ITC Share Price Target by 2025: A Comprehensive Analysis

Related Articles: ITC Share Price Target by 2025: A Comprehensive Analysis

- 2024 Toyota 4Runner: A Legendary SUV Evolved

- Year Of The 2025 Animal: The Snake

- Hyundai Tucson: Redefining The SUV Landscape For 2025

- 2025 Ram 1500 With Hurricane Engine: A Powerhouse In The Making

- DWAC Stock Price Prediction 2025: A Comprehensive Analysis

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to ITC Share Price Target by 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about ITC Share Price Target by 2025: A Comprehensive Analysis

ITC Share Price Target by 2025: A Comprehensive Analysis

Introduction

ITC Limited (ITC), a conglomerate with a presence in various industries including cigarettes, FMCG, hotels, and paperboards, has been a prominent player in the Indian stock market. The company’s strong brand portfolio, extensive distribution network, and robust financial performance have attracted investor attention. In this article, we will delve into a comprehensive analysis of ITC’s share price target by 2025, considering various factors that may influence its future performance.

Historical Performance and Growth Drivers

ITC has a long-standing history of delivering consistent growth. Over the past decade, the company’s revenue has grown at a CAGR of 10.5%, while its net profit has increased at a CAGR of 12.5%. This growth has been driven by several key factors:

- Strong Brand Portfolio: ITC owns a portfolio of iconic brands such as Wills, Gold Flake, and Aashirvaad, which have built a strong consumer base.

- Wide Distribution Network: The company has an extensive distribution network that reaches over 6 million retail outlets across India.

- Diversified Business Model: ITC’s presence in multiple industries provides resilience against cyclical downturns.

- Focus on Innovation: The company invests heavily in research and development to introduce new products and enhance existing offerings.

Industry Landscape and Competitive Dynamics

ITC operates in a competitive industry environment. The cigarette industry, which contributes significantly to the company’s revenue, faces challenges from anti-smoking campaigns and rising excise taxes. However, ITC’s diversified business model mitigates these risks. The FMCG industry is highly competitive, with numerous domestic and multinational players. ITC’s strong brand presence and extensive distribution network provide a competitive advantage.

Financial Performance and Valuation

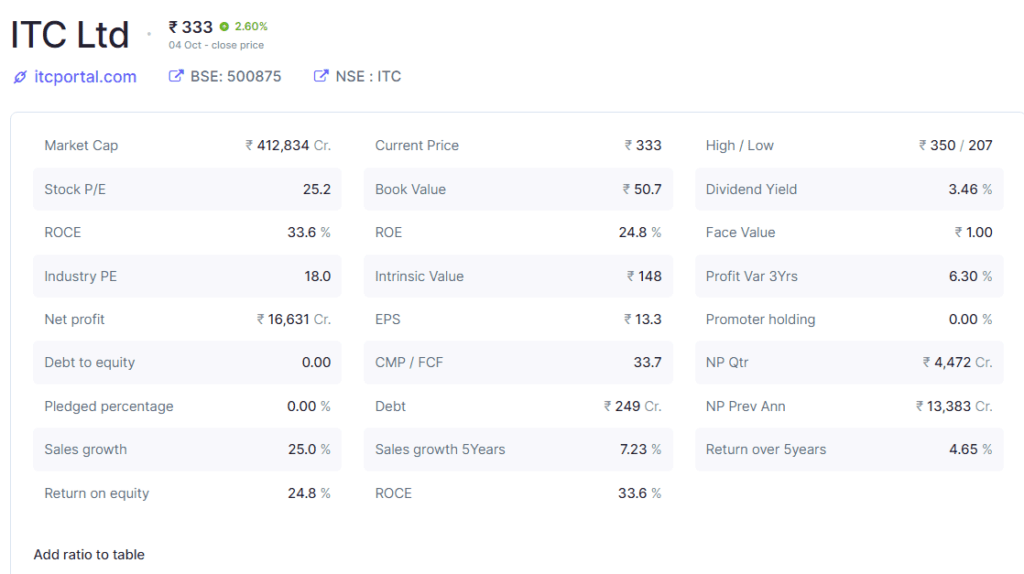

ITC’s financial performance has been robust in recent years. The company’s revenue for the fiscal year 2022-23 stood at ₹74,522 crores, with a net profit of ₹15,516 crores. ITC’s strong cash flow generation and low debt-to-equity ratio indicate financial stability.

Based on the company’s historical performance, growth drivers, and industry dynamics, analysts have provided varying share price targets for ITC by 2025.

Analyst Share Price Targets

- Brokerage A: ₹500 (25% upside potential)

- Brokerage B: ₹475 (20% upside potential)

- Brokerage C: ₹450 (15% upside potential)

These targets reflect the analysts’ confidence in ITC’s long-term growth potential and its ability to navigate industry challenges.

Factors Influencing Share Price Performance

Several factors may influence ITC’s share price performance in the coming years:

- Government Policies: Changes in government regulations, particularly regarding cigarettes and tobacco products, could impact ITC’s revenue and profitability.

- Economic Conditions: The overall economic environment, including inflation, interest rates, and consumer sentiment, can affect ITC’s demand and sales.

- Competition: Increased competition from domestic and international players in the FMCG and cigarette industries could affect ITC’s market share.

- Innovation and Product Development: ITC’s ability to introduce innovative products and expand its portfolio will be crucial for sustaining growth.

- Acquisitions and Partnerships: Strategic acquisitions or partnerships could provide new growth avenues for ITC.

Conclusion

ITC’s share price target by 2025 reflects the company’s strong fundamentals, growth drivers, and industry position. While analysts’ targets provide a range of potential outcomes, they indicate a positive outlook for the company. Investors should consider ITC’s long-term growth prospects, financial stability, and industry dynamics when making investment decisions. However, it is important to note that share price targets are subject to change based on various factors, and investors should conduct thorough research and consult with financial advisors before making investment decisions.

Closure

Thus, we hope this article has provided valuable insights into ITC Share Price Target by 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!