Federal Open Market Committee Meeting Minutes

Related Articles: Federal Open Market Committee Meeting Minutes

- Porsche 911 2025: A Glimpse Into The Future Of Sports Cars

- Latest Gate Design 2025: A Comprehensive Guide To Modern Gate Aesthetics And Functionality

- FIFA Club World Cup 2025: Teams, Format, And Predictions

- Martin Luther King Jr Day 2025

- Fashion Marketing Trends: Shaping The Future Of Fashion In 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Federal Open Market Committee Meeting Minutes. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Federal Open Market Committee Meeting Minutes

Federal Open Market Committee Meeting Minutes

June 17-18, 2025

Participants:

- Jerome Powell, Chair

- John Williams, Vice Chair

- Raphael Bostic

- Charles Evans

- Esther George

- James Bullard

- Lael Brainard

- Michelle Bowman

- Christopher Waller

Opening Remarks:

Chair Powell opened the meeting by welcoming members and providing an overview of the current economic situation. He noted that the economy had continued to grow at a moderate pace, with the unemployment rate remaining low. However, he expressed concern about the recent rise in inflation, which had reached a 40-year high.

Economic Outlook:

Members discussed the economic outlook and agreed that the economy was facing a number of challenges. They noted that the war in Ukraine was continuing to disrupt global supply chains and push up energy prices. They also expressed concern about the impact of the COVID-19 pandemic, which had led to ongoing supply chain disruptions and labor shortages.

Members agreed that the economy was likely to slow in the coming months, but they did not expect a recession. They forecast that growth would remain positive, but at a slower pace than in recent years. They also forecast that inflation would remain elevated, but that it would gradually decline over the course of the year.

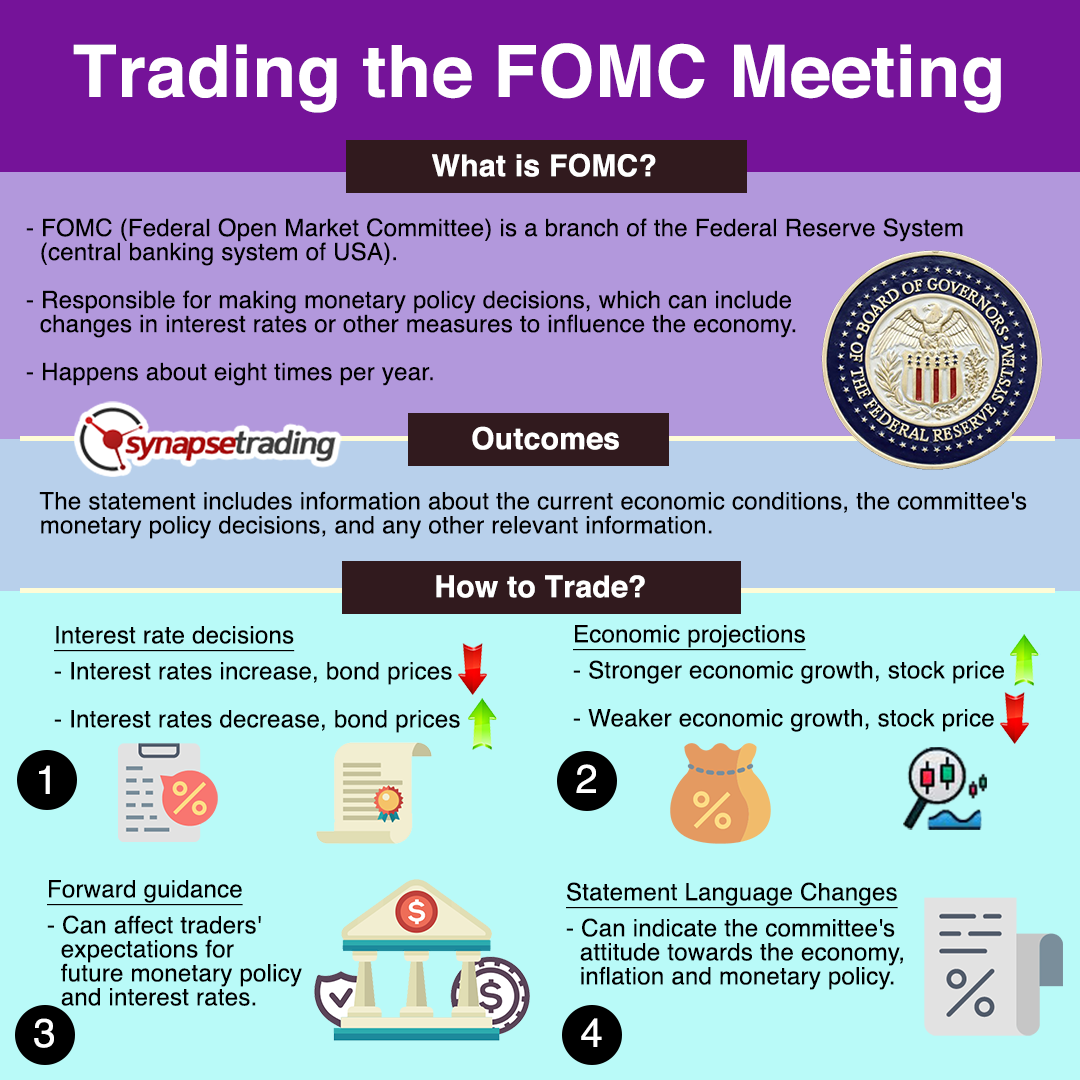

Monetary Policy Discussion:

Members discussed the appropriate monetary policy stance in light of the economic outlook. They agreed that it was necessary to raise interest rates in order to bring inflation back to the Fed’s target of 2%. However, they differed on the pace and magnitude of the rate increases.

Some members argued that it was necessary to raise rates aggressively in order to bring inflation under control quickly. They noted that the Fed had fallen behind the curve in raising rates and that it needed to act decisively to avoid a more serious inflation problem.

Other members argued that it was important to raise rates gradually in order to avoid a recession. They noted that the economy was still facing a number of challenges and that raising rates too quickly could derail the recovery.

Decision:

After a lengthy discussion, members voted to raise the target range for the federal funds rate by 50 basis points, to 1.50-1.75%. This was a larger rate increase than the 25 basis point increase that had been widely expected.

Members also agreed to continue to reduce the Fed’s balance sheet by $95 billion per month.

Economic Projections:

Following the monetary policy decision, members released their economic projections. These projections showed that members expected growth to slow in the coming months, but that they did not expect a recession. They also forecast that inflation would remain elevated, but that it would gradually decline over the course of the year.

Press Conference:

After the meeting, Chair Powell held a press conference to discuss the Fed’s decision. He said that the Fed was "strongly committed" to bringing inflation back to its target of 2%. He also said that the Fed was prepared to raise rates further if necessary.

Market Reaction:

The market reacted positively to the Fed’s decision. Stocks rose and bond yields fell. The dollar also strengthened against other currencies.

Conclusion:

The June 2025 FOMC meeting was a significant event. The Fed raised interest rates by 50 basis points and signaled that it was prepared to do more to bring inflation under control. The market reacted positively to the Fed’s decision, which was seen as a sign that the Fed was taking the inflation problem seriously.

Closure

Thus, we hope this article has provided valuable insights into Federal Open Market Committee Meeting Minutes. We appreciate your attention to our article. See you in our next article!