Fiscal Year 2025: A Comprehensive Overview of Key Economic Indicators and Projections

Related Articles: Fiscal Year 2025: A Comprehensive Overview of Key Economic Indicators and Projections

- 20254 County Road H, Goodman, WI 54125: A Haven Of Tranquility And Natural Beauty

- 2025: The World Enslaved By A Virus – A Harrowing Vision Of A Dystopian Future

- Will Summer Be Hot This Year 2025? A Comprehensive Analysis

- 2025 Nissan Armada: Release Date, Specs, And Features

- 2024 Kia Sorento: A Refined And Robust SUV With Enhanced Capabilities

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Fiscal Year 2025: A Comprehensive Overview of Key Economic Indicators and Projections. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fiscal Year 2025: A Comprehensive Overview of Key Economic Indicators and Projections

Fiscal Year 2025: A Comprehensive Overview of Key Economic Indicators and Projections

Introduction

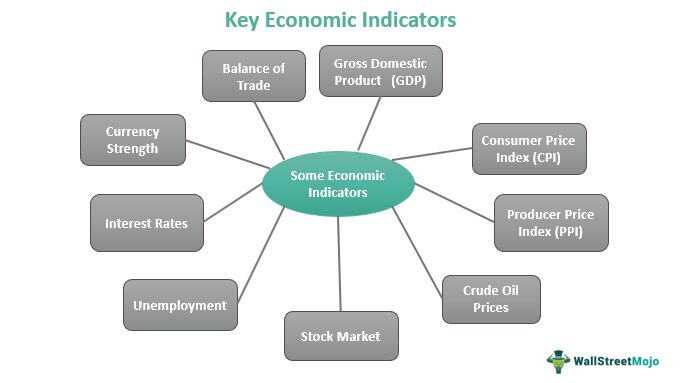

Fiscal year (FY) 2025 is a crucial period for global economies as they navigate the post-pandemic landscape and face new challenges and opportunities. This article provides a comprehensive overview of key economic indicators and projections for FY 2025, offering insights into the expected trajectory of the global economy and its implications for businesses, investors, and policymakers.

Global Economic Growth

According to the International Monetary Fund (IMF), global economic growth is projected to moderate in FY 2025, decelerating from an estimated 3.6% in FY 2024 to 3.3%. This slowdown is attributed to the waning impact of fiscal and monetary stimulus measures, as well as the ongoing geopolitical uncertainties and supply chain disruptions.

Inflation

Inflation remains a significant concern for central banks worldwide. While inflation rates are expected to ease from their elevated levels in FY 2024, they are still projected to remain above pre-pandemic averages. The IMF forecasts global inflation to average 4.1% in FY 2025, down from 6.1% in FY 2024.

Interest Rates

In response to persistent inflation, central banks are expected to continue raising interest rates in FY 2025. The Federal Reserve is projected to increase its benchmark interest rate by 0.25% in each quarter of the year, bringing the target range to 4.75% – 5.00% by the end of FY 2025.

Unemployment

The global unemployment rate is expected to decline gradually in FY 2025, reaching 5.4%, according to the IMF. This improvement reflects the ongoing recovery of labor markets from the pandemic-induced downturn. However, certain sectors and regions may experience higher levels of unemployment due to structural changes and technological advancements.

Fiscal Policy

Governments worldwide are expected to continue implementing supportive fiscal policies in FY 2025 to mitigate the economic impact of the pandemic and inflation. This includes measures such as tax cuts, infrastructure spending, and social safety nets. However, the need for fiscal consolidation to reduce budget deficits will become more pressing as economies recover.

Monetary Policy

Central banks will maintain a cautious approach to monetary policy in FY 2025, balancing the need to curb inflation with supporting economic growth. While interest rates are expected to continue rising, the pace of increases is likely to slow down as inflation moderates.

Trade and Investment

Global trade is projected to grow at a moderate pace in FY 2025, supported by the recovery of economic activity and the easing of supply chain disruptions. However, ongoing geopolitical tensions and trade barriers could pose challenges to trade growth.

Foreign direct investment (FDI) is expected to remain subdued in FY 2025, reflecting the uncertain global economic outlook and geopolitical risks. However, certain sectors, such as renewable energy and technology, are likely to attract significant investment.

Financial Markets

Equity markets are expected to experience volatility in FY 2025 as investors navigate rising interest rates, inflation, and geopolitical uncertainties. Earnings growth is likely to slow down, and valuations may come under pressure.

Bond markets are expected to remain in a low-yield environment in FY 2025, with long-term interest rates remaining below pre-pandemic levels. However, yield curves may steepen as central banks continue to raise short-term rates.

Emerging Markets

Emerging markets are expected to face a challenging economic environment in FY 2025, with slower growth, higher inflation, and currency pressures. The strengthening of the U.S. dollar and rising global interest rates could pose significant risks to these economies.

Key Challenges and Opportunities

FY 2025 presents several key challenges and opportunities for the global economy:

Challenges:

- Persistent inflation and the risk of stagflation

- Geopolitical uncertainties and supply chain disruptions

- High levels of debt and fiscal imbalances

- Technological advancements and structural changes in the labor market

Opportunities:

- Recovery from the pandemic and a return to economic growth

- Transition to a more sustainable and resilient economy

- Technological innovation and digital transformation

- Increased investment in infrastructure and human capital

Implications for Businesses, Investors, and Policymakers

The economic outlook for FY 2025 has significant implications for businesses, investors, and policymakers:

Businesses:

- Need to adapt to rising costs, supply chain disruptions, and changing consumer behavior

- Focus on innovation, productivity, and cost efficiency

- Explore new markets and diversify revenue streams

Investors:

- Adjust portfolios to navigate volatility and rising interest rates

- Seek out defensive investments and opportunities in sectors benefiting from long-term trends

- Monitor geopolitical risks and their potential impact on investments

Policymakers:

- Implement targeted policies to address inflation, support economic growth, and reduce inequality

- Foster collaboration and cooperation between governments, businesses, and international organizations

- Invest in education, infrastructure, and research and development to enhance long-term economic resilience

Conclusion

Fiscal year 2025 is a pivotal period for the global economy, presenting both challenges and opportunities. By understanding the key economic indicators and projections, businesses, investors, and policymakers can prepare for the evolving economic landscape and make informed decisions to navigate the uncertainties ahead. The path to a sustainable and resilient recovery requires a collective effort to address macroeconomic challenges, promote innovation, and foster inclusive growth.

:max_bytes(150000):strip_icc()/economic_indicator.aspfinal-15940724deaf40e09bf27f9e6b0bf832.jpg)

Closure

Thus, we hope this article has provided valuable insights into Fiscal Year 2025: A Comprehensive Overview of Key Economic Indicators and Projections. We thank you for taking the time to read this article. See you in our next article!