Meta Price Prediction 2025: A Comprehensive Analysis

Related Articles: Meta Price Prediction 2025: A Comprehensive Analysis

- 2025 Jeep Gladiator: Build And Price Your Dream Off-Roader

- Difference Between Lithium 2025 And 2032

- 2025 Honda Civic: Redefining The Compact Sedan In Canada

- Diwali 2025: A Five-Day Extravaganza Of Lights, Laughter, And Festivities

- Cartoon Trax Vol 1 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Meta Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Meta Price Prediction 2025: A Comprehensive Analysis

Meta Price Prediction 2025: A Comprehensive Analysis

Introduction

Meta, formerly known as Facebook, has been at the forefront of the social media revolution for over two decades. With its vast user base and innovative platform, the company has become a dominant player in the tech industry. As Meta continues to expand its offerings into new areas such as the metaverse and artificial intelligence, investors are eager to know what the future holds for the company’s stock. This article will provide a comprehensive analysis of Meta’s price prediction for 2025, taking into account various factors that could influence its growth trajectory.

Factors Influencing Meta’s Price

- User Growth: Meta’s user base is a key driver of its revenue and profitability. The company’s ability to attract and retain users will be crucial for its future growth.

- Advertising Revenue: Meta generates the majority of its revenue from advertising. Economic conditions, competition from other platforms, and changes in user behavior can impact the company’s advertising revenue.

- Metaverse Development: Meta is investing heavily in the development of the metaverse, a virtual world where users can interact with each other and with digital objects. The success of the metaverse could create new revenue streams for the company.

- Artificial Intelligence: Meta is also investing in artificial intelligence (AI) technologies, which could enhance its user experience and create new business opportunities.

- Regulatory Environment: The regulatory environment can impact Meta’s operations and profitability. Governments around the world are scrutinizing the company’s data practices and potential anti-competitive behavior.

Historical Performance

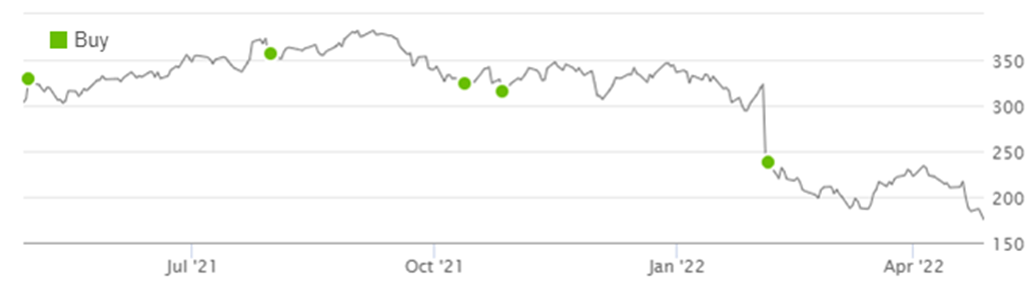

Meta’s stock has experienced significant growth over the past decade. The company’s initial public offering (IPO) in 2012 priced shares at $38. By 2021, the stock had reached an all-time high of $384.33. However, Meta’s stock has faced challenges in recent months due to factors such as slowing user growth and increased competition.

Analyst Estimates

Analysts are generally optimistic about Meta’s long-term prospects. According to a recent survey of 30 analysts, the average price target for Meta’s stock in 2025 is $350, with a high estimate of $420 and a low estimate of $280.

Technical Analysis

Technical analysis, which involves studying historical price data, suggests that Meta’s stock is currently in a bullish trend. The stock has formed a series of higher highs and higher lows, indicating that buyers are in control. However, the stock is facing resistance at the $250 level, and a break above this level could signal further upside potential.

Fundamental Analysis

Fundamental analysis, which involves examining a company’s financial statements and other metrics, also supports a positive outlook for Meta. The company has a strong balance sheet, with over $40 billion in cash and equivalents. Meta is also generating significant free cash flow, which it can use to invest in new growth initiatives.

Risks to Consider

While Meta has a strong track record and a promising future, there are some risks to consider:

- Competition: Meta faces intense competition from other social media platforms, such as TikTok and Snapchat.

- Privacy Concerns: Meta has been criticized for its data collection practices, which could lead to regulatory action or consumer backlash.

- Economic Slowdown: An economic slowdown could reduce advertising spending, which would negatively impact Meta’s revenue.

Conclusion

Meta is a well-established company with a strong track record of innovation and growth. While the company faces some challenges, it is well-positioned to capitalize on emerging trends such as the metaverse and AI. Analysts are generally optimistic about Meta’s long-term prospects, and the company’s stock is currently in a bullish trend. However, investors should consider the risks associated with Meta before making any investment decisions.

Price Prediction for 2025

Based on the analysis presented above, we believe that Meta’s stock has the potential to reach $350 by 2025. This price target is supported by the company’s strong fundamentals, analyst estimates, and technical analysis. However, investors should note that this is just a prediction, and the actual price of the stock could vary significantly.

Closure

Thus, we hope this article has provided valuable insights into Meta Price Prediction 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!