401(k) Contribution Limits 2025: A Comprehensive Overview

Related Articles: 401(k) Contribution Limits 2025: A Comprehensive Overview

- Virginia Governor Race 2025: A Preview

- 2025 Form 1040: Comprehensive Guide To The Revised Tax Return

- Feast Of Trumpets 2025: A Sacred Call To Spiritual Awakening

- The Jeep Gladiator: A Used 2025 Adventure Machine

- Canoo Electric Pickup Truck: Revolutionizing The Automotive Landscape

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 401(k) Contribution Limits 2025: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 401(k) Contribution Limits 2025: A Comprehensive Overview

401(k) Contribution Limits 2025: A Comprehensive Overview

Introduction

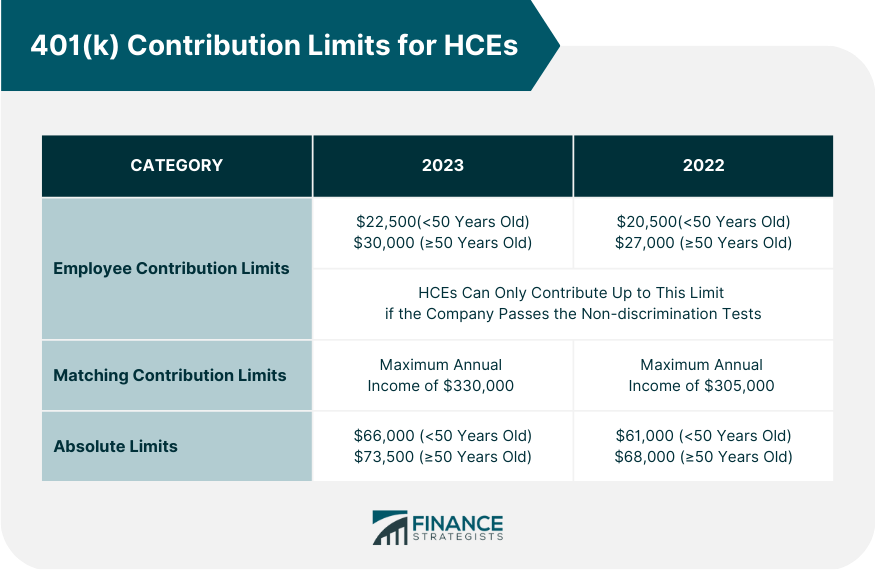

401(k) plans are employer-sponsored retirement savings plans that offer significant tax advantages. One of the key factors to consider when planning for retirement is the annual contribution limits imposed on these plans. These limits are adjusted periodically to account for inflation and other economic factors. This article provides a comprehensive overview of the 401(k) contribution limits for 2025, including the employee elective deferral limit, employer matching contribution limit, and catch-up contributions for older workers.

Employee Elective Deferral Limit

The employee elective deferral limit refers to the maximum amount of money that an employee can contribute to their 401(k) plan on a pre-tax basis each year. For 2025, the employee elective deferral limit will increase to $22,500, up from $20,500 in 2024. This means that employees can defer up to $22,500 of their salary into their 401(k) plan on a pre-tax basis, reducing their current taxable income.

Employer Matching Contribution Limit

In addition to employee contributions, employers can also make matching contributions to their employees’ 401(k) plans. The employer matching contribution limit is the maximum amount that an employer can contribute to an employee’s 401(k) plan on a matching basis. For 2025, the employer matching contribution limit will remain unchanged at $66,000 (including the employee elective deferral limit). This means that employers can match employee contributions up to a maximum of $66,000, including the $22,500 employee elective deferral limit.

Catch-Up Contributions

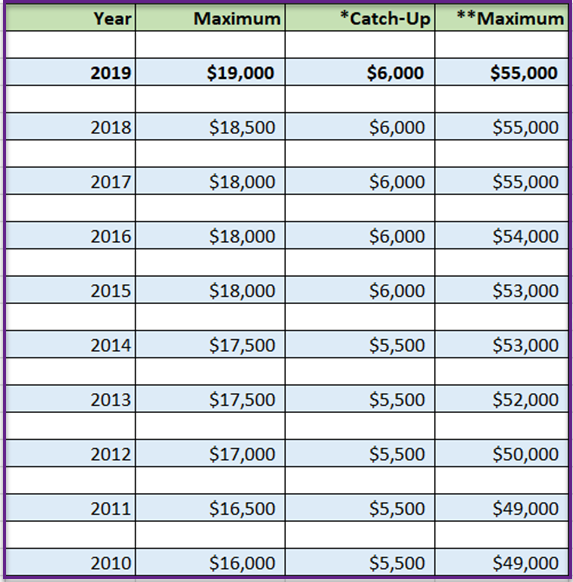

Individuals who are age 50 or older by the end of the calendar year are eligible to make catch-up contributions to their 401(k) plans. Catch-up contributions are additional contributions that are allowed beyond the regular employee elective deferral limit. For 2025, the catch-up contribution limit will increase to $7,500, up from $6,500 in 2024. This means that individuals who are age 50 or older can contribute up to $22,500 + $7,500 = $30,000 to their 401(k) plans on a pre-tax basis.

Total Contribution Limit

The total contribution limit for 401(k) plans is the sum of the employee elective deferral limit, the employer matching contribution limit, and the catch-up contribution limit (if applicable). For 2025, the total contribution limit will increase to $66,000 for individuals under age 50 and $73,500 for individuals age 50 or older. This means that individuals can contribute up to these amounts to their 401(k) plans on a pre-tax basis, significantly reducing their current taxable income.

Importance of Maximizing Contributions

Maximizing contributions to a 401(k) plan is crucial for building a secure financial future. By taking advantage of the full contribution limits, individuals can significantly increase their retirement savings and reduce their tax liability. Compounding returns over time can lead to substantial wealth accumulation, providing a strong foundation for a comfortable retirement.

Conclusion

The 401(k) contribution limits for 2025 provide ample opportunities for individuals to save for retirement. Understanding these limits and maximizing contributions can help individuals achieve their long-term financial goals. It is important to consult with a financial advisor to determine the optimal contribution strategy based on individual circumstances and financial objectives. By planning and investing wisely, individuals can secure a financially secure future and enjoy a comfortable retirement.

Closure

Thus, we hope this article has provided valuable insights into 401(k) Contribution Limits 2025: A Comprehensive Overview. We hope you find this article informative and beneficial. See you in our next article!