2025 Tax Brackets for Single Filers

Related Articles: 2025 Tax Brackets for Single Filers

- The 2025 YouTube Tahoe: Revolutionizing Video Consumption And Collaboration

- Tamil Monthly Calendar 2025 June: A Comprehensive Guide

- 2025 Lehigh Station Road: A Landmark Of Sustainable Urban Development

- 20251 Carlyle Street: A Historic Landmark In The Heart Of Detroit

- Ramadan 2025 In Canada: A Guide To Observances And Celebrations

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 Tax Brackets for Single Filers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Tax Brackets for Single Filers

2025 Tax Brackets for Single Filers

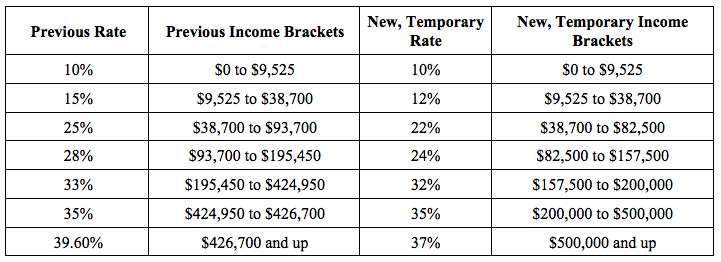

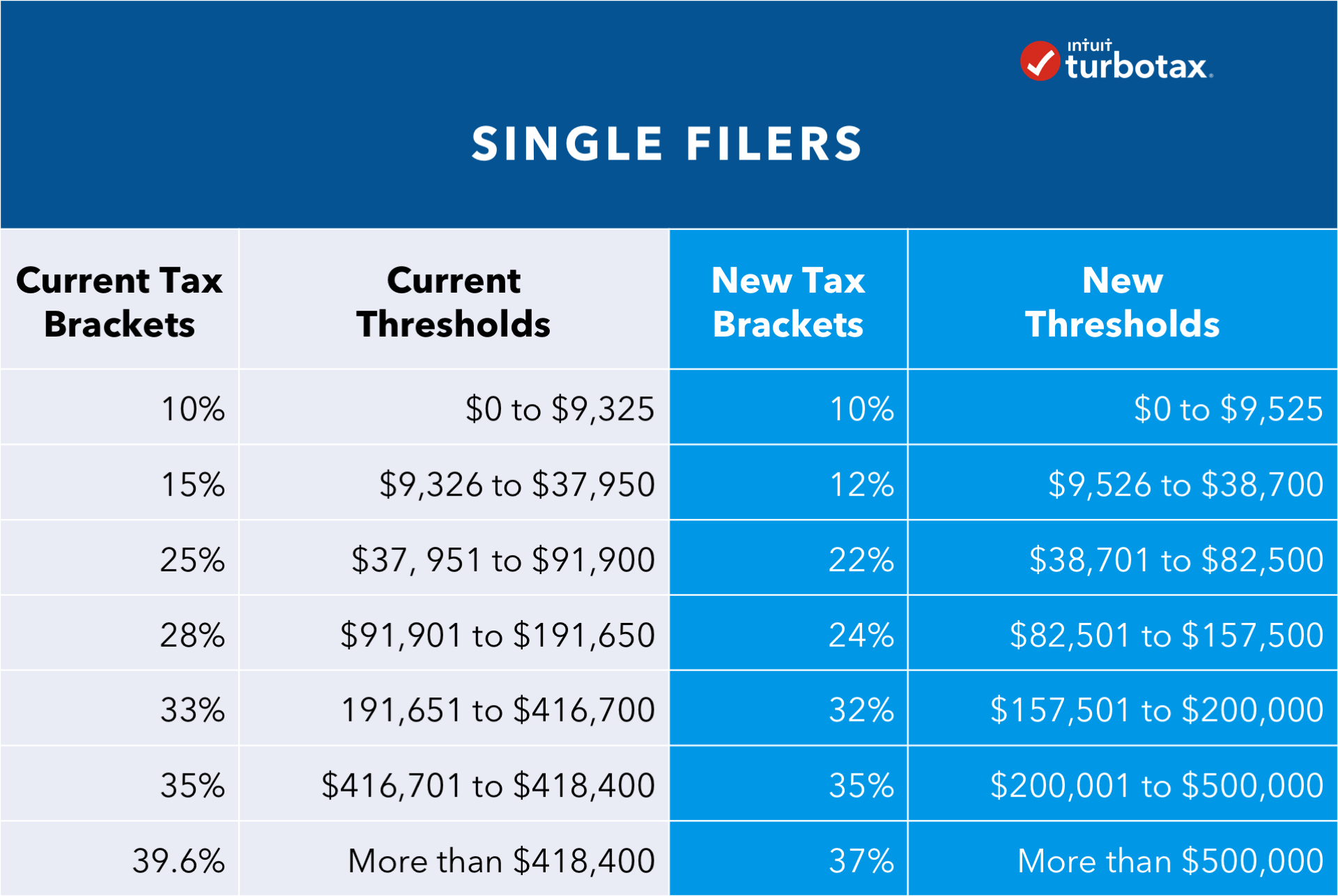

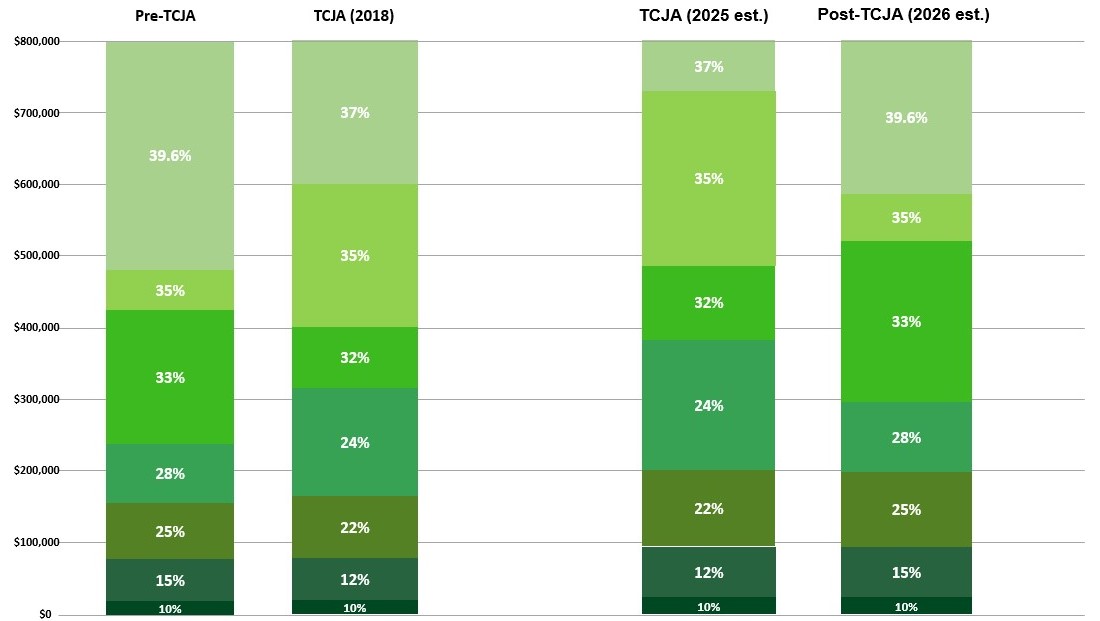

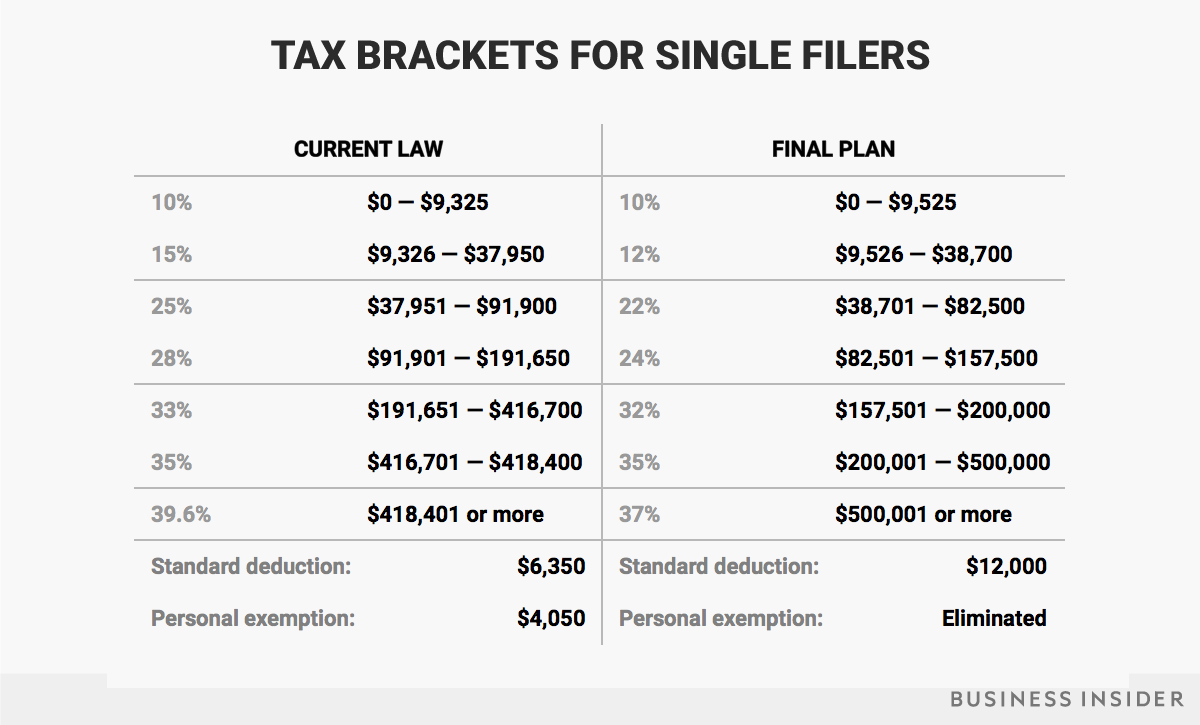

The 2025 tax brackets for single filers have been released by the Internal Revenue Service (IRS). These brackets determine the amount of income that is taxed at each marginal tax rate. For 2025, the tax brackets for single filers are as follows:

| Taxable Income | Marginal Tax Rate |

|---|---|

