2026 US Income Tax Brackets: A Comprehensive Guide

Related Articles: 2026 US Income Tax Brackets: A Comprehensive Guide

- Sony Pictures Movie Slate 2025: A Cinematic Odyssey Awaits

- When Is Earth Day 2025?

- 2025 Cadillac XT6: A Comprehensive Overview

- IR 2025 Tabla Sri: A High-Yielding, Disease-Resistant Rice Variety For The Future

- Dragon Ball Z Movie 2025: The Ultimate Showdown

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2026 US Income Tax Brackets: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2026 US Income Tax Brackets: A Comprehensive Guide

2026 US Income Tax Brackets: A Comprehensive Guide

Introduction

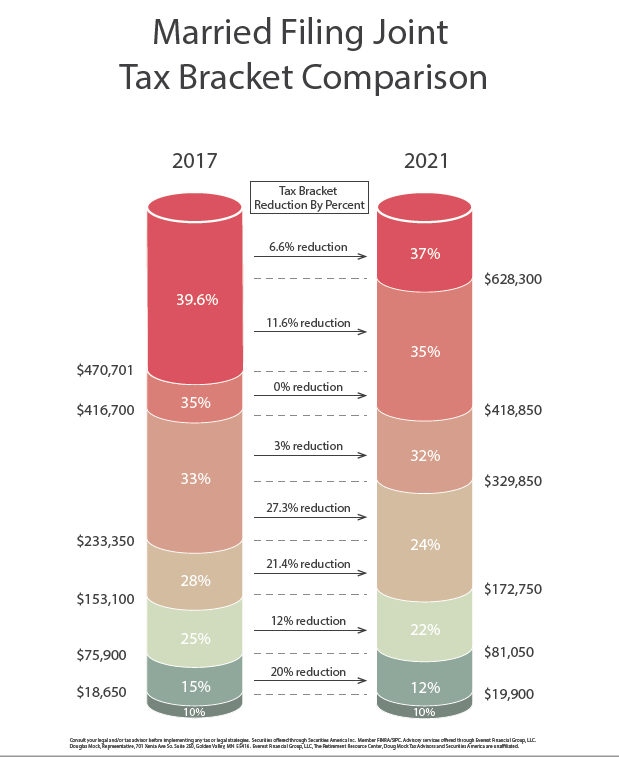

The United States income tax system is a progressive one, meaning that individuals with higher incomes pay a higher percentage of their income in taxes. The tax brackets for 2026 have been established by the Internal Revenue Service (IRS) and will determine the amount of taxes that individuals will owe on their taxable income. This article provides a comprehensive guide to the 2026 US income tax brackets, explaining the different tax rates and income ranges that apply to various individuals.

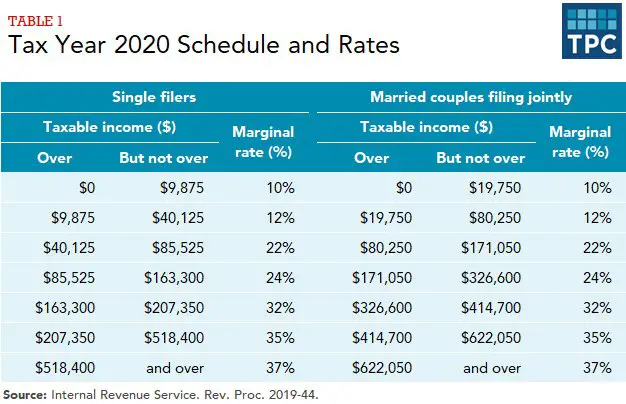

Tax Brackets for Single Filers

| Income Range | Tax Rate |

|---|---|

| $0 – $10,275 | 10% |

| $10,276 – $41,775 | 12% |

| $41,776 – $89,075 | 22% |

| $89,076 – $170,050 | 24% |

| $170,051 – $215,950 | 32% |

| $215,951 – $539,900 | 35% |

| Over $539,900 | 37% |

Tax Brackets for Married Couples Filing Jointly

| Income Range | Tax Rate |

|---|---|

| $0 – $20,550 | 10% |

| $20,551 – $83,550 | 12% |

| $83,551 – $178,150 | 22% |

| $178,151 – $356,300 | 24% |

| $356,301 – $431,900 | 32% |

| $431,901 – $647,850 | 35% |

| Over $647,850 | 37% |

Tax Brackets for Married Couples Filing Separately

| Income Range | Tax Rate |

|---|---|

| $0 – $10,275 | 10% |

| $10,276 – $41,775 | 12% |

| $41,776 – $89,075 | 22% |

| $89,076 – $178,150 | 24% |

| $178,151 – $215,950 | 32% |

| $215,951 – $323,925 | 35% |

| Over $323,925 | 37% |

Tax Brackets for Heads of Household

| Income Range | Tax Rate |

|---|---|

| $0 – $13,850 | 10% |

| $13,851 – $55,400 | 12% |

| $55,401 – $89,075 | 22% |

| $89,076 – $170,050 | 24% |

| $170,051 – $215,950 | 32% |

| $215,951 – $539,900 | 35% |

| Over $539,900 | 37% |

Standard Deductions and Personal Exemptions

In addition to the tax brackets, the standard deductions and personal exemptions also play a role in determining the amount of taxes owed. The standard deduction is a fixed amount that is subtracted from taxable income before taxes are calculated. The personal exemption is a specific amount that is allowed for each taxpayer and dependent.

For 2026, the standard deductions are as follows:

- Single filers: $13,850

- Married couples filing jointly: $27,700

- Married couples filing separately: $13,850

- Heads of household: $20,800

The personal exemption for 2026 is $4,300.

Tax Credits

Tax credits are another important factor to consider when calculating taxes. Tax credits are dollar-for-dollar reductions in the amount of taxes owed. There are various tax credits available, including the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit.

Conclusion

Understanding the US income tax brackets is crucial for individuals to accurately calculate their tax liability. The 2026 tax brackets provide a clear framework for determining the amount of taxes owed based on taxable income. By utilizing the standard deductions, personal exemptions, and tax credits available, taxpayers can minimize their tax burden and ensure that they are fulfilling their tax obligations accurately.

Closure

Thus, we hope this article has provided valuable insights into 2026 US Income Tax Brackets: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!