Fidelity Freedom Blend 2025 R: A Comprehensive Guide

Related Articles: Fidelity Freedom Blend 2025 R: A Comprehensive Guide

- OR 2025 Karlsruhe: Shaping The Future Of Orthopaedic Surgery

- What Will Happen To Florida In 2025: A Comprehensive Forecast

- Free Calendar For 2025 Printable: Plan Your Year With Ease

- Audi A5 Avant 2025: A Visionary Estate For The Future

- 2025 NFL Mock Draft: Predicting The Future Of The NFL

Introduction

With great pleasure, we will explore the intriguing topic related to Fidelity Freedom Blend 2025 R: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fidelity Freedom Blend 2025 R: A Comprehensive Guide

Fidelity Freedom Blend 2025 R: A Comprehensive Guide

Introduction

The Fidelity Freedom Blend 2025 R (FFB25R) is a target-date fund (TDF) offered by Fidelity Investments. TDFs are designed to provide a convenient and diversified investment option for individuals who are saving for retirement. They are structured to automatically adjust their asset allocation over time, becoming more conservative as the target retirement date approaches.

Investment Objective

The investment objective of FFB25R is to provide a moderate level of risk and return over the long term. The fund seeks to achieve this objective by investing primarily in a blend of stocks and bonds.

Asset Allocation

The asset allocation of FFB25R is designed to gradually shift from stocks to bonds as the target retirement date of 2025 approaches. As of December 31, 2022, the fund’s asset allocation was as follows:

- Stocks: 82.5%

- Bonds: 17.5%

Stock Exposure

The stock portion of FFB25R is invested in a diversified portfolio of domestic and international stocks. The fund’s stock investments are managed by Fidelity’s team of equity analysts and portfolio managers.

Bond Exposure

The bond portion of FFB25R is invested in a diversified portfolio of government, corporate, and mortgage-backed bonds. The fund’s bond investments are managed by Fidelity’s team of fixed income analysts and portfolio managers.

Glide Path

The glide path of FFB25R is the gradual shift in asset allocation from stocks to bonds over time. The fund’s glide path is designed to reduce risk as the target retirement date approaches. The following table shows the target asset allocation of FFB25R at different points in time:

