Home Interest Rates in 2025: A Comprehensive Forecast

Related Articles: Home Interest Rates in 2025: A Comprehensive Forecast

- The 2024 Dodge Charger SRT: Unleashing The Fury Of Electrification

- When Is Chinese New Year In 2025?

- Gmail May 30, 2025: A Glimpse Into The Future Of Email

- Astoria, New Condo Development: A Luxurious Waterfront Oasis In The Heart Of Queens

- The Enthralling Quest: Mars Expedition 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Home Interest Rates in 2025: A Comprehensive Forecast. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Home Interest Rates in 2025: A Comprehensive Forecast

Home Interest Rates in 2025: A Comprehensive Forecast

Introduction

Home interest rates play a pivotal role in the housing market, influencing mortgage affordability and the overall cost of homeownership. As we approach 2025, it is crucial to understand the factors that will shape interest rate trends and their potential impact on the housing market. This article provides a comprehensive forecast of home interest rates in 2025, examining the key economic indicators, market dynamics, and policy decisions that will influence their trajectory.

Economic Outlook

The economic outlook for 2025 will be a key determinant of home interest rates. A strong economy with robust job growth and rising wages will put upward pressure on interest rates as the Federal Reserve (Fed) seeks to contain inflation. Conversely, a weak economy with high unemployment and sluggish growth could lead to lower interest rates as the Fed attempts to stimulate economic activity.

Inflation

Inflation is a major concern for central banks, including the Fed. If inflation remains persistently high, the Fed may be forced to raise interest rates more aggressively to bring it under control. This could lead to higher home interest rates in 2025. However, if inflation moderates or declines, the Fed may be able to slow the pace of interest rate hikes, potentially keeping home interest rates relatively low.

Labor Market

The labor market is another important factor that will influence home interest rates. A tight labor market with low unemployment and strong wage growth will put upward pressure on inflation, leading to higher interest rates. On the other hand, a weak labor market with high unemployment and stagnant wages could lead to lower interest rates as the Fed tries to boost economic growth.

Fiscal Policy

Government fiscal policy, particularly the level of spending and taxation, can also affect home interest rates. Increased government spending or tax cuts can stimulate economic growth and put upward pressure on interest rates. Conversely, fiscal tightening, such as spending cuts or tax increases, can slow economic growth and potentially lead to lower interest rates.

