2025 Form 1040: Comprehensive Guide to the Revised Tax Return

Related Articles: 2025 Form 1040: Comprehensive Guide to the Revised Tax Return

- The 2025 Porsche 718 Boxster: A Symphony Of Performance And Refinement

- Dr In Kaufman Tx

- Top Interior Design Trends For 2025: Embracing Sustainability, Functionality, And Personalization

- Squid Game Season 2: Unveiling The Thrilling Continuation On January 24, 2025

- 2025: A Year Of Transformation And The Dawn Of A New Era

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2025 Form 1040: Comprehensive Guide to the Revised Tax Return. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Form 1040: Comprehensive Guide to the Revised Tax Return

2025 Form 1040: Comprehensive Guide to the Revised Tax Return

Introduction

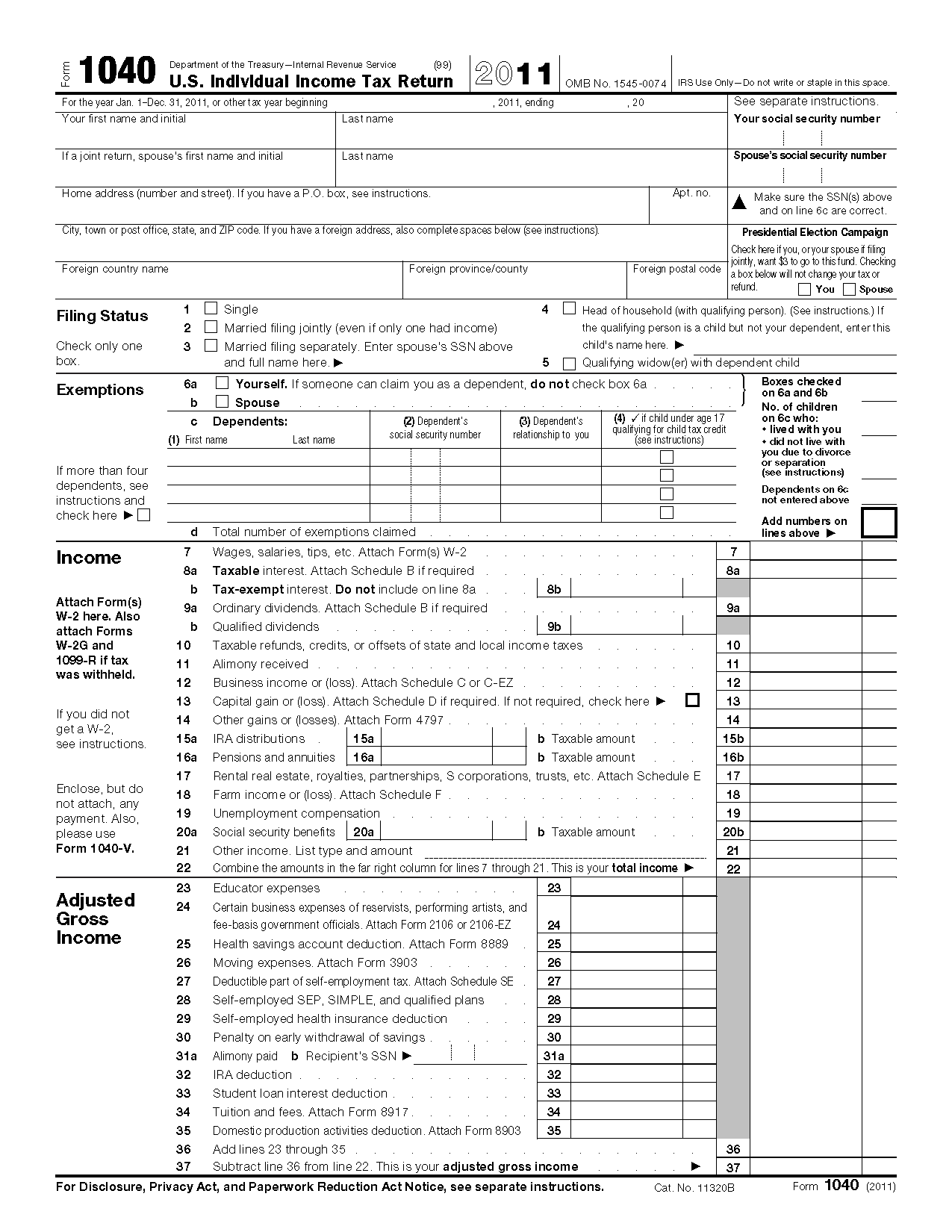

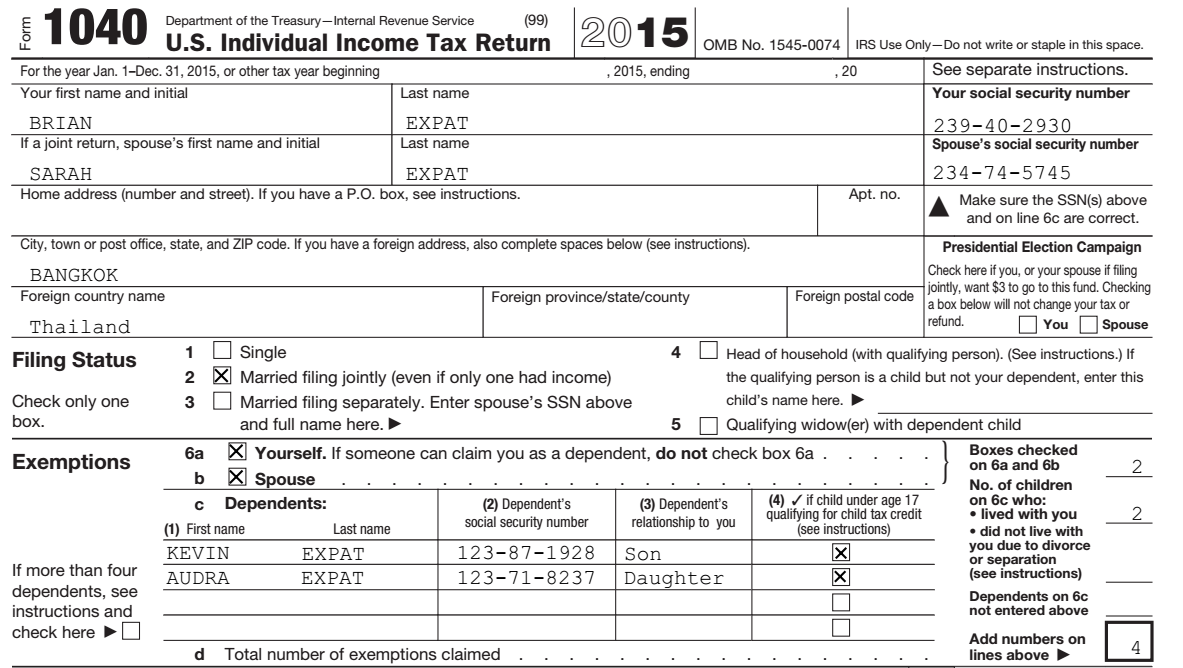

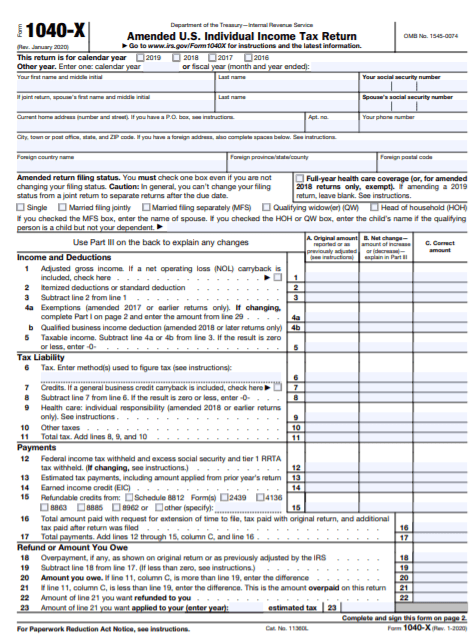

The Internal Revenue Service (IRS) has announced significant changes to the Form 1040, the primary tax return used by individual taxpayers in the United States. Effective for tax year 2025, the 1040 form will undergo a comprehensive revision to simplify and streamline the tax filing process. This article provides a detailed guide to the revised 2025 Form 1040, highlighting its key features, changes, and implications for taxpayers.

