Apple Stock Price in 2025: A Comprehensive Analysis and Forecast

Related Articles: Apple Stock Price in 2025: A Comprehensive Analysis and Forecast

- 2025 Ford Edge ST: A Comprehensive Review

- SHOT Show Vegas 2025: The Premier Event For The Firearms Industry

- 2025: The World Enslaved By A Virus – A Harrowing Vision Of A Dystopian Future

- The 2025 Canadian Federal Election: A Battle For The Future

- Cheap 2024 Holidays: Affordable Destinations And Budget-Friendly Tips

Introduction

With great pleasure, we will explore the intriguing topic related to Apple Stock Price in 2025: A Comprehensive Analysis and Forecast. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Apple Stock Price in 2025: A Comprehensive Analysis and Forecast

Apple Stock Price in 2025: A Comprehensive Analysis and Forecast

Apple Inc., the technology behemoth, has consistently captivated investors with its innovative products, loyal customer base, and solid financial performance. As we approach 2025, it is imperative to delve into the factors that will shape the company’s stock price and provide an informed forecast.

Factors Influencing Apple Stock Price

1. Technology Innovation:

Apple’s success hinges upon its ability to push the boundaries of technology and introduce groundbreaking products. The company’s relentless pursuit of innovation, particularly in areas such as artificial intelligence (AI), augmented reality (AR), and 5G connectivity, will drive its growth and enhance its competitive edge.

2. Product Ecosystem:

Apple has meticulously crafted a comprehensive ecosystem of interconnected devices and services, including the iPhone, iPad, Mac, Apple Watch, and Apple TV. This ecosystem fosters customer loyalty and increases the value proposition of each product. As Apple continues to expand its ecosystem, it will solidify its position as a dominant force in the tech industry.

3. Services Revenue:

In recent years, Apple has shifted its focus towards services, recognizing the recurring revenue potential. Services such as Apple Music, iCloud, and the App Store have witnessed significant growth and are expected to contribute substantially to the company’s revenue in the years to come.

4. Global Expansion:

Apple has a vast global presence, with operations in over 200 countries. The company’s strategic focus on emerging markets, particularly in Asia, will drive revenue growth and expand its customer base.

5. Competition:

Apple faces intense competition from tech giants such as Samsung, Google, and Huawei. However, the company’s strong brand recognition, loyal customer base, and technological prowess provide it with a competitive advantage.

Historical Performance and Future Trends

Over the past decade, Apple’s stock price has experienced remarkable growth, outperforming the broader market. In 2011, the stock traded at around $50 per share, and by the end of 2022, it had surpassed $150 per share. This impressive performance reflects the company’s consistent innovation, financial discipline, and strong brand equity.

Looking ahead, analysts anticipate continued growth for Apple’s stock price in 2025 and beyond. The company’s focus on technology innovation, product ecosystem expansion, and services revenue growth is expected to drive its performance.

