Best Target Date Funds for 2045

Related Articles: Best Target Date Funds for 2045

- The 2025 BMW X5 Hybrid: A Comprehensive Overview

- The 2025 Toyota Camry: A Comprehensive Overview

- Introducing The All-New 2025 Jeep Gladiator: The Ultimate Off-Road Adventure Machine

- 2025 Toyota Camry Leak: A Comprehensive Overview

- What Car Will Chevy Use In NASCAR In 2025?

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Best Target Date Funds for 2045. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Best Target Date Funds for 2045

Best Target Date Funds for 2045

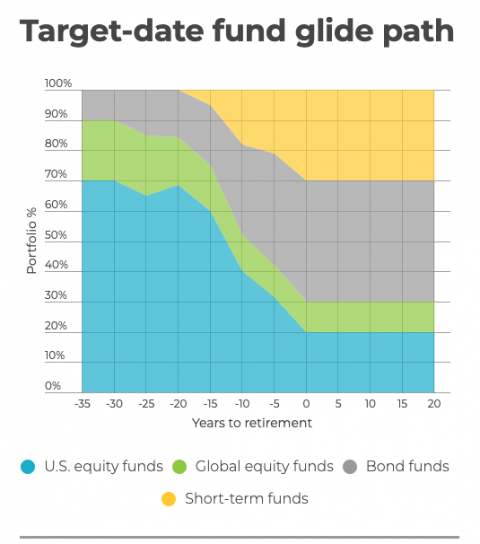

Target date funds are a type of mutual fund that automatically adjusts its asset allocation based on the investor’s expected retirement date. As the investor nears retirement, the fund gradually shifts from growth-oriented investments to more conservative ones, such as bonds. This helps to reduce risk and protect the investor’s savings.

Target date funds are a popular choice for retirement savings because they offer a simple and convenient way to invest for retirement. Investors only need to choose a fund with a target date that is close to their expected retirement year. The fund will then handle the rest, automatically adjusting the asset allocation and rebalancing the portfolio as needed.

