Google Stock Price Prediction 2025 and Beyond: A Comprehensive Analysis

Related Articles: Google Stock Price Prediction 2025 and Beyond: A Comprehensive Analysis

- Syncing Phone And Laptop Calendars: A Comprehensive Guide

- 2025 Honda Ridgeline Hybrid: Redefining The Midsize Truck

- Leprosy: A Review Of Clinical Features, Diagnosis, And Management

- Toy Story 5: The Enduring Legacy Of A Cinematic Masterpiece

- 2025 Yukon XL Denali: The Pinnacle Of Luxury And Capability

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Google Stock Price Prediction 2025 and Beyond: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Google Stock Price Prediction 2025 and Beyond: A Comprehensive Analysis

Google Stock Price Prediction 2025 and Beyond: A Comprehensive Analysis

Introduction

Google, the tech behemoth and a household name in the digital realm, has consistently captivated investors’ attention due to its remarkable growth trajectory and dominance in various industries. Its stock price has witnessed a meteoric rise over the years, making it a lucrative investment opportunity. As we delve into the future, it becomes imperative to analyze Google’s stock price prediction for 2025 and beyond, considering the company’s evolving business landscape, technological advancements, and market dynamics.

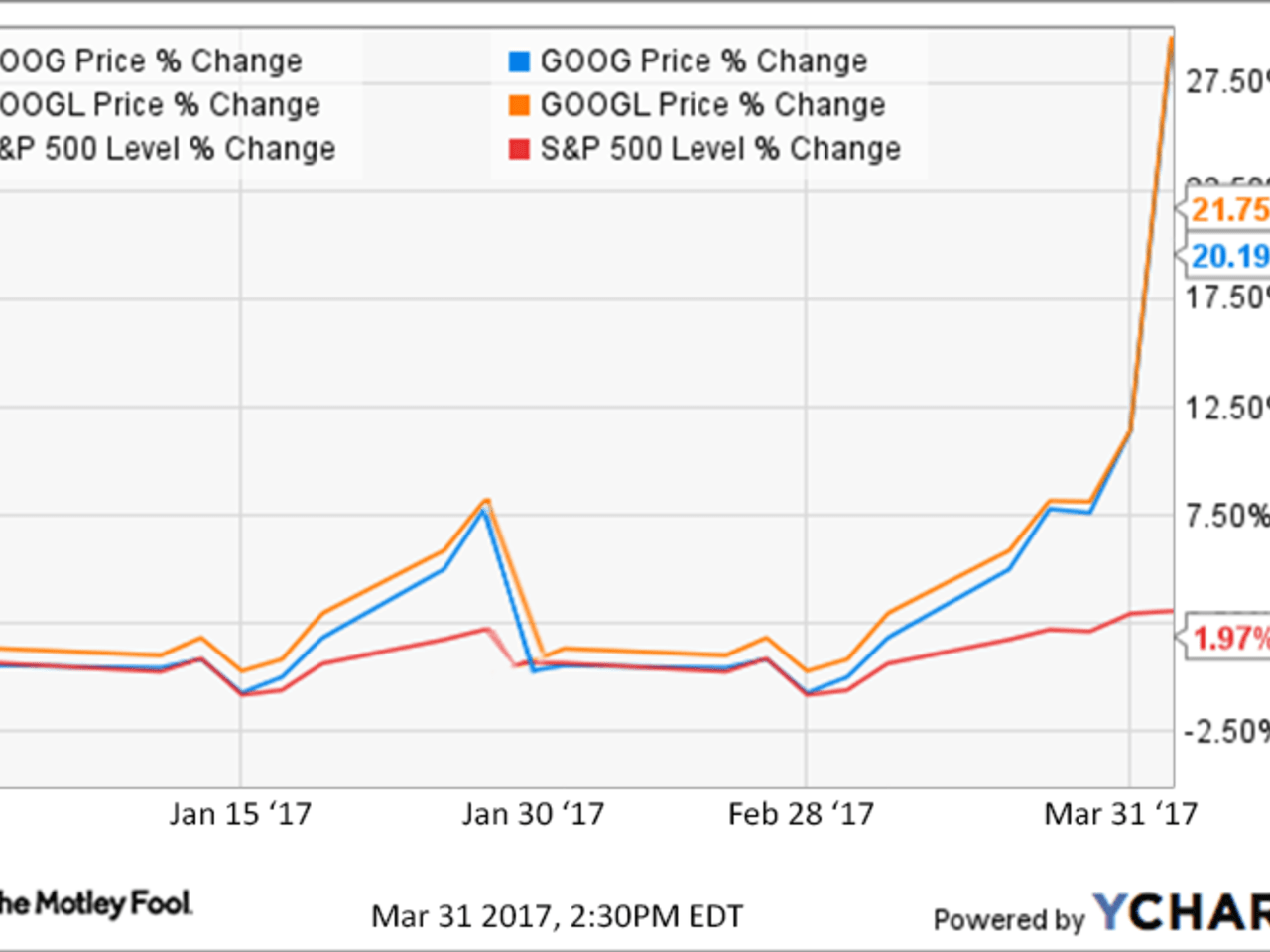

Current Market Position and Performance

Google’s current market capitalization stands at an astounding $1.3 trillion, making it one of the most valuable companies in the world. Its stock has exhibited remarkable resilience, consistently outperforming the broader market indices. Over the past five years, Google’s stock price has surged by more than 150%, highlighting the company’s strong financial performance and investor confidence.

Key Growth Drivers

Google’s continued growth is fueled by several key factors:

-