Forecast for 2025

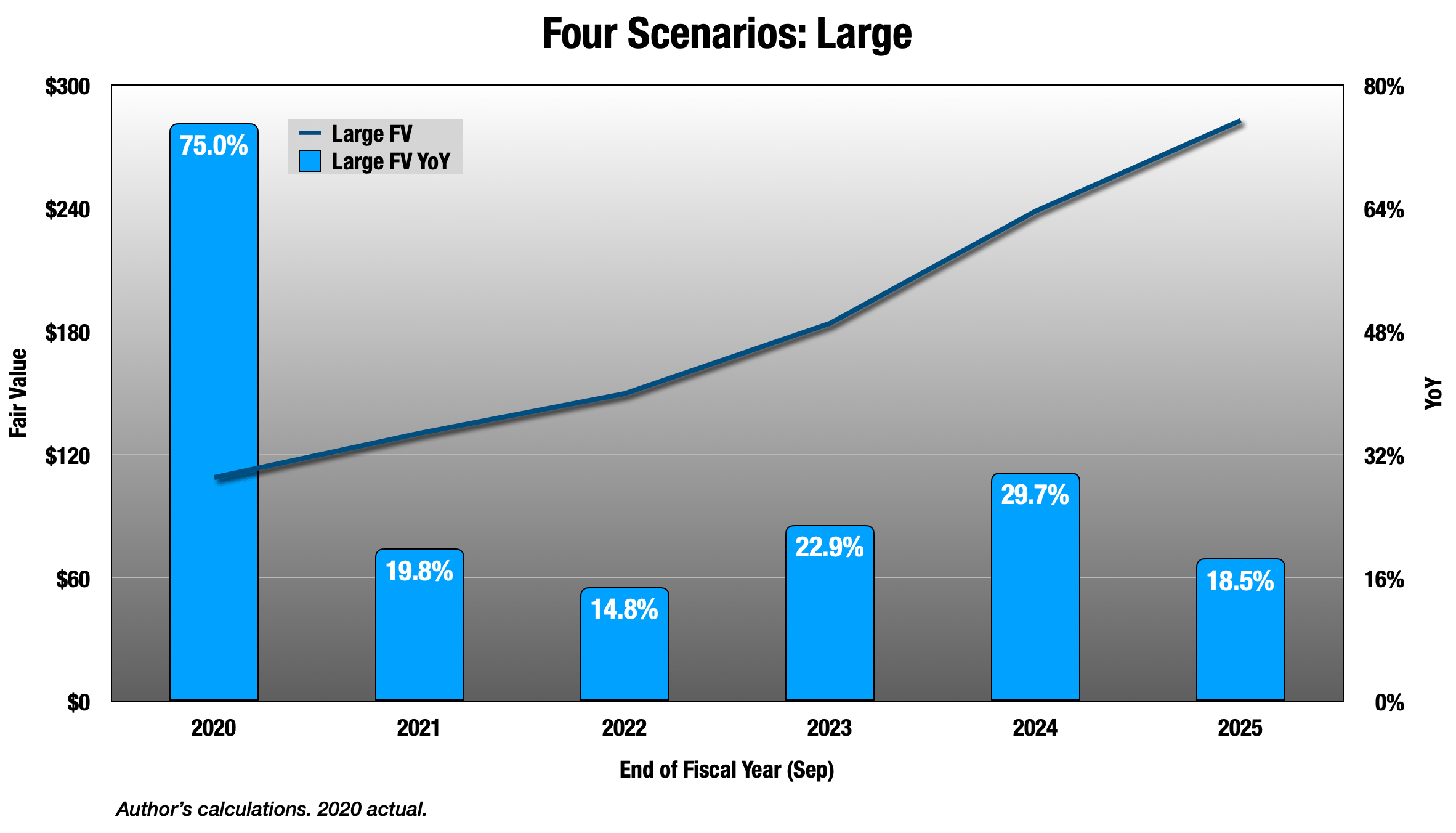

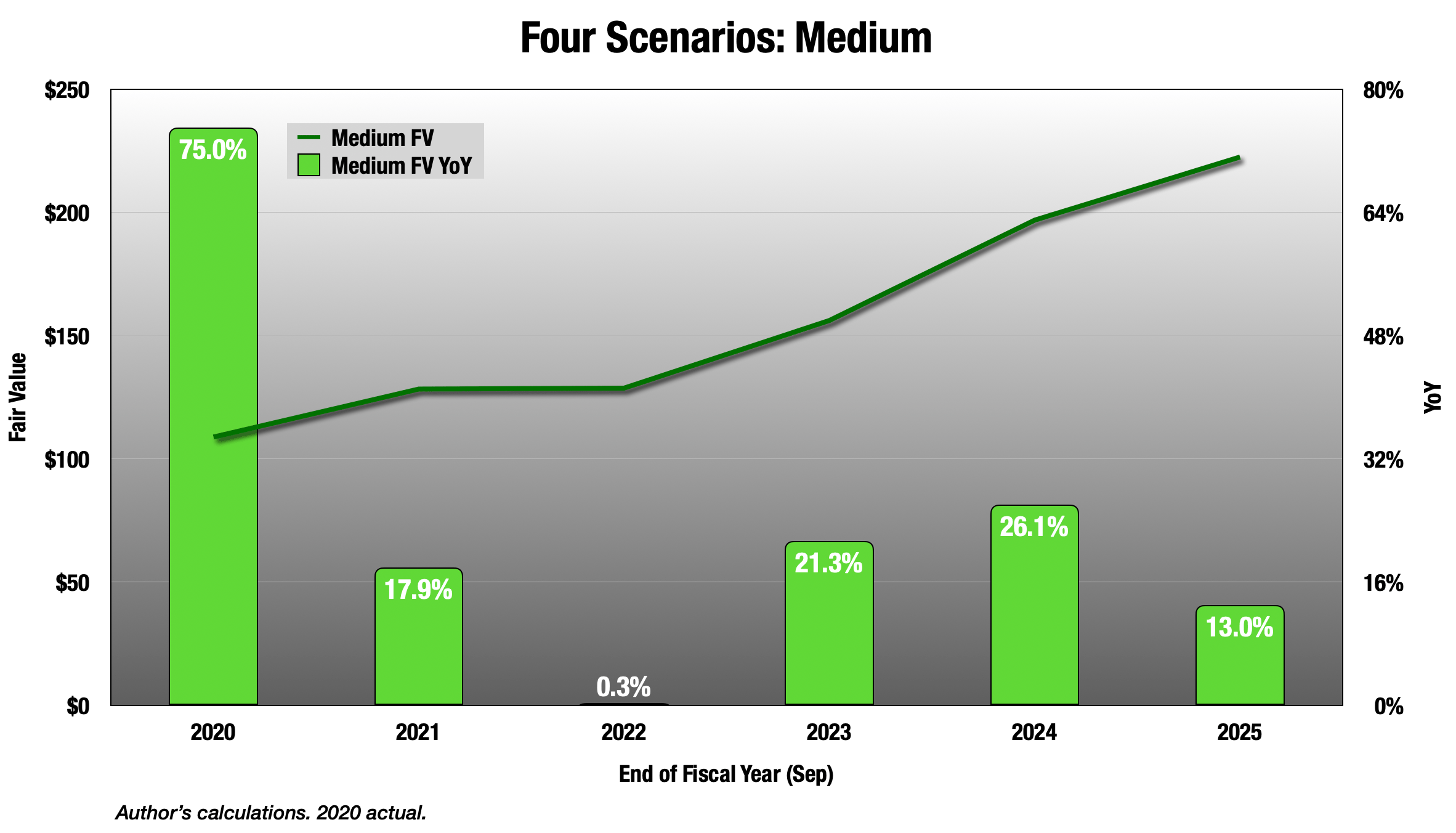

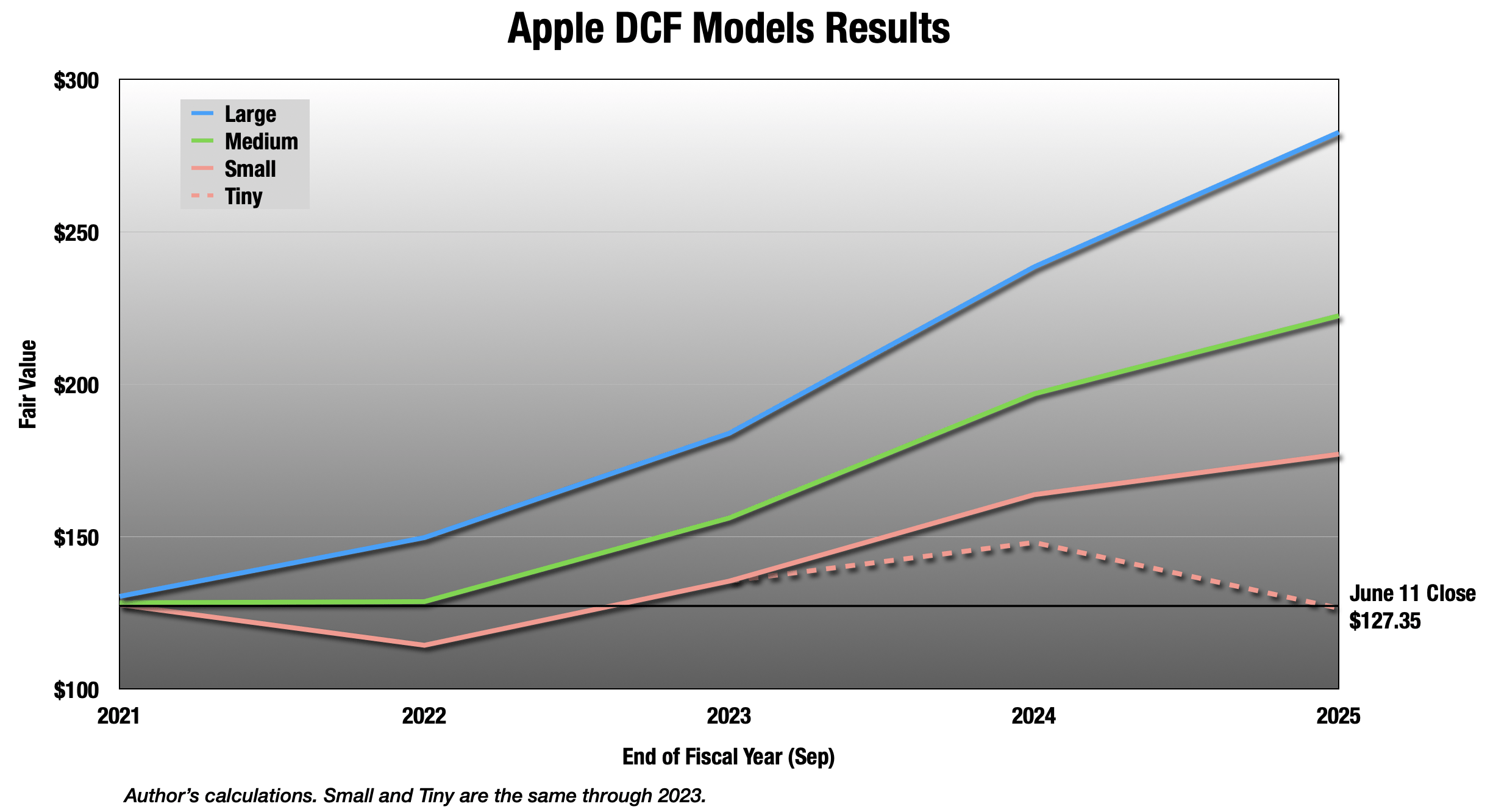

Based on an in-depth analysis of the factors influencing Apple’s stock price, we forecast that the company’s share price could reach approximately $250 per share by 2025. This represents a potential return of over 60% from current levels.

Assumptions and Considerations:

- Continued technological innovation and the introduction of groundbreaking products

- Further expansion of Apple’s product ecosystem and services revenue

- Successful penetration into emerging markets

- Maintenance of Apple’s competitive advantage

- Favorable macroeconomic conditions

Risks and Uncertainties:

- Intense competition from rival tech companies

- Economic downturns or geopolitical events

- Supply chain disruptions

- Regulatory challenges

Conclusion

Apple Inc. is a well-positioned company with a strong foundation and a clear growth trajectory. Its focus on innovation, product ecosystem expansion, and services revenue growth is expected to drive its stock price higher in the coming years. While risks and uncertainties exist, the company’s solid fundamentals and long-term growth prospects make it an attractive investment for investors seeking long-term capital appreciation.

It is important to note that stock price forecasts are inherently uncertain and subject to change based on market conditions and unforeseen events. Investors should conduct thorough research and consider their own risk tolerance before making investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Apple Stock Price in 2025: A Comprehensive Analysis and Forecast. We hope you find this article informative and beneficial. See you in our next article!