Interest Rates in Canada: Outlook for 2025

Related Articles: Interest Rates in Canada: Outlook for 2025

- 2025 KBO Fa: A Distant Object With A Mysterious Past

- IR 2025 CAC: A Comprehensive Review Of The Next-Generation Infrared Countermeasure

- Ontario Street: A Historic And Vibrant Thoroughfare In The Heart Of Cleveland, Ohio

- PUP Admission 2024 To 2025: A Comprehensive Guide

- Marvel Cinematic Universe: A Comprehensive Timeline For 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Interest Rates in Canada: Outlook for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Interest Rates in Canada: Outlook for 2025

Interest Rates in Canada: Outlook for 2025

Introduction

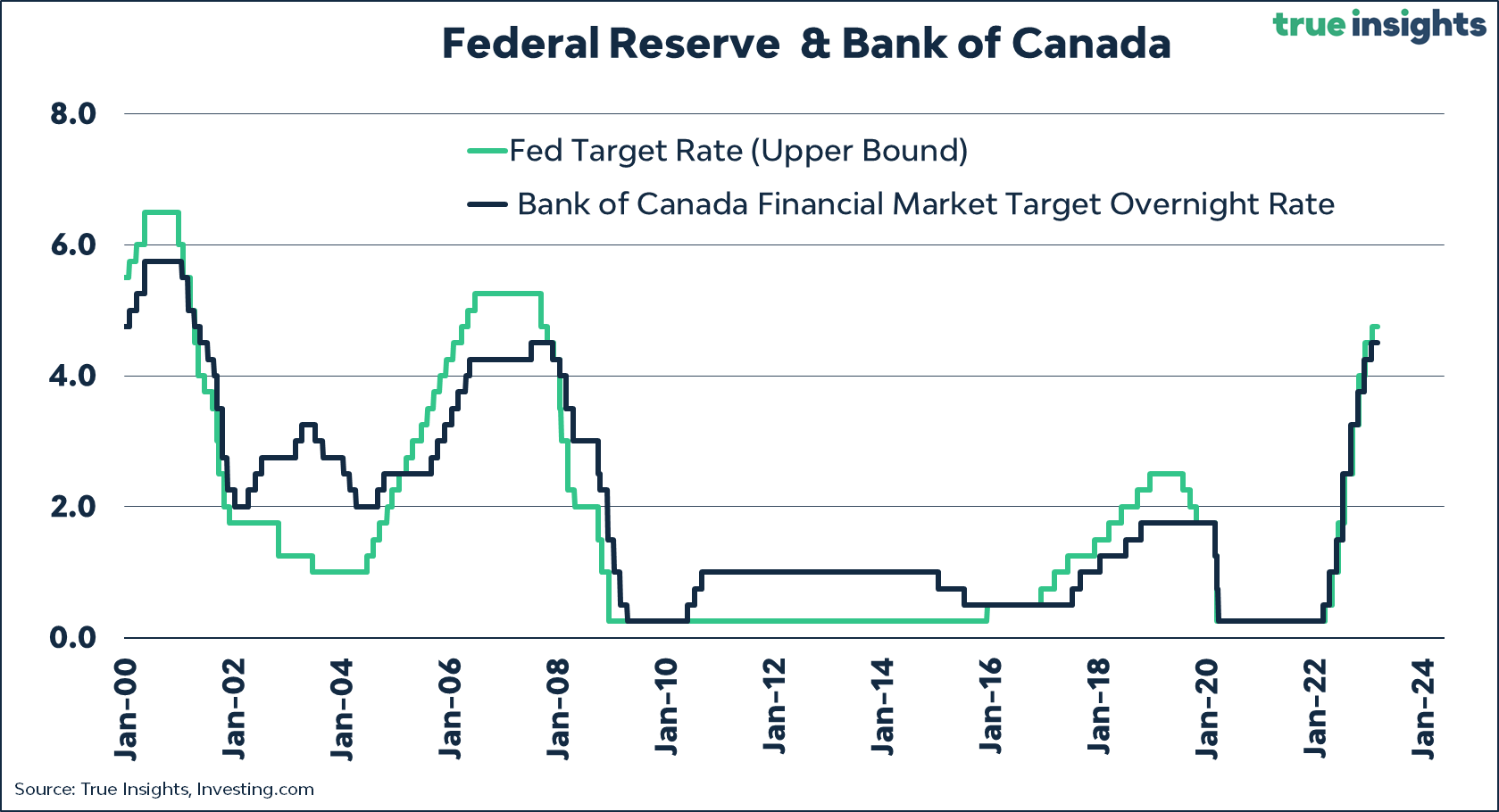

Interest rates are a crucial economic indicator that impact a wide range of financial decisions, from borrowing costs to investment returns. In Canada, the central bank, the Bank of Canada (BoC), sets the target for the overnight rate, which serves as the benchmark for other interest rates in the economy. This article examines the current state of interest rates in Canada and provides an outlook for their trajectory in 2025.

