2025 Schedule SE (Form 1040): Understanding Self-Employment Tax

Related Articles: 2025 Schedule SE (Form 1040): Understanding Self-Employment Tax

- Blood Of Chucky: A Chilling Return To The Cult Classic

- Consumer Reports’ Comprehensive Review Of The 2025 Nissan Rogue

- The All-New 2025 Kia Carnival: Redefining The Family Adventure

- When Are A Levels 2025?

- What Is The G20 Summit 2025?

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2025 Schedule SE (Form 1040): Understanding Self-Employment Tax. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

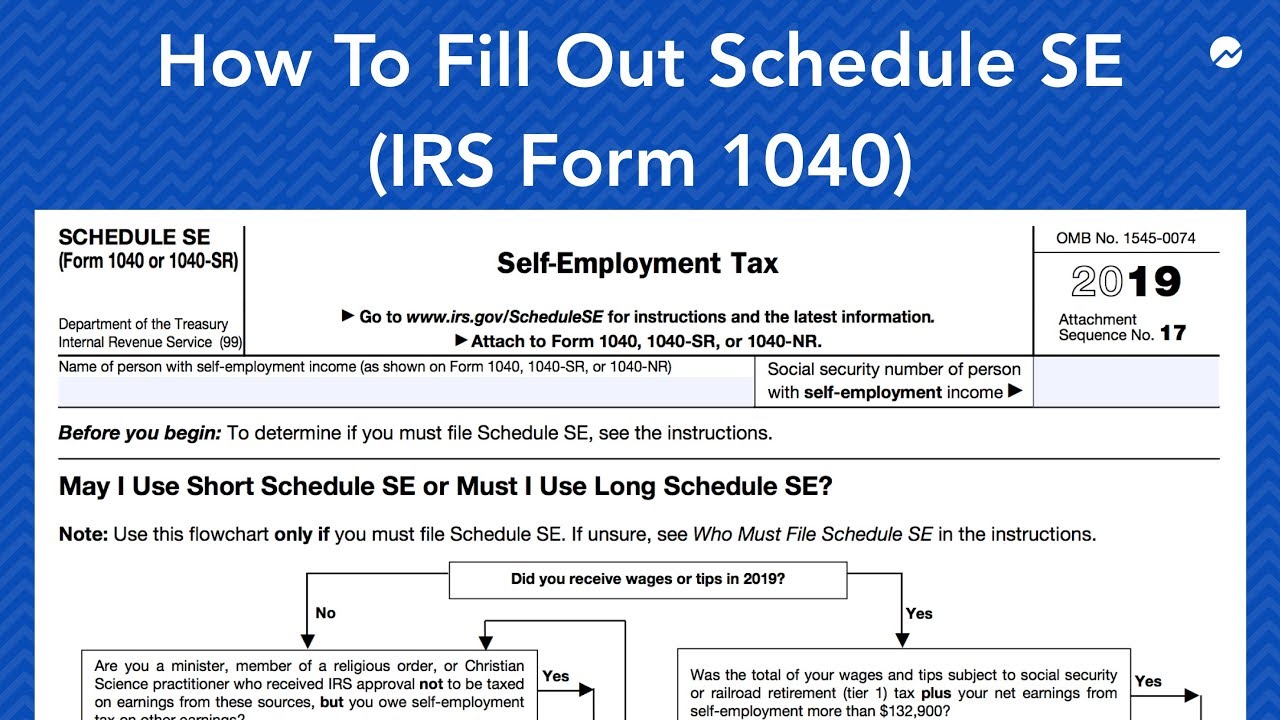

Video about 2025 Schedule SE (Form 1040): Understanding Self-Employment Tax

2025 Schedule SE (Form 1040): Understanding Self-Employment Tax

Introduction

Self-employment is a growing trend in the United States, with millions of individuals working for themselves as freelancers, contractors, or small business owners. However, self-employment comes with its own set of tax implications, including the need to file Schedule SE (Form 1040) to calculate and pay self-employment tax.