Dominance in Search and Advertising: Google controls over 90% of the global search engine market, providing a massive platform for advertisers. Its advertising revenue, which constitutes a significant portion of its earnings, continues to grow as businesses seek to reach consumers online.

-

Cloud Computing Leadership: Google Cloud has emerged as a formidable player in the cloud computing industry, competing with Amazon Web Services (AWS) and Microsoft Azure. Google’s cloud services offer a comprehensive suite of solutions for businesses, including infrastructure, platform, and software services.

-

Innovation and New Technologies: Google is renowned for its relentless pursuit of innovation, investing heavily in research and development. The company’s advancements in artificial intelligence (AI), machine learning (ML), and quantum computing hold immense potential for future growth.

-

Expansion into New Markets: Google has strategically expanded its operations into new markets, including healthcare, finance, and e-commerce. These ventures present opportunities for revenue diversification and long-term growth.

Industry Trends and Challenges

While Google enjoys a strong market position, it faces several industry trends and challenges:

-

Increased Competition: The tech industry is highly competitive, with emerging players constantly challenging the incumbents. Google faces competition from rivals such as Amazon, Microsoft, and Apple in various business segments.

-

Regulatory Scrutiny: Google has come under increasing regulatory scrutiny in recent years, facing antitrust investigations and concerns over its data privacy practices. Regulatory actions could potentially impact the company’s growth and profitability.

-

Economic Downturns: Economic downturns can adversely affect advertising spending, which is a major source of revenue for Google. In times of economic uncertainty, businesses may reduce their marketing budgets, impacting Google’s earnings.