| Year | Stocks | Bonds |

|---|---|---|

| 2022 | 82.5% | 17.5% |

| 2025 | 70.0% | 30.0% |

| 2030 | 50.0% | 50.0% |

| 2035 | 30.0% | 70.0% |

| 2040 | 10.0% | 90.0% |

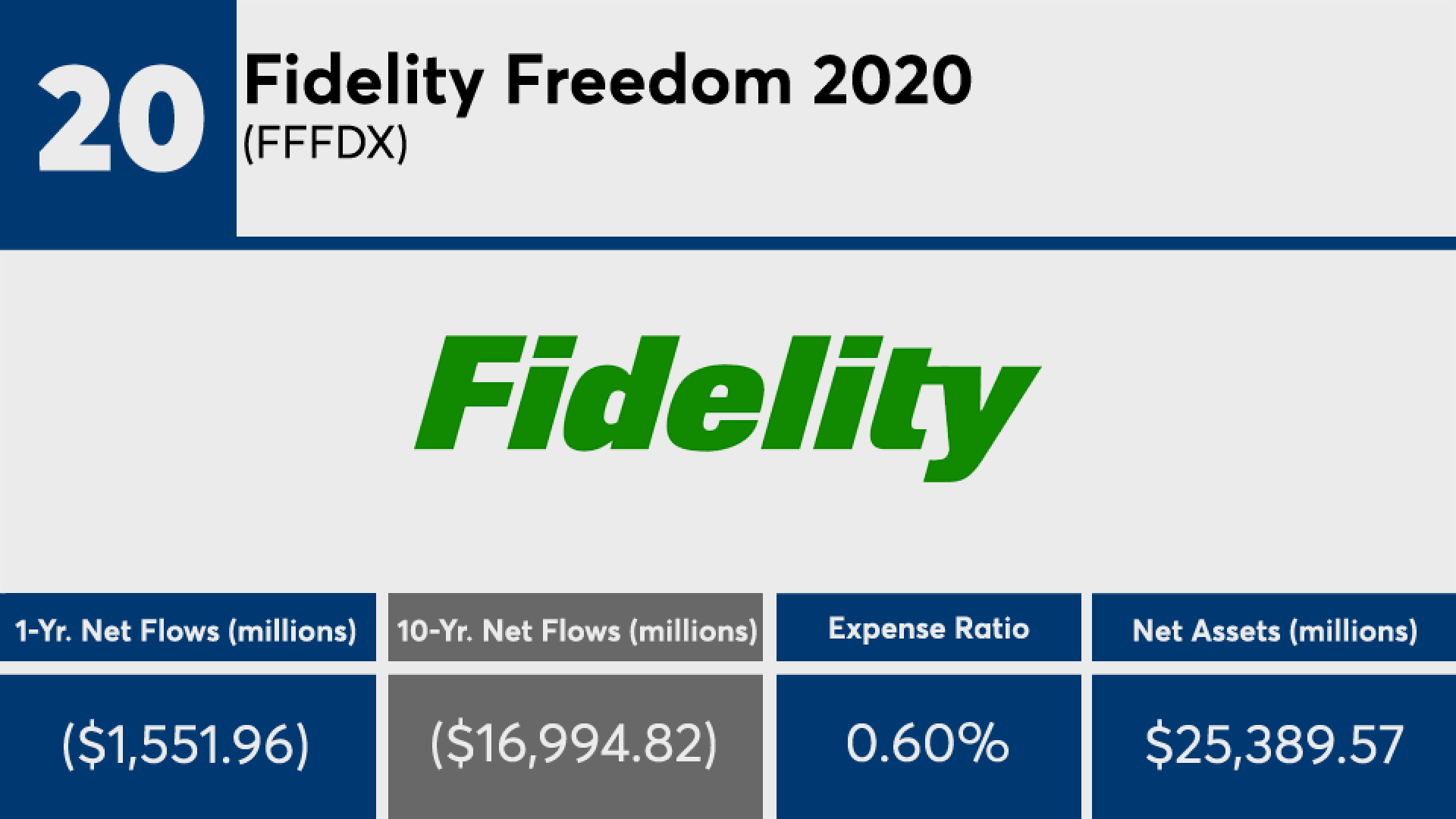

Fees and Expenses

The expense ratio of FFB25R is 0.75%. This means that for every $10,000 invested in the fund, $75 will be deducted annually to cover the fund’s operating expenses.

Suitability

FFB25R is suitable for individuals who are saving for retirement and are comfortable with a moderate level of risk. The fund is designed to provide a diversified investment option that automatically adjusts its asset allocation over time.

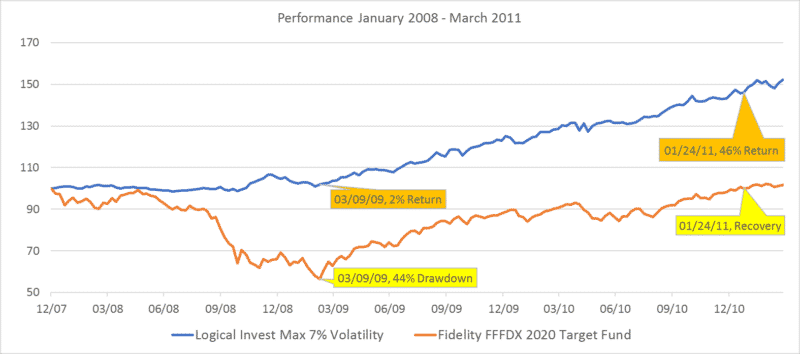

Performance

The performance of FFB25R has been strong over the long term. Over the past 10 years, the fund has returned an average of 8.5% per year. However, it is important to note that past performance is not a guarantee of future results.

Risks

As with all investments, there are risks associated with investing in FFB25R. These risks include:

- Market risk: The value of the fund’s investments can fluctuate with the market.

- Interest rate risk: The value of the fund’s bond investments can decline if interest rates rise.

- Inflation risk: The value of the fund’s investments can decline if inflation rises.

Conclusion

The Fidelity Freedom Blend 2025 R is a well-diversified target-date fund that can provide a convenient and cost-effective way to save for retirement. The fund’s moderate risk profile and automatic asset allocation make it a suitable option for individuals who are comfortable with a moderate level of risk.

Closure

Thus, we hope this article has provided valuable insights into Fidelity Freedom Blend 2025 R: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!