Google Price Prediction 2025: A Comprehensive Analysis

Related Articles: Google Price Prediction 2025: A Comprehensive Analysis

- CR2025 Battery: A Comprehensive Guide

- IR 2025: Brazil’s Vision For The Future Of Infrastructure

- Super Bowl LVIII: A Clash Of Titans

- 2025 Cadillac XT5: A Comprehensive Interior Review

- 2025 European Capital Of Culture: Chemnitz, Germany

Introduction

With great pleasure, we will explore the intriguing topic related to Google Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Google Price Prediction 2025: A Comprehensive Analysis

Google Price Prediction 2025: A Comprehensive Analysis

Introduction

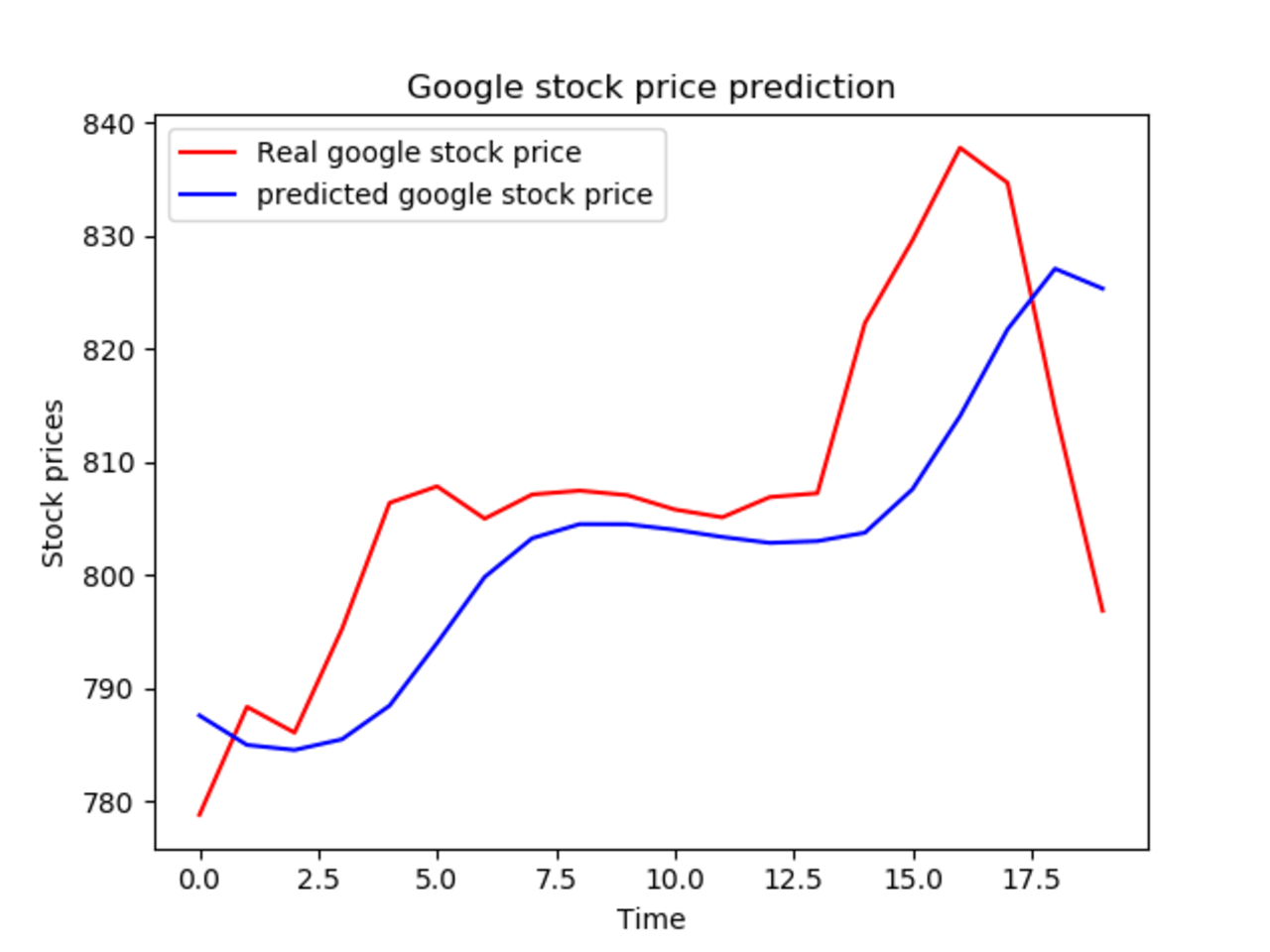

Google, the global tech giant, has consistently captivated the attention of investors and analysts alike. As the company continues to innovate and expand its offerings, predicting its future performance becomes an intriguing endeavor. This article delves into a comprehensive analysis of Google’s price prediction for 2025, examining various factors that could influence its trajectory.