Google Stock Price Prediction 2025 and Beyond

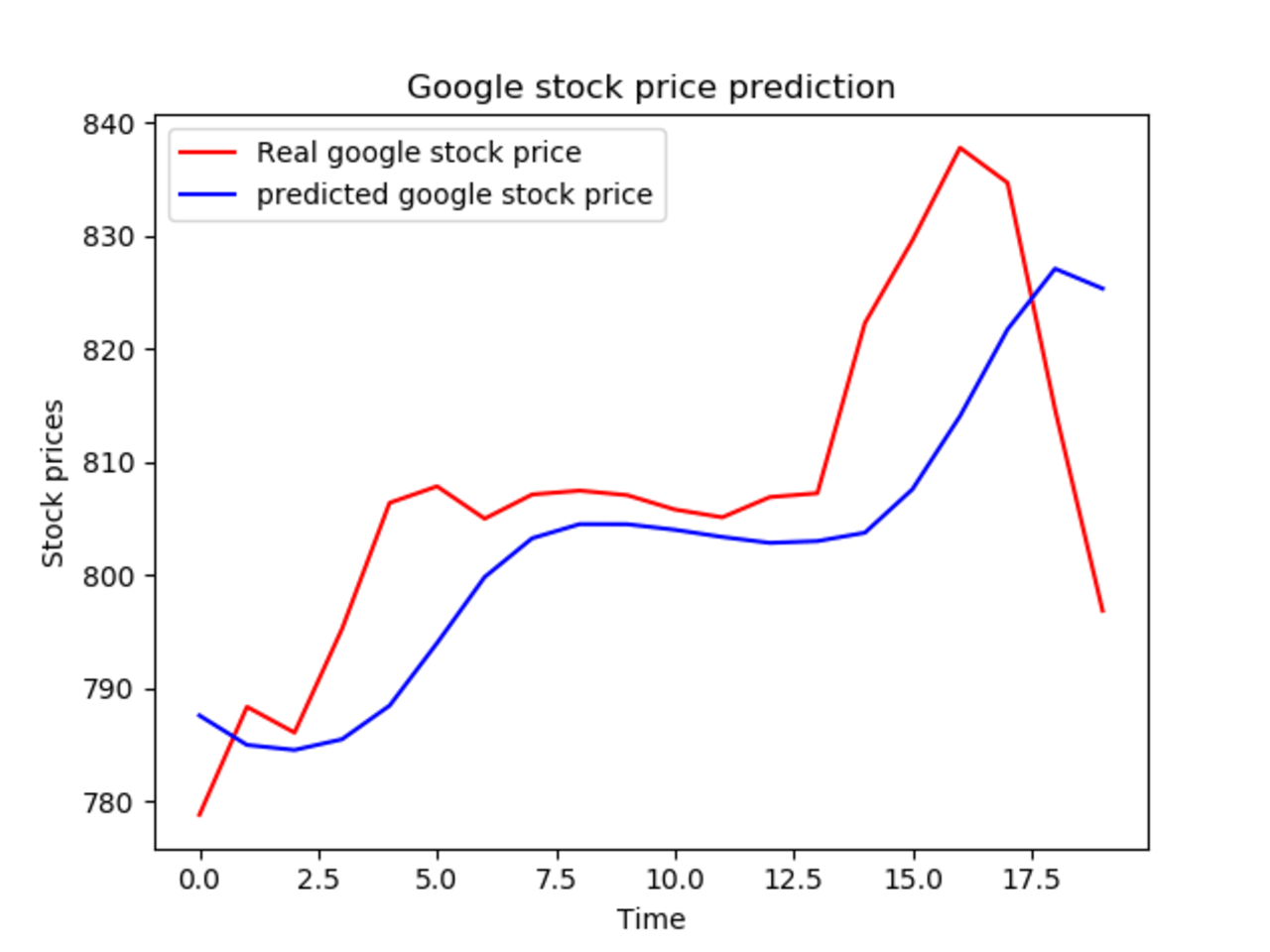

Based on a comprehensive analysis of Google’s current performance, growth drivers, industry trends, and challenges, several analysts have provided their predictions for the company’s stock price in 2025 and beyond:

-

TipRanks: A consensus of 37 analysts polled by TipRanks estimates Google’s stock price to reach $1,650 by 2025, representing an upside potential of approximately 30%. The analysts attribute this growth to the company’s continued dominance in search and advertising, strong cloud computing business, and ongoing innovation.

-

Zacks Investment Research: Zacks Investment Research forecasts Google’s stock price to climb to $1,700 by 2025, driven by the company’s strong earnings growth and long-term growth prospects. Zacks analysts believe that Google’s focus on cloud computing, AI, and healthcare will contribute to its future success.

-

Seeking Alpha: Seeking Alpha analysts have a more conservative outlook, predicting Google’s stock price to reach $1,500 by 2025. They acknowledge Google’s strong fundamentals but express some concerns about regulatory headwinds and potential economic downturns.

Beyond 2025: Long-Term Outlook

Looking beyond 2025, Google’s long-term growth trajectory remains promising. The company’s commitment to innovation and its vast resources position it well to capitalize on emerging technologies and market opportunities.

-

AI and Machine Learning: Google’s leadership in AI and ML is expected to drive significant growth in the coming years. AI applications have the potential to transform various industries, including healthcare, finance, and transportation, creating new revenue streams for Google.

-

Cloud Computing Expansion: Cloud computing is projected to be a major growth driver for Google in the long term. As businesses increasingly embrace cloud-based solutions, Google Cloud is well-positioned to capture a significant market share.

-

New Market Penetration: Google is expected to continue its expansion into new markets, such as healthcare, finance, and e-commerce. These ventures could provide additional growth opportunities and diversify Google’s revenue streams.

Risks and Considerations

While Google’s stock price prediction for 2025 and beyond appears optimistic, it is essential to consider potential risks and uncertainties that could impact its growth trajectory:

-

Regulatory Environment: Ongoing regulatory scrutiny could result in fines, penalties, or restrictions on Google’s operations, potentially affecting its profitability and growth.

-

Economic Downturns: Economic downturns can significantly impact Google’s advertising revenue, as businesses reduce their marketing budgets.

-

Competition: Intense competition from rivals such as Amazon, Microsoft, and Apple could limit Google’s market share and growth opportunities.

-

Technological Disruptions: Rapid technological advancements could disrupt Google’s existing business models and create new challenges for the company.

Conclusion

Google’s stock price prediction for 2025 and beyond presents a compelling investment opportunity for those seeking exposure to the tech industry’s continued growth. The company’s strong fundamentals, growth drivers, and long-term outlook suggest that its stock price has the potential to appreciate significantly in the coming years. However, it is essential to be aware of potential risks and uncertainties that could impact Google’s growth trajectory. Investors should conduct thorough research, consider their investment goals and risk tolerance, and consult with financial advisors before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Google Stock Price Prediction 2025 and Beyond: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!