Monetary Policy

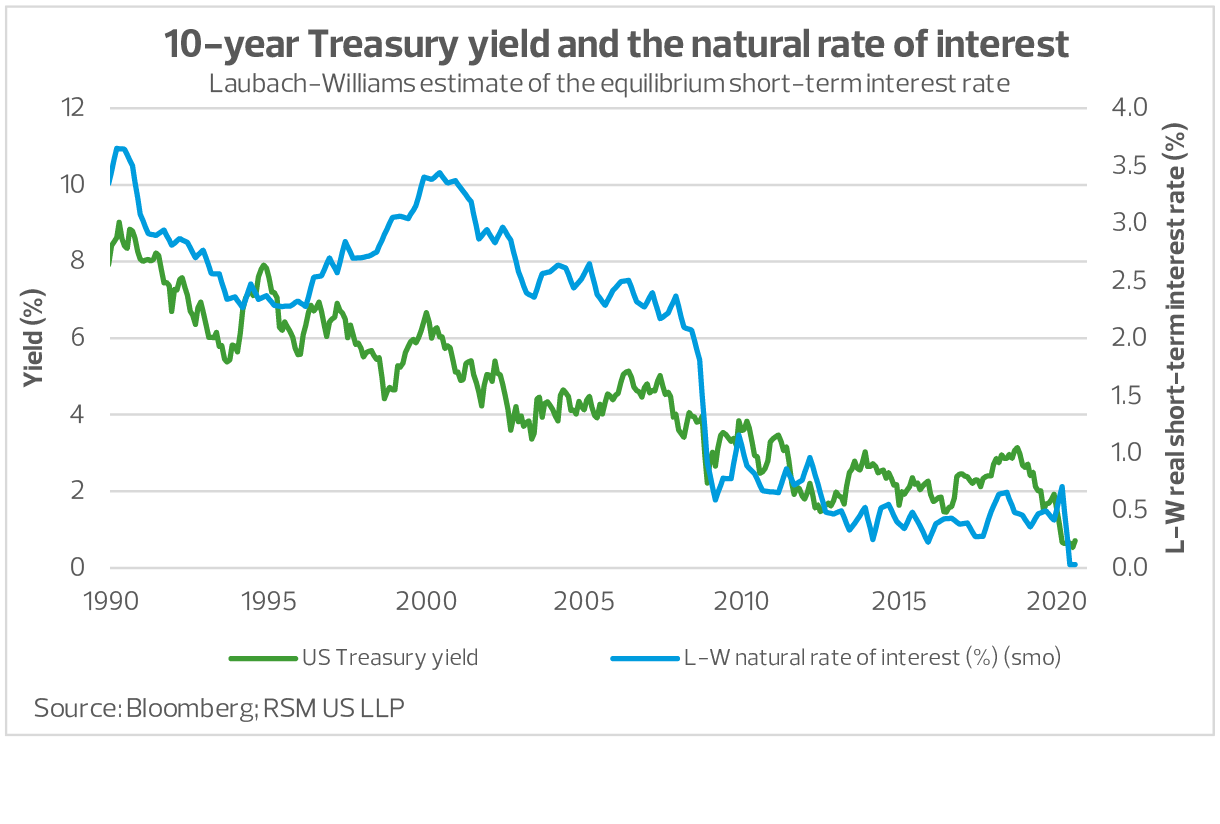

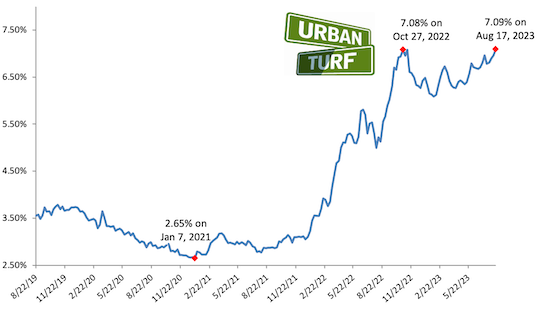

The Fed’s monetary policy is the primary driver of short-term interest rates, which in turn influence home interest rates. The Fed has signaled its intention to continue raising interest rates in 2023 and 2024 to combat inflation. However, the pace and magnitude of these hikes will depend on economic conditions and the outlook for inflation.

Market Dynamics

In addition to economic and policy factors, market dynamics will also play a role in shaping home interest rates in 2025. The supply of homes for sale, the demand from buyers, and the level of investor activity will all influence interest rate trends.

Supply of Homes

The supply of homes for sale has been constrained in recent years due to factors such as rising construction costs, zoning restrictions, and a shortage of skilled labor. This limited supply has put upward pressure on home prices, which could lead to higher interest rates in 2025 as buyers compete for a limited number of available homes.

Demand from Buyers

Demand from buyers is another key factor that will influence home interest rates. A strong demand for homes, driven by factors such as population growth, low unemployment, and rising wages, could put upward pressure on interest rates as buyers are willing to pay higher prices. Conversely, weak demand from buyers could lead to lower interest rates as sellers are forced to compete for buyers.

Investor Activity

Investor activity can also affect home interest rates. A large number of investors purchasing homes can drive up prices and put upward pressure on interest rates. However, if investor activity declines, it could lead to lower interest rates as there is less competition for homes.