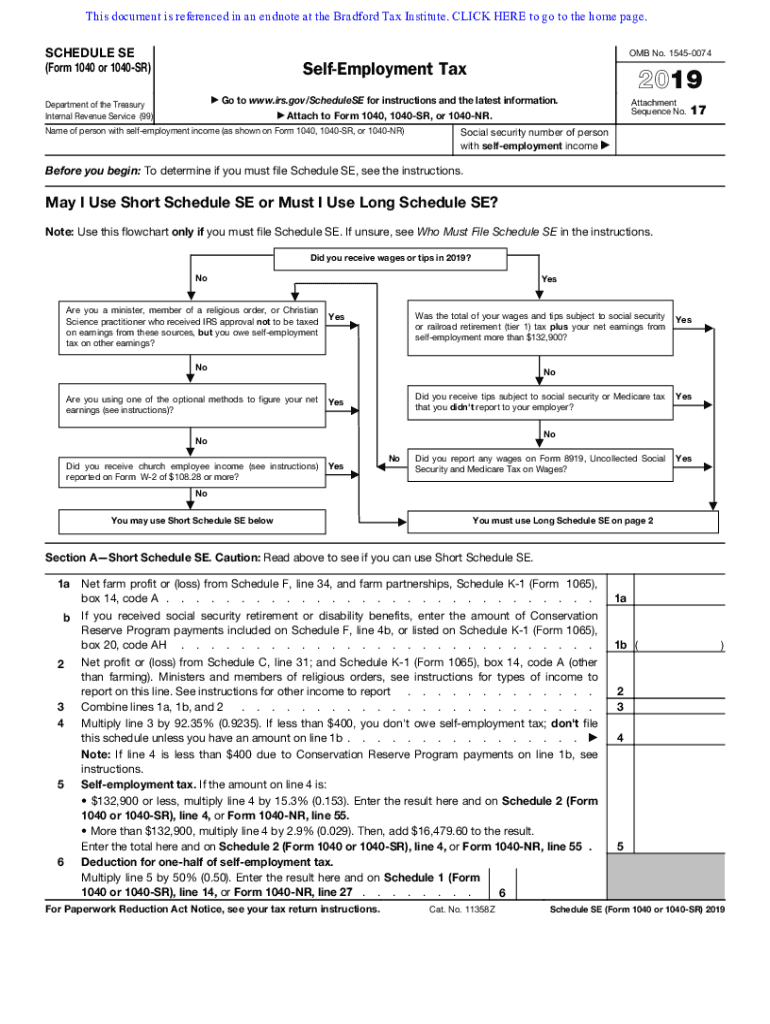

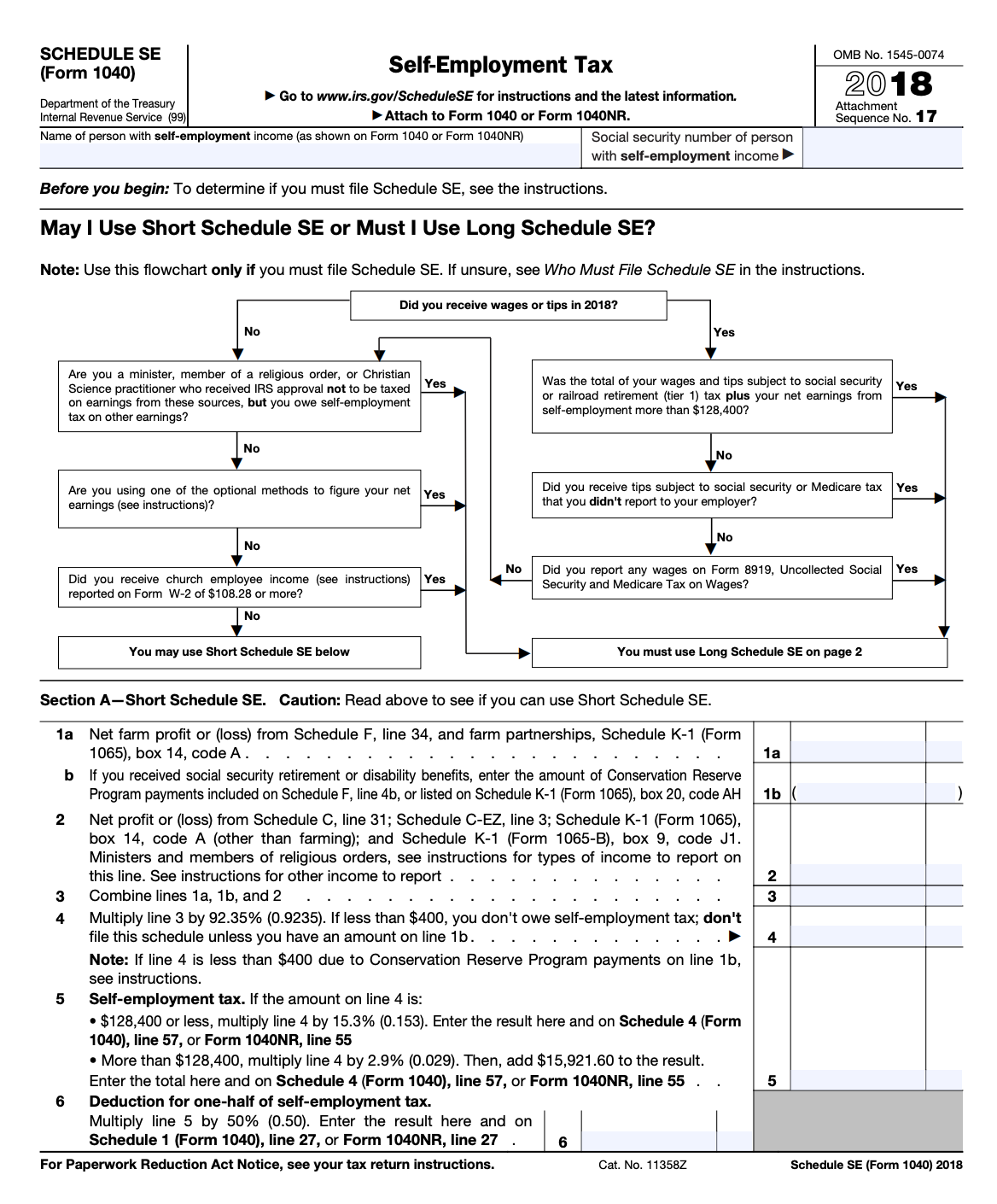

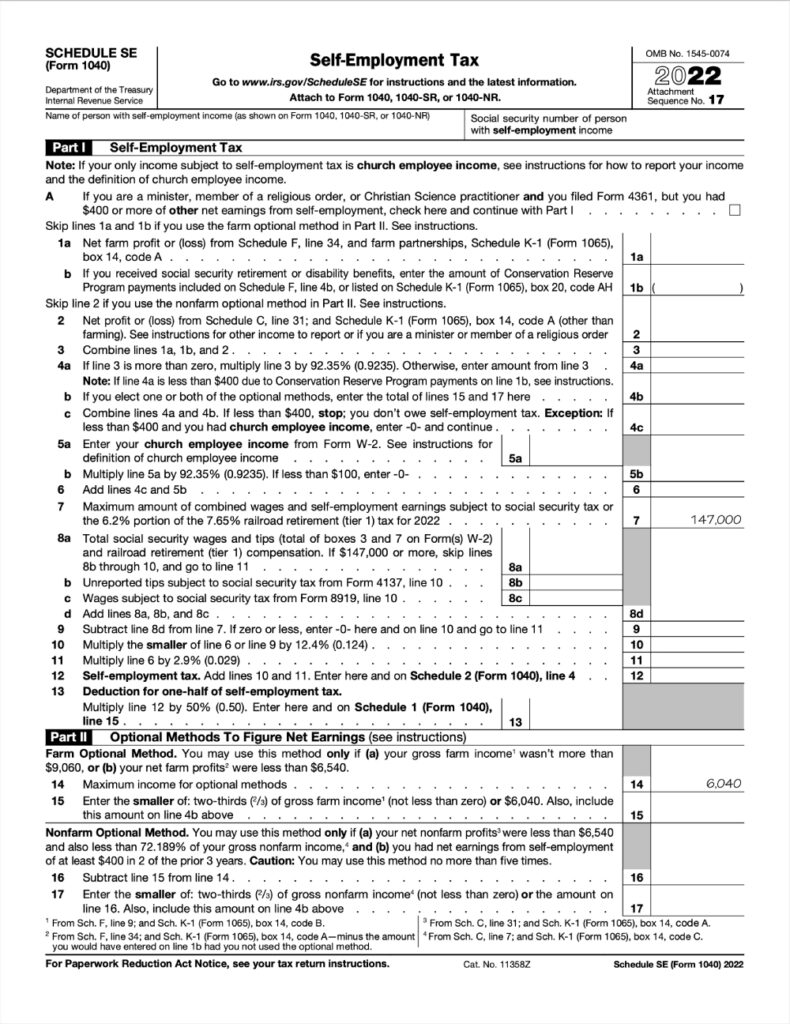

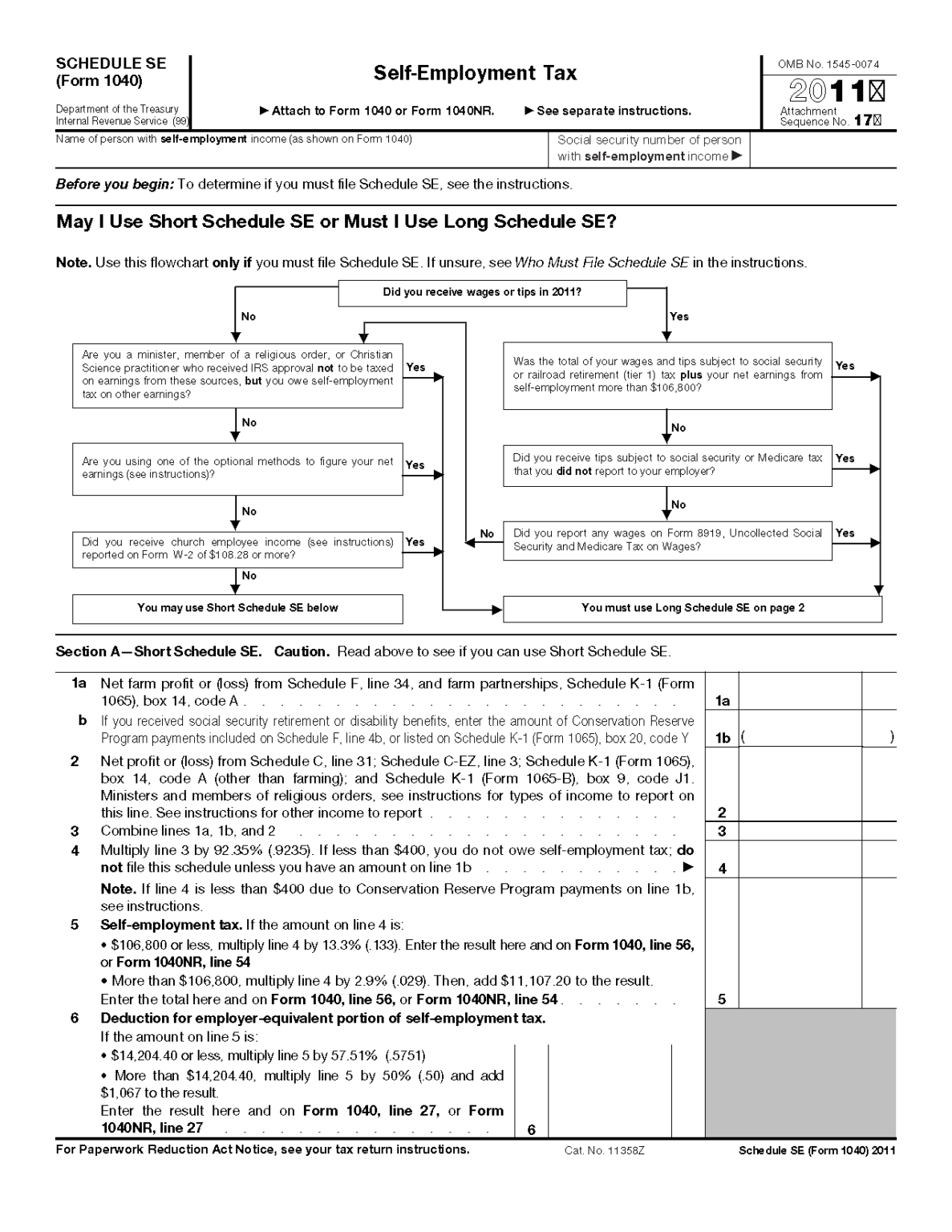

What is Schedule SE?

Schedule SE is a tax form used by self-employed individuals to report their net earnings from self-employment and calculate their self-employment tax liability. Self-employment tax is a combination of Social Security and Medicare taxes, which are typically withheld from the paychecks of employees. However, self-employed individuals are responsible for paying both the employee and employer portions of these taxes.

Who Must File Schedule SE?

You are required to file Schedule SE if you meet the following criteria:

- You had net earnings from self-employment of $400 or more during the tax year.

- You are not an employee of another individual or business.

- You are not a qualifying church employee.

Calculating Self-Employment Tax