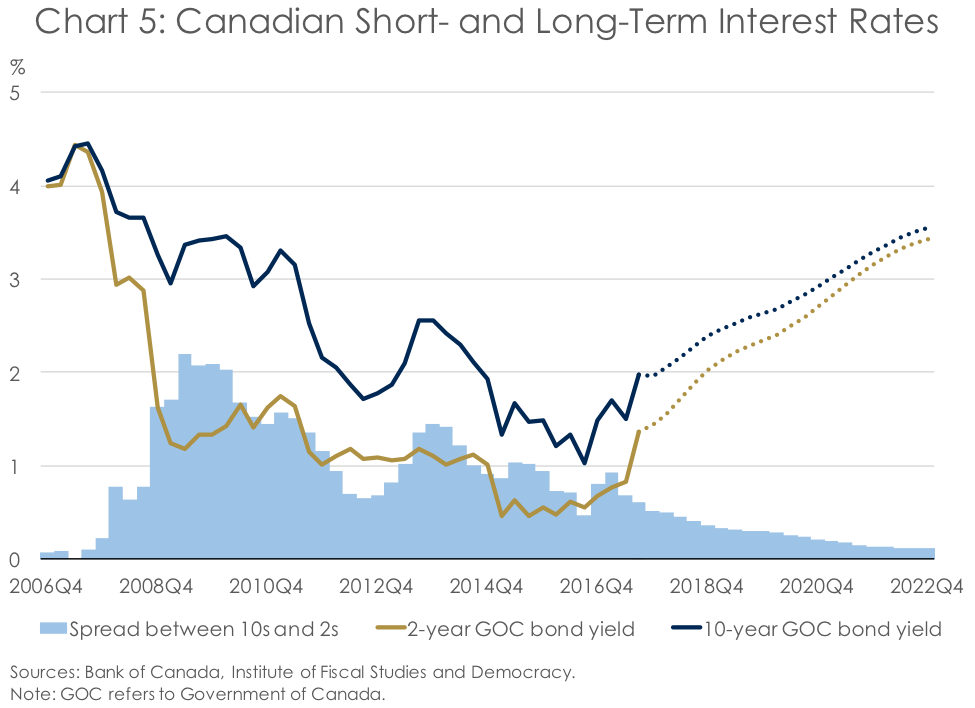

Current Interest Rate Environment

As of December 2022, the BoC’s target for the overnight rate is 4.25%, the highest level since January 2008. This aggressive tightening cycle, which began in March 2022, was implemented to combat persistently high inflation, which has been driven by supply chain disruptions, geopolitical tensions, and strong consumer demand.

Factors Influencing Interest Rates

Several factors influence the BoC’s decision-making process regarding interest rates, including:

- Inflation: The BoC’s primary mandate is to maintain price stability. High inflation erodes the purchasing power of money and can lead to economic instability.

- Economic Growth: Interest rates can be used to stimulate or slow economic growth. Lower rates tend to encourage borrowing and investment, while higher rates can curb spending and reduce inflation.

- Global Economic Conditions: The BoC considers global economic developments when setting interest rates, as they can impact inflation and economic growth in Canada.

- Financial Stability: The BoC aims to maintain financial stability by ensuring that the financial system is sound and resilient to shocks.

Outlook for 2025

Forecasting interest rates beyond the near term is inherently uncertain, but several factors suggest that rates may remain elevated in 2025.

Inflationary Pressures: While inflation is expected to moderate in the coming months, it is likely to remain above the BoC’s target of 2%. Persistent inflationary pressures may necessitate further interest rate hikes.

Economic Growth: The Canadian economy is projected to experience moderate growth in the coming years. However, slowing global growth and geopolitical uncertainties could pose downside risks to the outlook.

Global Monetary Policy: Central banks around the world are tightening monetary policy to combat inflation. This synchronized tightening could limit the BoC’s ability to lower interest rates in the near future.

Market Expectations: Financial markets anticipate that the BoC will maintain a relatively high policy rate in 2025. Forward rate agreements, which are contracts that lock in future interest rates, indicate that the overnight rate is expected to remain above 4% throughout the year.

Potential Scenarios

Depending on the evolution of economic and financial conditions, several scenarios could unfold for interest rates in 2025:

- Scenario 1: Continued Inflationary Pressures: If inflation remains stubbornly high, the BoC may need to raise interest rates further, potentially pushing the overnight rate above 5%.

- Scenario 2: Moderate Inflation and Economic Growth: If inflation moderates and economic growth remains steady, the BoC may pause its tightening cycle and maintain the overnight rate around its current level.

- Scenario 3: Economic Slowdown: If the Canadian economy slows significantly or enters a recession, the BoC may cut interest rates to stimulate growth. However, this scenario is less likely given the current inflationary environment.

