2025 Tax Brackets for Married Filing Jointly

Related Articles: 2025 Tax Brackets for Married Filing Jointly

- Upcoming Blockbusters And Cinematic Masterpieces Of 2025

- Jewish Holidays In 2025

- Lethal Weapon 5: A Legacy Revived (2025)

- Current Home Design Trends For 2025: Embracing Sustainability, Comfort, And Personalization

- Washington Huskies Football Schedule 2025: A Season Of Promise And Potential

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2025 Tax Brackets for Married Filing Jointly. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Tax Brackets for Married Filing Jointly

2025 Tax Brackets for Married Filing Jointly

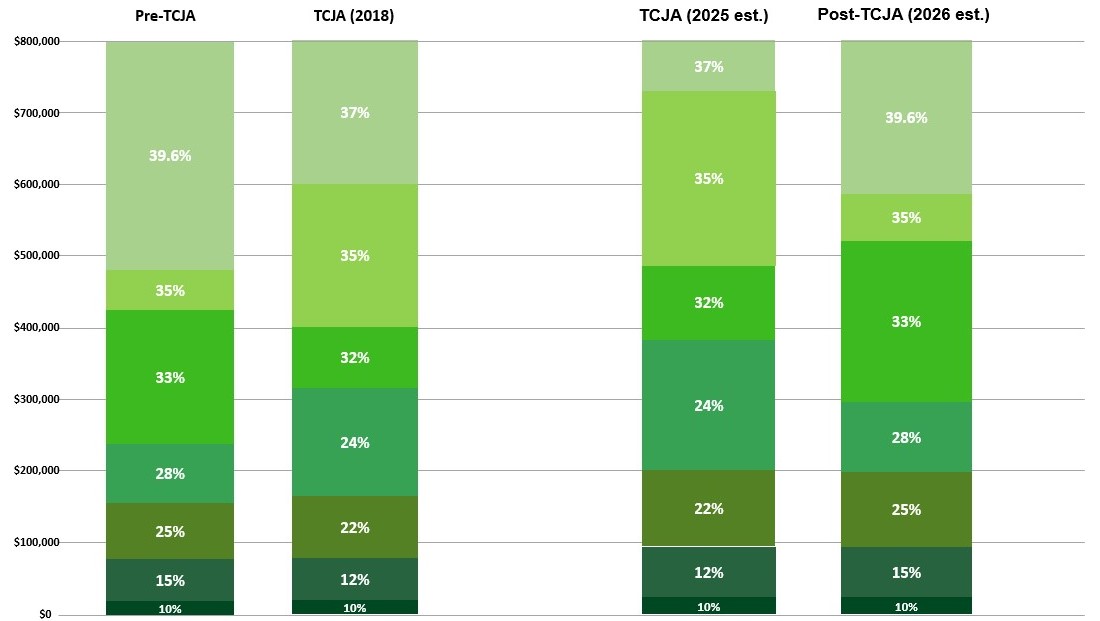

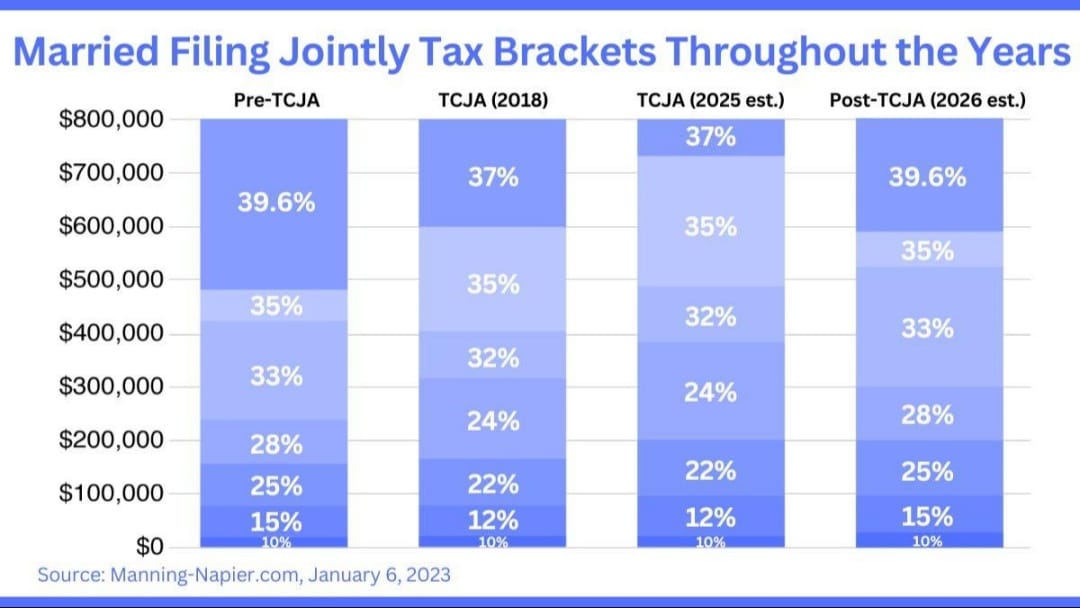

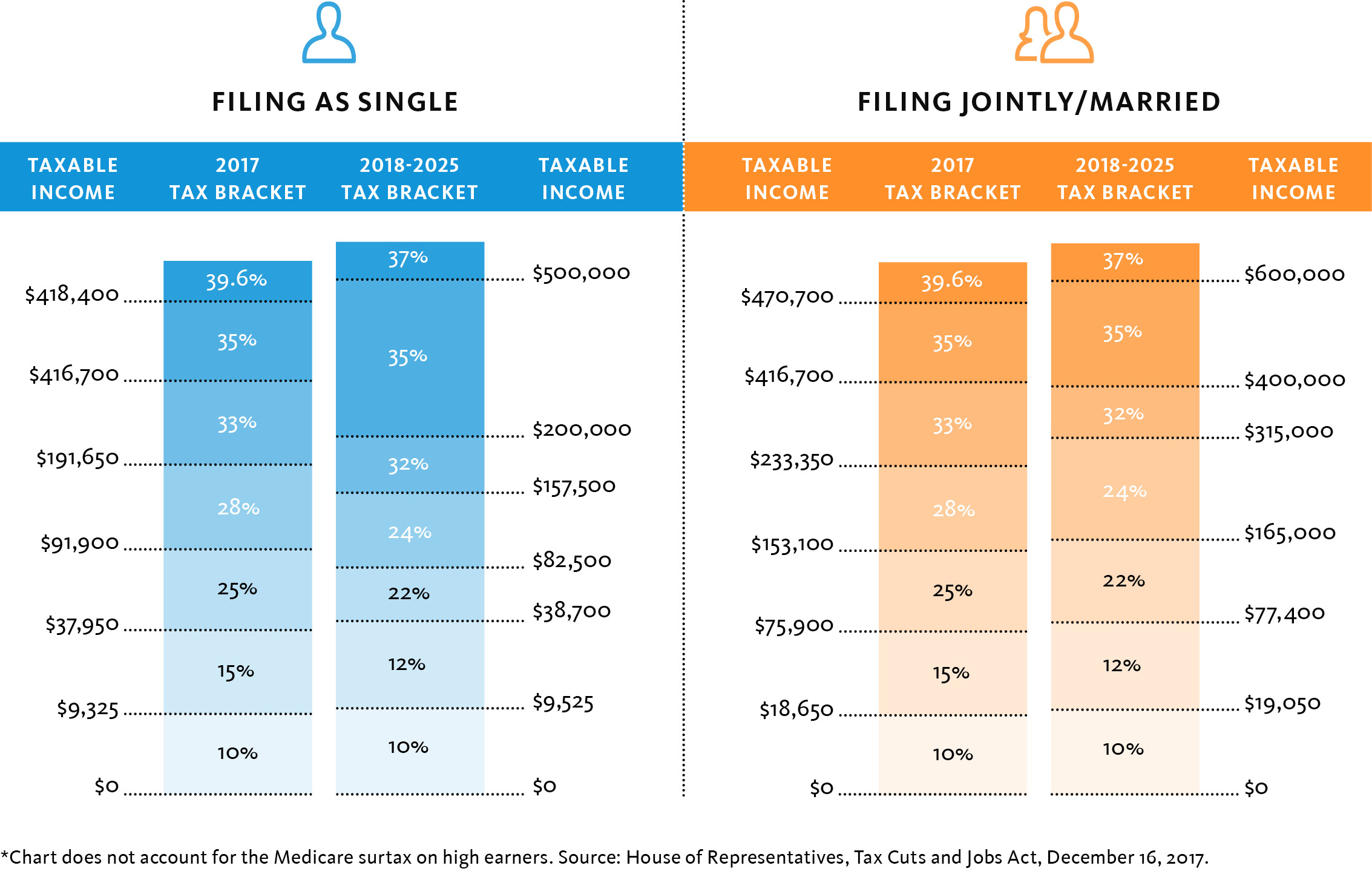

The Tax Cuts & Jobs Act (TCJA) of 2017 made significant changes to the individual income tax brackets. These changes are scheduled to expire after 2025, but there is uncertainty about whether they will be extended or modified.

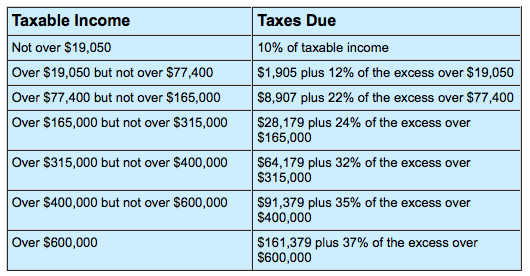

The following are the 2025 tax brackets for married filing jointly, assuming the TCJA provisions remain in place:

| Taxable Income | Marginal Tax Rate |

|---|---|

| $0 – $19,900 | 10% |

| $19,901 – $81,050 | 12% |

| $81,051 – $172,750 | 22% |

| $172,751 – $539,900 | 24% |

| $539,901 – $1,077,350 | 32% |

| $1,077,351 – $1,250,000 | 35% |

| $1,250,001 – $2,000,000 | 37% |

| Over $2,000,000 | 39.6% |

Standard Deduction and Personal Exemption

The standard deduction for married filing jointly in 2025 is $27,700. This means that the first $27,700 of your taxable income is not subject to federal income tax.

The personal exemption was eliminated by the TCJA. This means that you can no longer reduce your taxable income by a specific amount for each dependent.

Additional Considerations

- The tax brackets are adjusted for inflation each year. The amounts shown above are for 2025, but they may be different in subsequent years.

- If you have other sources of income, such as dividends or capital gains, you may be subject to additional taxes.

- You may be eligible for certain tax credits or deductions that can reduce your tax liability.

Conclusion

The 2025 tax brackets for married filing jointly are scheduled to expire after 2025. However, there is uncertainty about whether they will be extended or modified. It is important to consult with a tax professional to determine your specific tax liability.

Additional Resources

Closure

Thus, we hope this article has provided valuable insights into 2025 Tax Brackets for Married Filing Jointly. We hope you find this article informative and beneficial. See you in our next article!