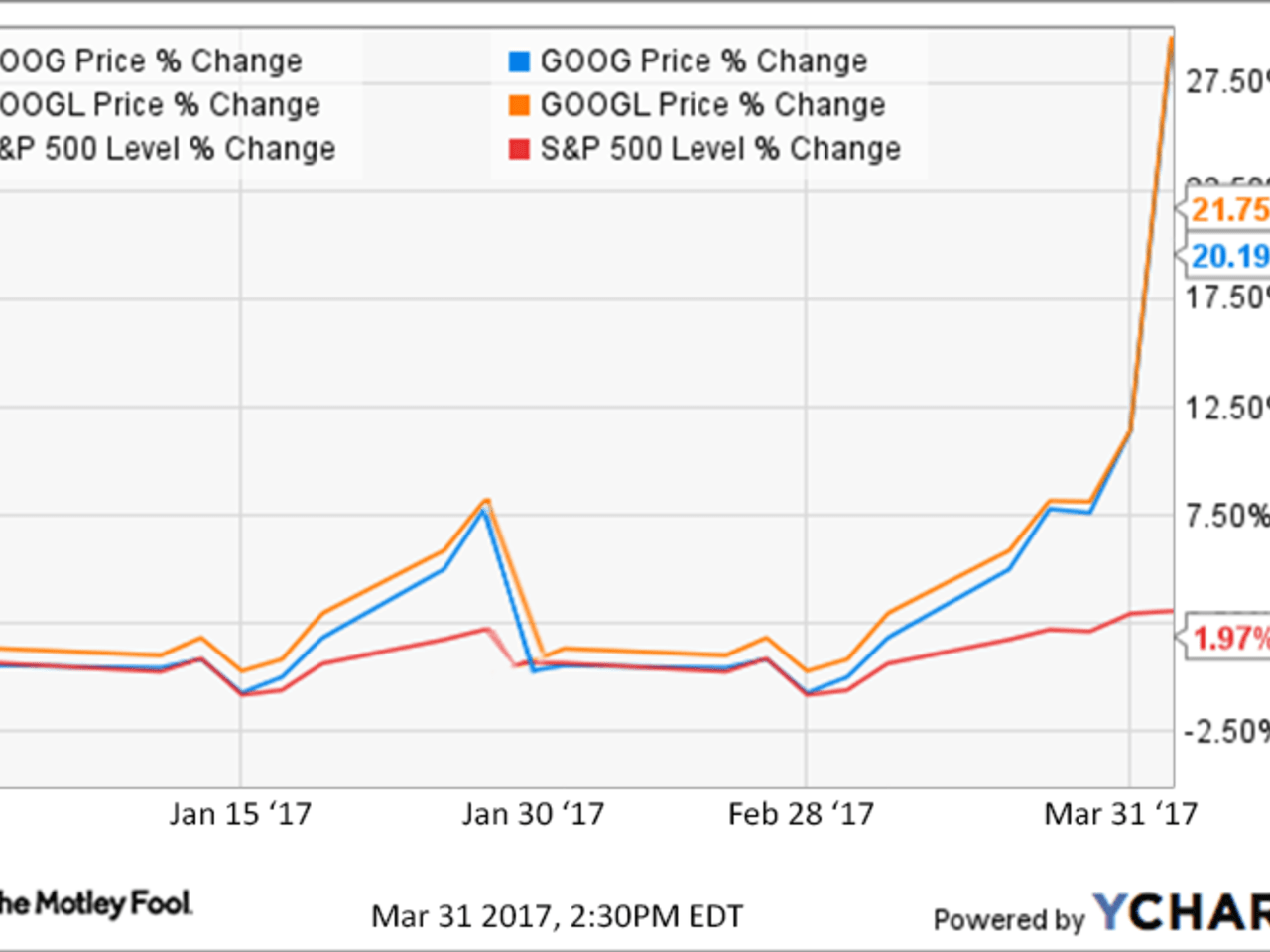

Historical Performance

Over the past decade, Google’s stock price has exhibited remarkable growth, consistently outperforming the broader market. From its initial public offering (IPO) in 2004 at $85 per share, Google’s stock has surged to over $2,800 per share as of 2023. This impressive growth has been driven by the company’s dominance in search advertising, cloud computing, and other technology sectors.

Factors Influencing Future Performance

Several key factors are likely to shape Google’s price performance in the coming years:

1. Continued Dominance in Search Advertising:

Google’s search engine remains the world’s primary destination for online information, accounting for over 90% of the global search market share. This dominance generates significant revenue through advertising, which is expected to continue growing as internet usage expands.

2. Growth in Cloud Computing:

Google Cloud Platform (GCP) is rapidly gaining market share in the cloud computing industry. The increasing demand for cloud-based services, such as data storage, analytics, and application hosting, bodes well for GCP’s future growth.

3. Expansion into New Markets:

Google has been actively exploring new markets, including hardware (e.g., Pixel smartphones), healthcare (e.g., Google Health), and artificial intelligence (e.g., Google AI). These ventures could diversify Google’s revenue streams and drive future growth.

4. Regulatory Scrutiny:

Google faces ongoing regulatory scrutiny in various jurisdictions due to its dominant position in the tech industry. Antitrust investigations and potential regulations could impact the company’s operations and profitability.

5. Economic Conditions:

Macroeconomic factors, such as inflation, interest rates, and economic growth, can significantly affect the overall performance of tech companies. A slowdown in economic growth could adversely impact Google’s advertising revenue and cloud computing demand.

Analysts’ Estimates

Based on these factors, analysts have provided a range of price predictions for Google in 2025:

-

Optimistic Estimates: Some analysts predict that Google’s stock could reach as high as $5,000 per share by 2025, citing the company’s strong fundamentals and growth potential.

-

Moderate Estimates: A majority of analysts forecast Google’s stock to trade between $3,500 and $4,500 per share in 2025, reflecting continued growth but tempered by potential challenges.

-

Conservative Estimates: A small number of analysts remain cautious, projecting Google’s stock to remain below $3,000 per share in 2025, due to concerns about regulatory risks and economic headwinds.

Factors to Consider

When evaluating Google’s price prediction, it is crucial to consider the following:

-

Long-term Growth Potential: Google has consistently demonstrated its ability to innovate and adapt to changing market dynamics. Its strong brand recognition and loyal customer base provide a solid foundation for long-term growth.

-

Valuation Multiples: Google’s stock is currently trading at a premium valuation compared to other tech companies. Investors should consider the company’s earnings growth potential relative to its current valuation.

-

Market Sentiment: Market sentiment towards tech stocks can fluctuate significantly. Positive sentiment can drive up prices, while negative sentiment can lead to declines.

-

Risks: Google faces various risks, including regulatory challenges, competition from emerging technologies, and economic downturns. Investors should assess the potential impact of these risks on the company’s future performance.

Conclusion

Predicting Google’s price in 2025 is a complex undertaking, influenced by a multitude of factors. While analysts provide a range of estimates, it is important to approach these predictions with caution. Investors should carefully consider Google’s historical performance, growth potential, valuation, market sentiment, and potential risks before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Google Price Prediction 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!