Implications for Businesses and Households

Elevated interest rates have significant implications for businesses and households:

- Businesses: Higher interest rates increase borrowing costs for businesses, which can affect investment decisions and profitability.

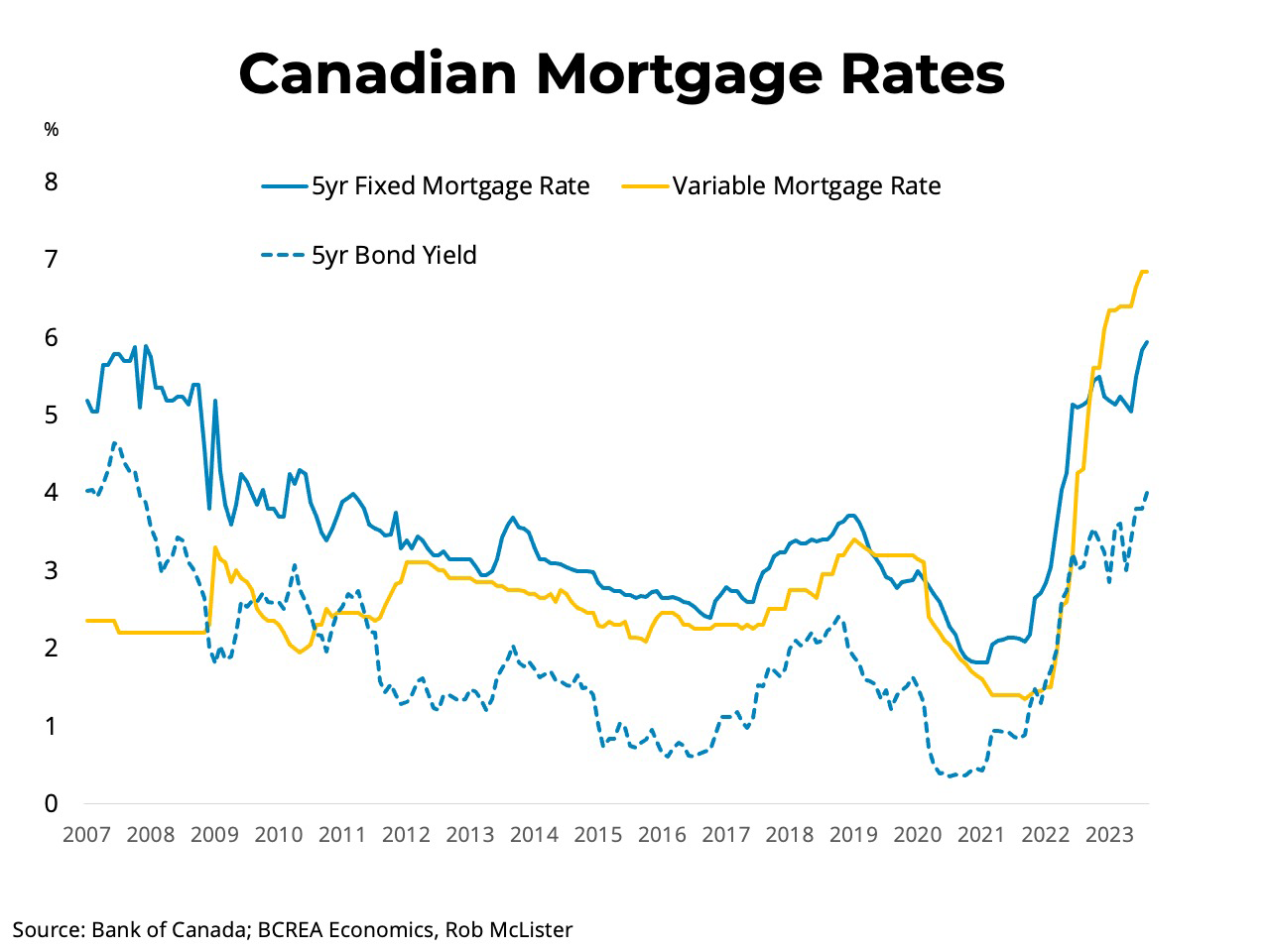

- Households: Mortgages and other consumer loans become more expensive, reducing disposable income and potentially dampening consumer spending.

- Investors: Higher interest rates make fixed-income investments more attractive, while stock market valuations may come under pressure due to increased borrowing costs.

Conclusion

The outlook for interest rates in Canada in 2025 remains uncertain but is likely to be influenced by inflationary pressures, economic growth, and global monetary policy. Market expectations suggest that rates will remain elevated throughout the year. Businesses and households should carefully consider the potential implications of higher interest rates on their financial planning and decision-making.

.png)

Closure

Thus, we hope this article has provided valuable insights into Interest Rates in Canada: Outlook for 2025. We hope you find this article informative and beneficial. See you in our next article!