IRS Standard Deduction for Individuals Over 65 in 2025: A Comprehensive Guide

Related Articles: IRS Standard Deduction for Individuals Over 65 in 2025: A Comprehensive Guide

- The 2024 Dodge Charger SRT: Unleashing The Fury Of Electrification

- The All-New Toyota Hilux 2025: A Revolutionary Force In The Pickup Truck Segment

- Hampshire School Holidays 2025: A Comprehensive Guide

- Super Bowl 2025: A Look Ahead To New Orleans

- Will There Be Flying Cars In 2025?

Introduction

With great pleasure, we will explore the intriguing topic related to IRS Standard Deduction for Individuals Over 65 in 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IRS Standard Deduction for Individuals Over 65 in 2025: A Comprehensive Guide

IRS Standard Deduction for Individuals Over 65 in 2025: A Comprehensive Guide

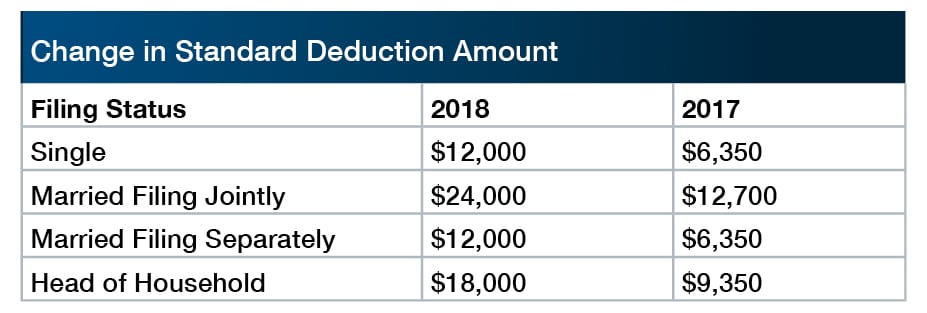

The Internal Revenue Service (IRS) provides a standard deduction to taxpayers, which is a specific amount that can be subtracted from their taxable income before calculating their tax liability. This deduction is designed to simplify the tax filing process and reduce the tax burden for individuals. The standard deduction varies based on several factors, including filing status and age.

For individuals over the age of 65, the standard deduction is higher than the standard deduction for younger individuals. This is because seniors often have higher expenses related to healthcare, housing, and other necessities. The standard deduction for individuals over 65 in 2025 is as follows:

- Single: $14,350

- Married filing jointly: $28,700

- Married filing separately: $14,350

- Head of household: $20,800

Eligibility Requirements

To qualify for the higher standard deduction for individuals over 65, you must meet the following requirements:

- You must be 65 years of age or older by the end of the tax year.

- You must be a U.S. citizen or resident alien.

- You cannot be claimed as a dependent on someone else’s tax return.

Impact on Tax Liability

The standard deduction plays a significant role in determining your tax liability. By subtracting the standard deduction from your taxable income, you reduce the amount of income that is subject to taxation. This can result in lower taxes owed.

For example, if you are single and over 65 in 2025 and have a taxable income of $30,000, your standard deduction would be $14,350. This means that only $15,650 of your income would be subject to taxation. If you were in the 12% tax bracket, you would owe $1,878 in taxes.

However, if you were under the age of 65 and had the same taxable income, your standard deduction would be $12,950. This would result in $17,050 of taxable income and a tax liability of $2,046. As you can see, the higher standard deduction for individuals over 65 can result in significant tax savings.

Additional Considerations

In addition to the basic standard deduction, there are several other factors that can affect your standard deduction:

- Itemized deductions: If you have itemized deductions that exceed the standard deduction, you may choose to itemize your deductions instead of taking the standard deduction.

- Dependents: If you have dependents, you may be eligible for an additional standard deduction.

- Age 65 threshold: If you turn 65 during the tax year, you can claim the higher standard deduction for the entire year, even if you were not 65 for the full year.

Conclusion

The IRS standard deduction for individuals over 65 is a valuable tax benefit that can help reduce your tax liability. By understanding the eligibility requirements and how the standard deduction works, you can maximize your tax savings and ensure that you are paying the correct amount of taxes. If you have any questions or concerns about the standard deduction, it is recommended that you consult with a tax professional for guidance.

Closure

Thus, we hope this article has provided valuable insights into IRS Standard Deduction for Individuals Over 65 in 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!