Key Features of the Revised 1040 Form

-

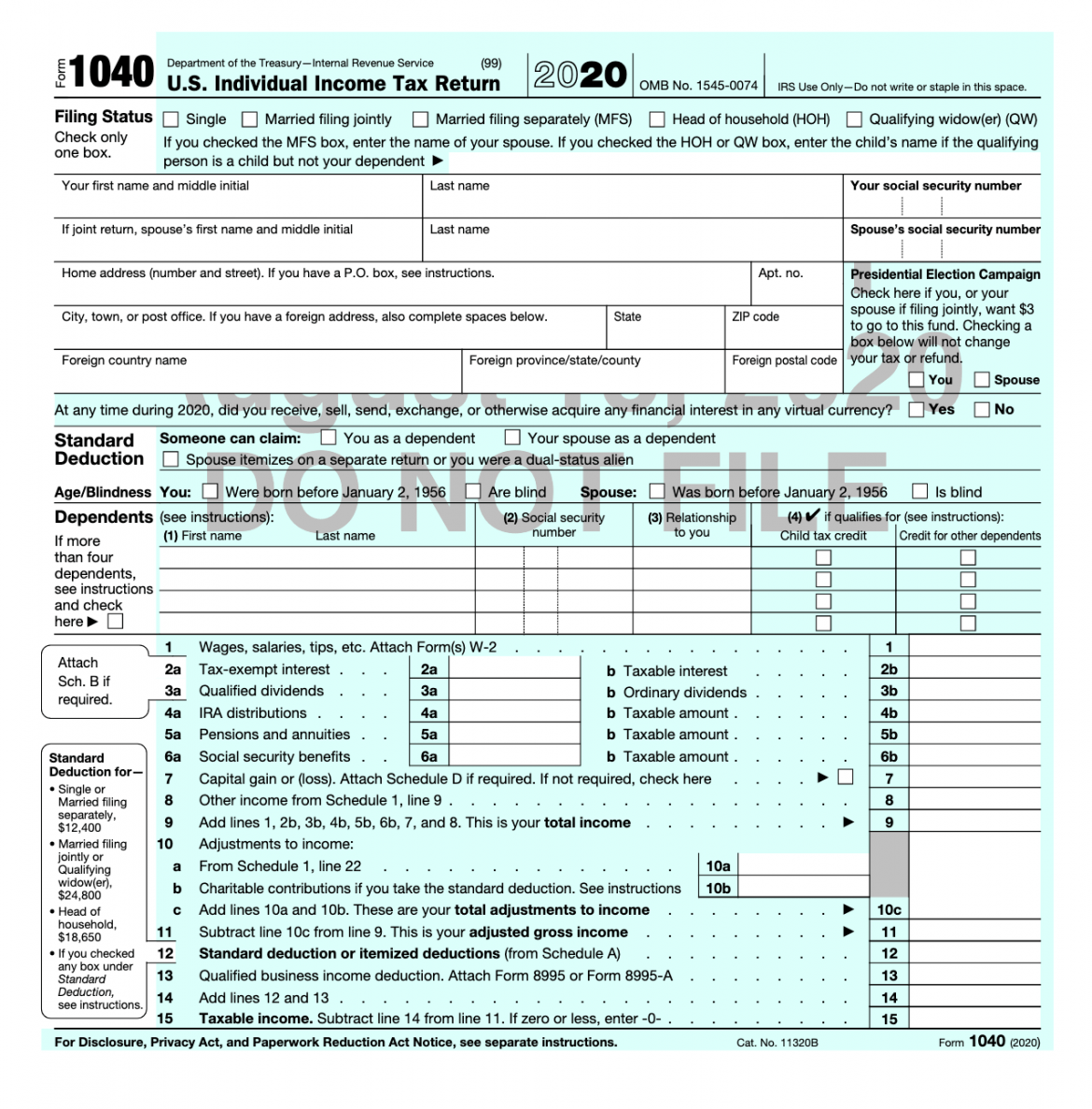

Simplified Layout: The new 1040 form features a redesigned layout that is more user-friendly and intuitive. The lines and instructions have been reorganized to make it easier for taxpayers to find the information they need.

-

Reduced Number of Lines: The revised 1040 form has a significantly reduced number of lines compared to the previous version. This simplification aims to make the form more concise and easier to complete.

-

Integrated Schedules: Previously separate schedules have been integrated into the main 1040 form. This change eliminates the need for taxpayers to file multiple documents, simplifying the filing process.

-

Enhanced Electronic Filing: The revised 1040 form is fully compatible with electronic filing systems. Taxpayers can easily submit their returns electronically through tax software or the IRS website.

Changes from the Previous 1040 Form

-

Elimination of Filing Status Boxes: The traditional filing status boxes (single, married filing jointly, etc.) have been removed from the 1040 form. Instead, taxpayers will indicate their filing status in a designated section of the form.

-

Consolidated Deductions and Credits: The revised 1040 form combines various deductions and credits into a single section. This change simplifies the process of claiming these tax benefits.

-

Removal of Line-by-Line Instructions: Detailed line-by-line instructions have been eliminated from the 1040 form. Taxpayers can refer to the accompanying instructions booklet for guidance.

-

Revised Income Reporting: The revised 1040 form includes updated sections for reporting income from various sources, such as wages, self-employment, and investments.

Implications for Taxpayers

The revised 2025 Form 1040 has several implications for taxpayers:

-

Reduced Complexity: The simplified layout and reduced number of lines make the 1040 form easier to understand and complete.

-

Improved Accuracy: The integrated schedules and enhanced electronic filing capabilities help reduce errors and improve the accuracy of tax returns.

-

Increased Efficiency: The streamlined filing process saves time and effort for taxpayers, especially those who file electronically.

-

Potential for Lower Tax Liability: The consolidated deductions and credits section may make it easier for taxpayers to claim all eligible tax benefits, potentially resulting in lower tax liability.

Transition to the Revised 1040 Form

The revised 2025 Form 1040 will be used for tax year 2025 and beyond. Taxpayers should familiarize themselves with the new form and its instructions to ensure accurate and timely tax filing. The IRS will provide ample resources and guidance to assist taxpayers during the transition.

Conclusion

The revised 2025 Form 1040 represents a significant modernization of the individual tax return. Its simplified layout, reduced complexity, and enhanced electronic filing capabilities make it easier for taxpayers to fulfill their tax obligations. By embracing these changes, taxpayers can streamline the tax filing process, improve accuracy, and potentially reduce their tax liability.

:max_bytes(150000):strip_icc()/Form10402copy-054425ef8a5a4ca29b183c856f7e7133.jpg)

Closure

Thus, we hope this article has provided valuable insights into 2025 Form 1040: Comprehensive Guide to the Revised Tax Return. We hope you find this article informative and beneficial. See you in our next article!