Federal Tax Brackets After 2025: A Comprehensive Overview

Related Articles: Federal Tax Brackets After 2025: A Comprehensive Overview

- The Outcomes Of The G20 2025: A Path To Global Recovery And Resilience

- Nissan Murano Price 2025: Unveiling The Future Of Luxury SUVs

- Cheap 2024 Holidays: Affordable Destinations And Budget-Friendly Tips

- ITC Share Price Target By 2025: A Comprehensive Analysis

- Can A 2025 Battery Replace A 2032 Battery?

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Federal Tax Brackets After 2025: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Federal Tax Brackets After 2025: A Comprehensive Overview

Federal Tax Brackets After 2025: A Comprehensive Overview

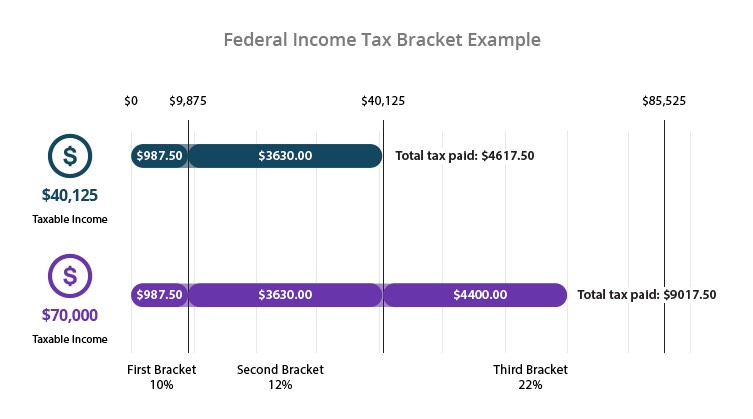

The federal tax brackets are a set of income ranges that determine the tax rate individuals and corporations pay on their taxable income. The tax brackets are adjusted annually for inflation, and the rates are set by Congress.

The Tax Cuts and Jobs Act (TCJA) of 2017 made significant changes to the federal tax brackets. The TCJA lowered the individual income tax rates and increased the standard deduction and child tax credit. The TCJA also eliminated the personal exemption.

The TCJA is scheduled to expire after 2025, and the federal tax brackets will revert to their pre-TCJA levels. This means that the individual income tax rates will increase, and the standard deduction and child tax credit will decrease.

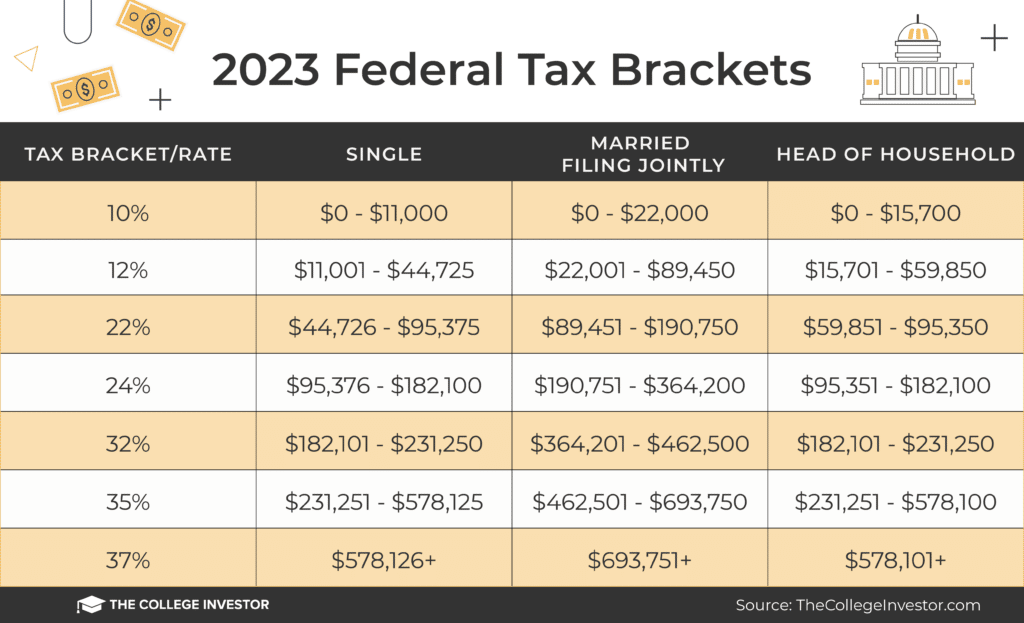

Individual Income Tax Brackets

The following table shows the individual income tax brackets for 2023 and the projected brackets for 2026, after the TCJA expires:

| Tax Bracket | 2023 | 2026 |

|---|---|---|

| 10% | $0 – $10,275 | $0 – $9,950 |

| 12% | $10,275 – $41,775 | $9,950 – $40,525 |

| 22% | $41,775 – $89,075 | $40,525 – $84,200 |

| 24% | $89,075 – $170,550 | $84,200 – $160,725 |

| 32% | $170,550 – $215,950 | $160,725 – $209,425 |

| 35% | $215,950 – $539,900 | $209,425 – $523,600 |

| 37% | $539,900+ | $523,600+ |

Corporate Income Tax Brackets

The following table shows the corporate income tax brackets for 2023 and the projected brackets for 2026, after the TCJA expires:

| Tax Bracket | 2023 | 2026 |

|---|---|---|

| 15% | $0 – $50,000 | $0 – $48,200 |

| 25% | $50,000 – $100,000 | $48,200 – $96,400 |

| 34% | $100,000 – $335,000 | $96,400 – $324,600 |

| 39% | $335,000 – $10,000,000 | $324,600 – $9,893,700 |

| 40% | $10,000,000+ | $9,893,700+ |

Impact of the TCJA Expiration

The expiration of the TCJA will have a significant impact on individual and corporate taxes. The individual income tax rates will increase, and the standard deduction and child tax credit will decrease. This will result in higher taxes for most taxpayers.

The corporate income tax rate will also increase from 21% to 28%. This will make the United States less competitive globally and could lead to job losses.

Conclusion

The expiration of the TCJA will have a significant impact on individual and corporate taxes. Taxpayers should be aware of the changes and plan accordingly.

Additional Resources

- IRS: Individual Income Tax Brackets

- IRS: Corporate Income Tax Brackets

- Tax Foundation: The Impact of the TCJA Expiration

Closure

Thus, we hope this article has provided valuable insights into Federal Tax Brackets After 2025: A Comprehensive Overview. We hope you find this article informative and beneficial. See you in our next article!