To calculate your self-employment tax, you need to determine your net earnings from self-employment. This is your gross income from self-employment minus allowable business expenses. Once you have your net earnings, you will need to multiply that amount by the self-employment tax rate, which is 15.3% in 2025.

Half of Self-Employment Tax is Deductible

One important aspect of self-employment tax is that half of the amount you pay is deductible from your income on your Form 1040. This means that you will only pay income tax on the remaining half of your self-employment tax liability.

Completing Schedule SE

To complete Schedule SE, you will need the following information:

- Your Social Security number

- Your name and address

- Your business name and address

- Your gross income from self-employment

- Your allowable business expenses

- Your net earnings from self-employment

- Your self-employment tax liability

Filing Schedule SE

Schedule SE is filed with your Form 1040. You can file your tax return electronically or by mail. If you are filing by mail, you should attach Schedule SE to the front of your Form 1040.

Penalties for Not Filing Schedule SE

Failing to file Schedule SE or paying your self-employment tax can result in penalties and interest charges. Therefore, it is important to ensure that you file Schedule SE and pay your self-employment tax liability on time.

Conclusion

Understanding and filing Schedule SE is an essential part of being self-employed. By following the information provided in this article, you can ensure that you are meeting your tax obligations and avoiding any potential penalties. If you have any questions or need assistance with completing Schedule SE, you should consult with a tax professional.

Closure

Thus, we hope this article has provided valuable insights into 2025 Schedule SE (Form 1040): Understanding Self-Employment Tax. We appreciate your attention to our article. See you in our next article!