| $0 – $12,950 | 10% |

| $12,950 – $41,775 | 12% |

| $41,775 – $89,075 | 22% |

| $89,075 – $170,050 | 24% |

| $170,050 – $215,950 | 32% |

| $215,950 – $539,900 | 35% |

| $539,900 – $1,077,350 | 37% |

| Over $1,077,350 | 39.6% |

Standard Deduction and Personal Exemption

In addition to the tax brackets, the standard deduction and personal exemption also affect the amount of taxes that you owe. For 2025, the standard deduction for single filers is $13,850. The personal exemption is $4,300.

Taxable Income

Your taxable income is your total income minus your deductions and exemptions. Your taxable income is used to determine which tax bracket you fall into.

Marginal Tax Rate

The marginal tax rate is the tax rate that you pay on the last dollar of income that you earn. For example, if you are in the 22% tax bracket, you will pay 22% in taxes on the last dollar of income that you earn.

Calculating Your Taxes

To calculate your taxes, you will need to use the following formula:

Taxes = (Taxable Income * Marginal Tax Rate) - Tax CreditFor example, if you have a taxable income of $50,000 and you are in the 22% tax bracket, your taxes would be calculated as follows:

Taxes = ($50,000 * 0.22) - $0 = $11,000Tax Credits

Tax credits are dollar-for-dollar reductions in your taxes. There are many different types of tax credits available, including the child tax credit, the earned income tax credit, and the saver’s credit.

Estimated Taxes

If you expect to owe more than $1,000 in taxes, you will need to make estimated tax payments throughout the year. Estimated tax payments are due on April 15, June 15, September 15, and January 15 of the following year.

Filing Your Taxes

You will need to file your taxes by April 15 of the following year. You can file your taxes online, by mail, or through a tax preparer.

Additional Resources

- IRS website

- Tax brackets for all filing statuses

- Standard deduction and personal exemption amounts

- Tax credits

- Estimated taxes

- Filing your taxes

Closure

Thus, we hope this article has provided valuable insights into 2025 Tax Brackets for Single Filers. We hope you find this article informative and beneficial. See you in our next article!