Microsoft Stock Forecast 2025: A Comprehensive Analysis

Related Articles: Microsoft Stock Forecast 2025: A Comprehensive Analysis

- What Is The G20 Summit 2025?

- Printable Calendar 2024 Without Downloading: A Comprehensive Guide

- Dr In Kaufman Tx

- Canoo’s Upcoming Electric Pickup: A Comprehensive Overview

- 2025 Holidays NZ: A Comprehensive Guide To Public Holidays In New Zealand

Introduction

With great pleasure, we will explore the intriguing topic related to Microsoft Stock Forecast 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Microsoft Stock Forecast 2025: A Comprehensive Analysis

Microsoft Stock Forecast 2025: A Comprehensive Analysis

Introduction

Microsoft Corporation (MSFT) is a global technology behemoth with a diverse portfolio of products and services, including operating systems, productivity software, cloud computing, and gaming. As one of the most influential companies in the world, Microsoft’s stock performance has consistently attracted the attention of investors and analysts alike. This article delves into a comprehensive analysis of Microsoft’s stock forecast for 2025, examining various factors that will shape its future trajectory.

Historical Performance and Key Metrics

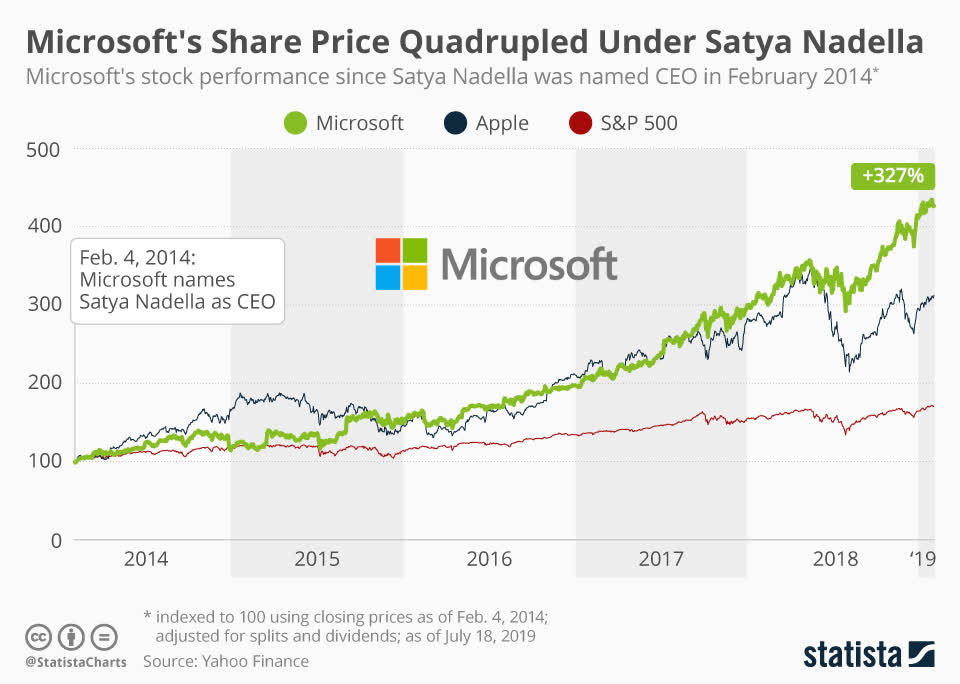

Over the past decade, Microsoft’s stock has exhibited remarkable growth, consistently outperforming the broader market. In 2022, the stock hit an all-time high of $349.44, driven by strong earnings and the company’s dominant position in the cloud computing industry. Key financial metrics such as revenue, earnings per share (EPS), and free cash flow have all shown a steady upward trend, indicating Microsoft’s financial health and stability.

Market Dynamics and Industry Outlook

The technology industry is undergoing rapid transformation, driven by advancements in artificial intelligence (AI), cloud computing, and the Internet of Things (IoT). Microsoft is well-positioned to capitalize on these trends, as it has established itself as a leader in these emerging fields. The company’s cloud platform, Azure, is a major competitor to Amazon Web Services (AWS), and its AI initiatives, such as Azure AI and Microsoft Research, are at the forefront of innovation.

