goals.

Withdrawals from 401(k) Plans

You can start taking withdrawals from your 401(k) plan when you reach age 59½. However, you may be subject to a 10% early withdrawal penalty if you take withdrawals before age 59½.

There are several ways to take withdrawals from your 401(k) plan:

- You can take a lump sum distribution.

- You can take periodic withdrawals.

- You can roll over your money to an IRA.

Choosing the Right 401(k) Plan

If your employer offers a 401(k) plan, it is important to choose the right plan for you. Consider the following factors when choosing a 401(k) plan:

- Investment options: Choose a plan that offers a variety of investment options that meet your risk tolerance, time horizon, and retirement goals.

- Fees: Some 401(k) plans have fees associated with them. Be sure to compare the fees of different plans before choosing one.

- Employer match: Many employers offer a matching contribution to their employees’ 401(k) plans. Be sure to take advantage of this free money if it is offered.

Conclusion

A 401(k) plan is a great way to save for retirement on a tax-advantaged basis. The 2025 401(k) contribution limits have increased, so now is a great time to start saving for your future. If you are not already participating in a 401(k) plan, talk to your employer about enrolling today.

Closure

Thus, we hope this article has provided valuable insights into 2025 401(k) Contribution Limits: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!