Forecast

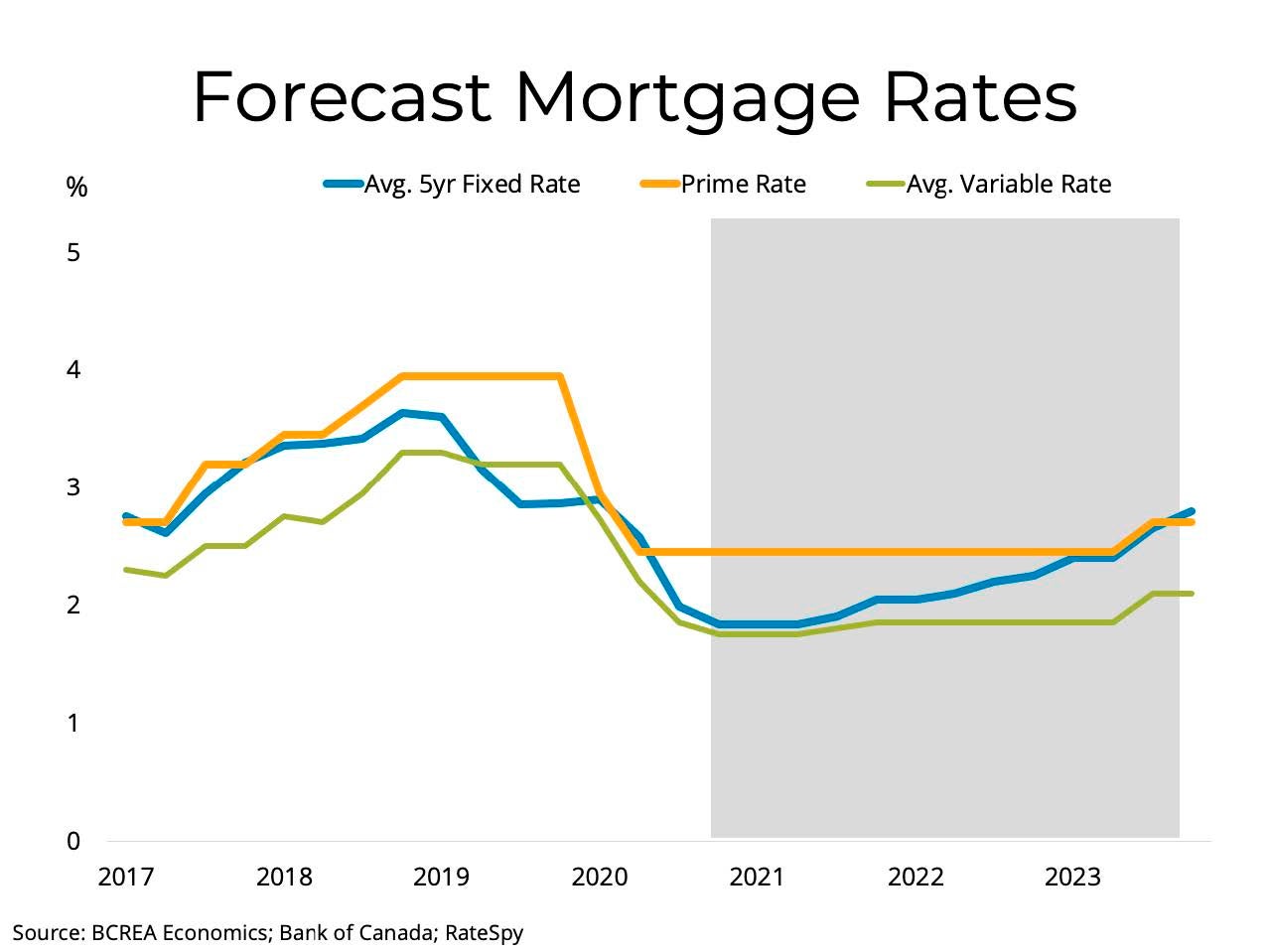

Based on the factors discussed above, we forecast that home interest rates will likely be higher in 2025 than they are today. The Fed’s ongoing efforts to combat inflation, coupled with a strong economy and limited supply of homes for sale, will put upward pressure on interest rates. However, the pace and magnitude of interest rate increases will depend on economic conditions and the outlook for inflation.

Impact on the Housing Market

Higher home interest rates in 2025 will have a significant impact on the housing market. Mortgage affordability will decline, making it more difficult for buyers to qualify for loans and purchase homes. This could lead to a slowdown in home sales and price appreciation.

Conclusion

Home interest rates in 2025 will be shaped by a complex interplay of economic factors, policy decisions, and market dynamics. While it is difficult to predict interest rates with certainty, our forecast suggests that they will likely be higher than they are today. This will have a significant impact on the housing market, potentially slowing down home sales and price appreciation.

Closure

Thus, we hope this article has provided valuable insights into Home Interest Rates in 2025: A Comprehensive Forecast. We thank you for taking the time to read this article. See you in our next article!