I Turn 73 in 2025: When Must I Start My RMD?

Related Articles: I Turn 73 in 2025: When Must I Start My RMD?

- Porsche 911 2025: A Glimpse Into The Future Of Sports Cars

- 2025 Cadillac XT5: A Comprehensive Interior Review

- 2024 Or 2025 Equinox EV: A Comprehensive Analysis

- Keine Verbrenner Mehr Ab 2030: Deutschland Treibt Die Verkehrswende Voran

- 2025 US Holiday List

Introduction

With great pleasure, we will explore the intriguing topic related to I Turn 73 in 2025: When Must I Start My RMD?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about I Turn 73 in 2025: When Must I Start My RMD?

I Turn 73 in 2025: When Must I Start My RMD?

Understanding Required Minimum Distributions (RMDs)

As you approach retirement, it’s crucial to plan for Required Minimum Distributions (RMDs) from your tax-advantaged retirement accounts. RMDs ensure that you withdraw a minimum amount from these accounts each year to satisfy the Internal Revenue Service (IRS) tax regulations.

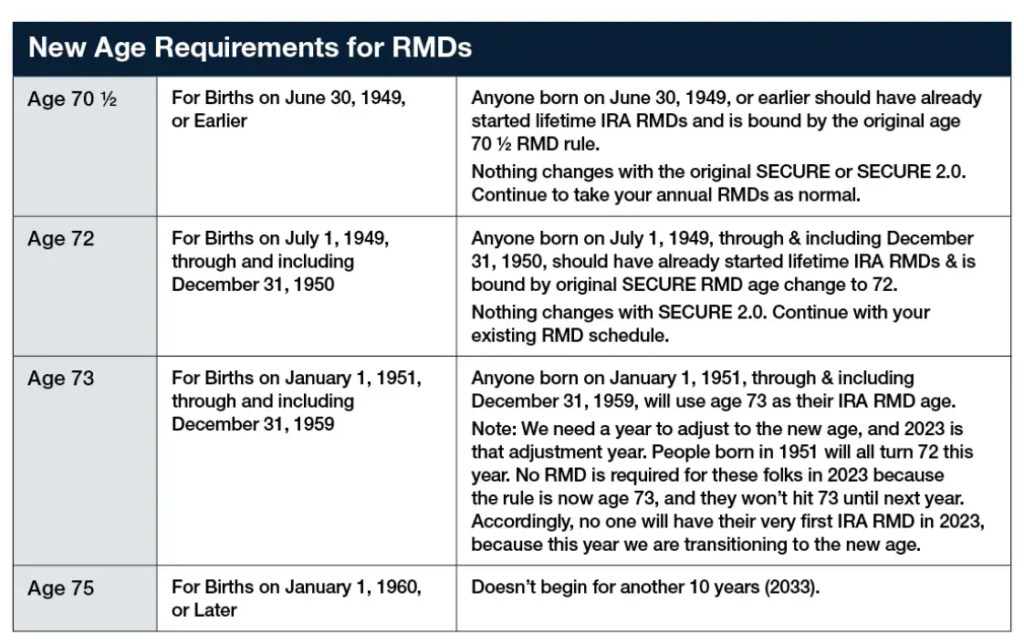

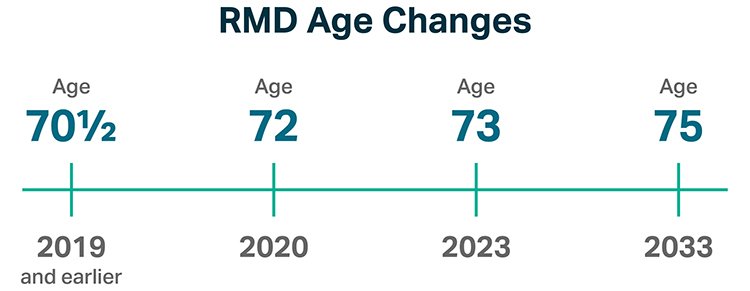

Determining Your RMD Start Date

The age at which you must begin taking RMDs depends on your birth year. For individuals born after June 30, 1949, the RMD start date is April 1 of the year following the year you turn 73. This means that if you were born on or after July 1, 1951, your RMD start date will be April 1, 2025.

Calculating Your RMD Amount

The amount of your RMD is calculated based on your account balance as of December 31 of the previous year. The IRS provides a formula for calculating your RMD, which is:

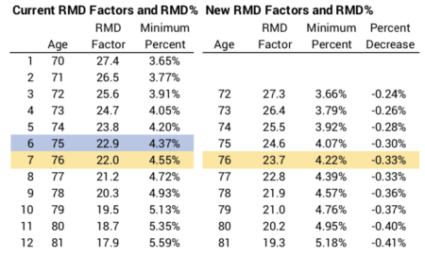

RMD = (Account Balance / Life Expectancy Factor)The IRS publishes life expectancy factors each year, which are based on the average life expectancy of individuals of a specific age. For example, the life expectancy factor for someone who turns 73 in 2025 is 26.5.

Example Calculation

Let’s say you have an IRA account balance of $500,000 on December 31, 2024. Using the life expectancy factor of 26.5, your RMD for 2025 would be:

RMD = (500,000 / 26.5) = $18,868Penalties for Failing to Take RMDs

It’s essential to take your RMDs on time each year. If you fail to do so, you may face a penalty of 50% of the amount that should have been distributed. This penalty can be substantial, so it’s important to avoid it by withdrawing the required amount by the deadline.

Taking Your RMDs

You can take your RMDs in several ways, including:

- Withdrawing the amount directly from your account

- Rolling the amount over to another retirement account, such as an IRA or 401(k)

- Using the funds to purchase an annuity

Planning for RMDs

To ensure a smooth transition into retirement, it’s wise to start planning for your RMDs well in advance. Consider the following strategies:

- Estimate your future RMDs: Use the IRS life expectancy factors to estimate the amount of your future RMDs. This will help you budget accordingly.

- Increase your savings: If your retirement savings are not sufficient to cover your estimated RMDs, consider increasing your contributions to your tax-advantaged accounts.

- Consider tax-efficient withdrawals: Explore strategies such as Roth conversions or qualified charitable distributions to minimize the tax impact of your RMDs.

Conclusion

Understanding and planning for your RMDs is a crucial part of retirement planning. By taking the necessary steps to withdraw the required amounts on time, you can avoid penalties and ensure that your retirement savings last throughout your lifetime. If you have any questions or need assistance with calculating or taking your RMDs, it’s advisable to consult with a qualified financial advisor.

Closure

Thus, we hope this article has provided valuable insights into I Turn 73 in 2025: When Must I Start My RMD?. We thank you for taking the time to read this article. See you in our next article!