How to Pay Taxes in Morocco

Related Articles: How to Pay Taxes in Morocco

- Future Flying Cars: Revolutionizing Urban Transportation By 2025

- Will Interest Rates Fall In 2025?

- Wightman Street: A Vibrant And Historic Pittsburgh Neighborhood

- Upcoming Movies To Anticipate: A Comprehensive List Of 2024 And 2025 Releases

- Counting Down The Days: How Many Days Until February 25, 2025?

Introduction

With great pleasure, we will explore the intriguing topic related to How to Pay Taxes in Morocco. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about How to Pay Taxes in Morocco

How to Pay Taxes in Morocco

Introduction

Paying taxes is a crucial obligation for citizens and businesses in Morocco. The Moroccan tax system is designed to generate revenue for the government to fund essential public services and infrastructure. Understanding the tax laws and procedures is vital for individuals and entities to fulfill their tax obligations accurately and efficiently. This comprehensive guide will provide a detailed overview of the Moroccan tax system, including the different types of taxes, tax rates, filing requirements, and payment methods.

Types of Taxes in Morocco

The Moroccan tax system encompasses various types of taxes, including:

- Income Tax (IR): Levied on individuals and businesses based on their taxable income.

- Corporate Tax (IS): Imposed on companies and other legal entities on their net profits.

- Value Added Tax (VAT): Applied to the sale of goods and services, as well as imports.

- Professional Tax (TP): Charged on individuals engaged in professional activities, such as doctors, lawyers, and engineers.

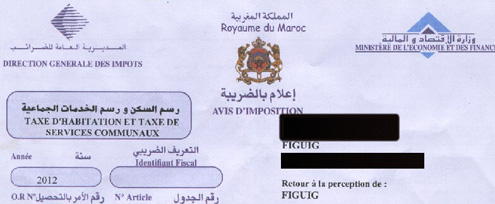

- Real Estate Tax (TF): Assessed on the ownership of real property.

- Transfer Tax (DT): Imposed on the transfer of real estate or businesses.

- Registration Tax (DR): Levied on the registration of companies, vehicles, and other legal documents.

- Customs Duties: Applied to imported goods.

Tax Rates in Morocco

The tax rates in Morocco vary depending on the type of tax and the taxpayer’s circumstances. Here is a summary of the key tax rates:

-

Income Tax (IR):

- Individuals: Progressive rates ranging from 0% to 45%.

- Businesses: Flat rate of 31%.

- Corporate Tax (IS): Flat rate of 31%.

- Value Added Tax (VAT): Standard rate of 20%, reduced rates of 10% and 14%, and a zero rate for certain essential goods.

- Professional Tax (TP): Progressive rates ranging from 0% to 20%.

- Real Estate Tax (TF): Varies based on the location and value of the property.

- Transfer Tax (DT): 5% on the transfer of real estate, 3% on the transfer of businesses.

- Registration Tax (DR): 1% on the registration of companies, 4% on the registration of vehicles.

Tax Filing Requirements

Taxpayers in Morocco are required to file tax returns and make payments by specific deadlines. The filing requirements vary depending on the type of tax:

- Income Tax (IR): Individuals and businesses must file annual tax returns by April 30th.

- Corporate Tax (IS): Companies must file annual tax returns within three months of their fiscal year-end.

- Value Added Tax (VAT): Businesses must file monthly VAT returns.

- Professional Tax (TP): Individuals engaged in professional activities must file annual tax returns by April 30th.

- Real Estate Tax (TF): Property owners must file annual tax returns by March 31st.

- Transfer Tax (DT): The transfer tax is paid at the time of the property or business transfer.

- Registration Tax (DR): The registration tax is paid at the time of company registration or vehicle registration.

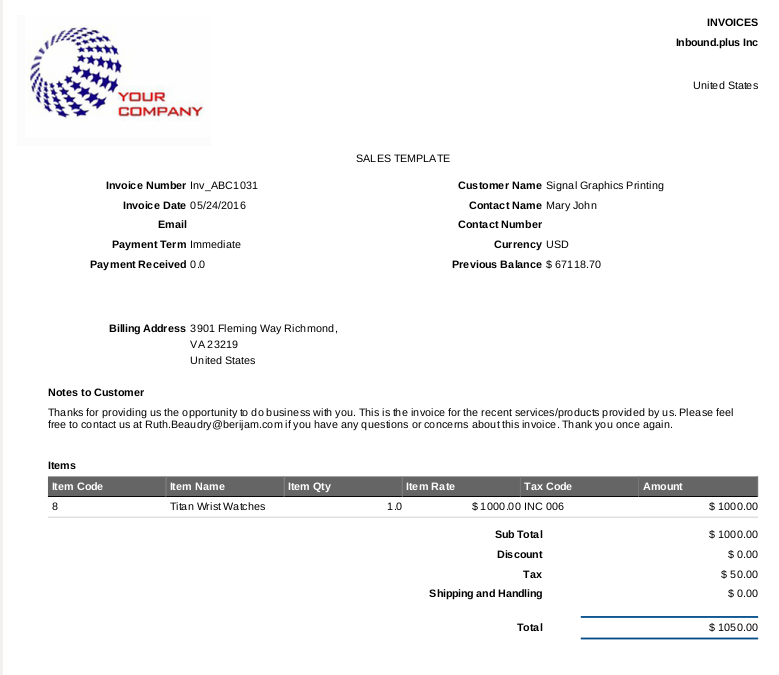

Tax Payment Methods

Taxpayers in Morocco can make tax payments using various methods:

- Online: Through the online tax portal of the Moroccan Tax Administration (DGI).

- Bank Transfer: By transferring funds to the DGI’s bank account.

- Cheque: By issuing a cheque payable to the DGI.

- Cash: By paying in person at a tax office.

Penalties for Late Payment

Failure to file tax returns or make payments on time may result in penalties. The penalties can vary depending on the type of tax and the duration of the delay. It is important to adhere to the tax deadlines to avoid any additional charges.

Tax Incentives and Exemptions

The Moroccan government offers various tax incentives and exemptions to encourage investment and economic growth. These incentives include:

- Investment Tax Credits: Tax credits for investments in certain sectors, such as renewable energy and tourism.

- Exemptions for Exported Goods: Exemption from VAT for goods exported outside Morocco.

- Tax Holidays: Temporary exemptions from corporate income tax for businesses in specific industries.

Conclusion

Understanding the Moroccan tax system is essential for individuals and businesses to fulfill their tax obligations accurately and efficiently. By adhering to the tax laws and procedures, taxpayers can contribute to the country’s revenue generation and support the provision of essential public services. The Moroccan Tax Administration (DGI) provides comprehensive resources and assistance to taxpayers to ensure compliance and facilitate tax payments. By staying informed and seeking professional guidance when needed, taxpayers can navigate the Moroccan tax system effectively and meet their responsibilities as citizens and businesses.

Closure

Thus, we hope this article has provided valuable insights into How to Pay Taxes in Morocco. We hope you find this article informative and beneficial. See you in our next article!