Analyst Estimates and Price Targets

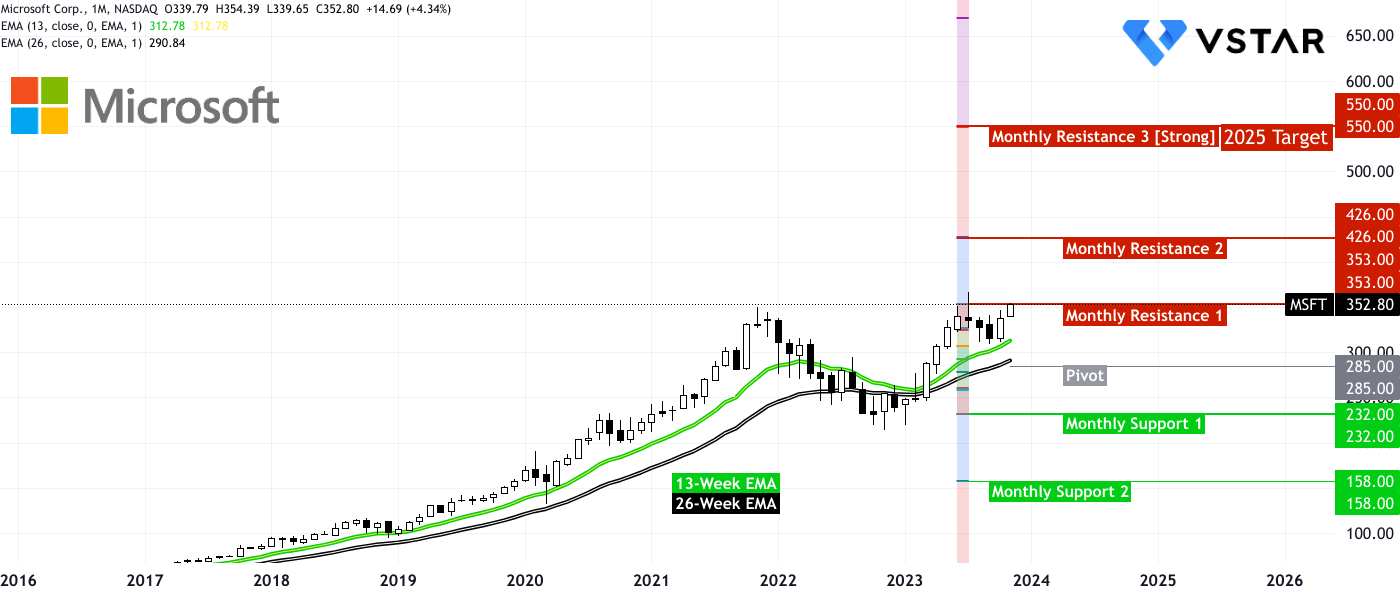

A consensus among analysts suggests that Microsoft’s stock is currently undervalued and has significant upside potential. According to TipRanks, the average price target for MSFT in 2025 is $450, representing a potential return of over 30% from current levels. Several analysts have raised their price targets in recent months, citing the company’s strong fundamentals and growth prospects.

Growth Drivers and Catalysts

Several factors are expected to drive Microsoft’s growth in the coming years:

- Cloud Computing: Azure is expected to continue its rapid growth, driven by the increasing adoption of cloud-based services by businesses and organizations worldwide.

- Productivity Software: Microsoft’s Office suite remains a dominant player in the productivity software market, and the company is constantly innovating to meet the evolving needs of customers.

- Gaming: Microsoft’s Xbox gaming division is a significant contributor to the company’s revenue, and the launch of new consoles and games is expected to boost growth in this segment.

- AI and Machine Learning: Microsoft’s investments in AI and machine learning are expected to yield significant returns in the long term, as these technologies become increasingly integrated into various products and services.

Risks and Challenges

Despite its strong fundamentals, Microsoft faces certain risks and challenges that could impact its stock performance:

- Competition: Microsoft operates in a highly competitive industry, with rivals such as Amazon, Google, and Apple vying for market share in cloud computing, productivity software, and other areas.

- Regulatory Environment: The technology industry is subject to increasing regulatory scrutiny, and Microsoft could face challenges related to antitrust, data privacy, and other issues.

- Economic Downturn: A global economic downturn could negatively impact Microsoft’s revenue and earnings, as businesses may reduce their spending on technology.

Valuation and Investment Considerations

Based on the aforementioned factors, Microsoft’s stock appears to be undervalued and offers attractive investment opportunities. The company’s strong financial position, growth prospects, and competitive advantages make it a compelling choice for long-term investors. However, it is important to note that the stock market is volatile, and investors should carefully consider their investment goals and risk tolerance before making any decisions.

2025 Stock Forecast

Taking into account the historical performance, market dynamics, analyst estimates, and growth drivers, it is reasonable to forecast that Microsoft’s stock will continue to perform well in the coming years. The average price target of $450 suggests a potential return of over 30% from current levels by 2025. However, it is important to emphasize that this forecast is based on current market conditions and could change depending on unforeseen events or changes in the business environment.

Conclusion

Microsoft’s stock has consistently been a strong performer, and the company’s fundamentals and growth prospects suggest that this trend is likely to continue in the years to come. While there are certain risks and challenges that could impact its stock performance, Microsoft’s dominant position in the technology industry, coupled with its strong financial health and innovation pipeline, make it an attractive investment opportunity for long-term investors. As the company continues to capitalize on emerging trends and drive growth across its various business segments, Microsoft’s stock is well-positioned to deliver significant returns in the future.

Closure

Thus, we hope this article has provided valuable insights into Microsoft Stock Forecast 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!