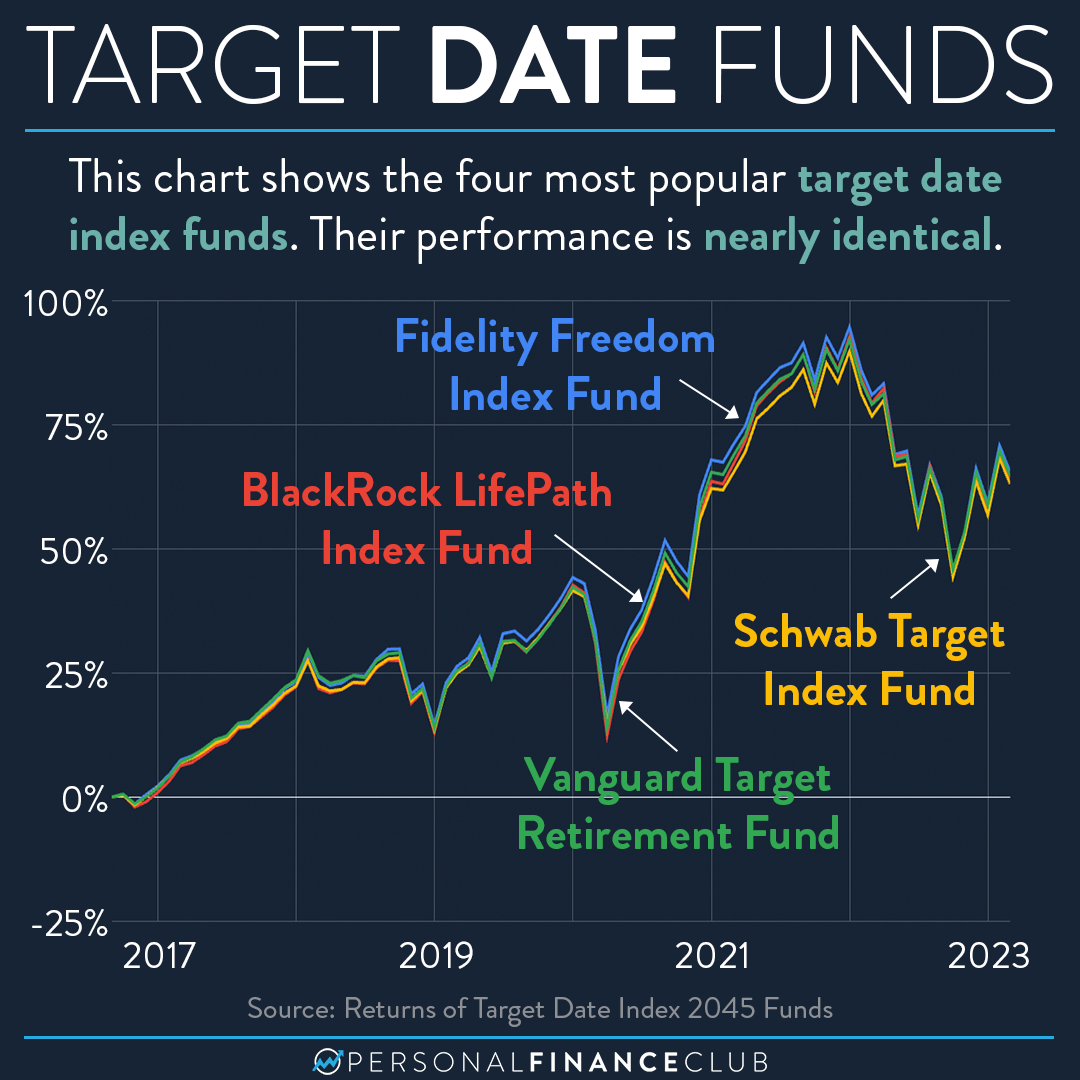

There are many different target date funds available, so it is important to compare the different options before choosing one. Some of the factors to consider include the fund’s expense ratio, investment strategy, and historical performance.

Here are some of the best target date funds for 2045:

- Vanguard Target Retirement 2045 Fund (VFFVX)

- Fidelity Freedom Index 2045 Fund (FFIAX)

- T. Rowe Price Retirement 2045 Fund (TRRIX)

- American Funds Target Retirement 2045 Fund (AFTVX)

- TIAA Traditional 2045 Retirement Fund (TCIAX)

These funds all have low expense ratios, solid investment strategies, and a history of strong performance. They are a good choice for investors who are looking for a simple and convenient way to save for retirement.

How to Choose a Target Date Fund

When choosing a target date fund, it is important to consider the following factors:

- Your risk tolerance: Target date funds are available with a range of risk levels. Investors who are more comfortable with risk can choose a fund with a more aggressive asset allocation. Investors who are more conservative can choose a fund with a more conservative asset allocation.

- Your investment horizon: Target date funds are designed to meet the needs of investors who are planning to retire on a specific date. Investors who are planning to retire early should choose a fund with a shorter target date. Investors who are planning to retire later should choose a fund with a longer target date.

- Your financial goals: Target date funds can be used to achieve a variety of financial goals, such as saving for retirement, paying for college, or buying a house. Investors should choose a fund that is aligned with their financial goals.

Benefits of Target Date Funds

Target date funds offer a number of benefits for investors, including:

- Simplicity: Target date funds are a simple and convenient way to invest for retirement. Investors only need to choose a fund with a target date that is close to their expected retirement year. The fund will then handle the rest, automatically adjusting the asset allocation and rebalancing the portfolio as needed.

- Diversification: Target date funds are diversified across a range of asset classes, including stocks, bonds, and cash. This helps to reduce risk and protect the investor’s savings.

- Automatic rebalancing: Target date funds automatically rebalance the portfolio as needed. This helps to ensure that the asset allocation remains aligned with the investor’s risk tolerance and investment horizon.

Risks of Target Date Funds

Target date funds are not without risks. Some of the risks to consider include:

- Market risk: Target date funds are subject to market risk, which means that the value of the fund can fluctuate with the market. Investors should be prepared for the possibility of losing money when investing in a target date fund.

- Interest rate risk: Target date funds that invest in bonds are subject to interest rate risk, which means that the value of the fund can decline if interest rates rise. Investors should be aware of the interest rate risk associated with target date funds.

- Inflation risk: Target date funds that invest in stocks and bonds are subject to inflation risk, which means that the value of the fund can decline if inflation rises. Investors should be aware of the inflation risk associated with target date funds.

Target Date Funds vs. Other Retirement Savings Options

Target date funds are one of many different retirement savings options available to investors. Other options include traditional IRAs, Roth IRAs, and 401(k) plans.

Target date funds offer a number of advantages over other retirement savings options, including simplicity, diversification, and automatic rebalancing. However, target date funds also have some disadvantages, such as higher expense ratios and less flexibility.

Investors should carefully consider the pros and cons of target date funds before deciding if they are the right choice for them.

Closure

Thus, we hope this article has provided valuable insights into Best Target Date Funds for 2045. We appreciate your attention to our article. See you in our next article!