Prediction for Interest Rates 2025: A Comprehensive Analysis

Related Articles: Prediction for Interest Rates 2025: A Comprehensive Analysis

- What Will Happen To Florida In 2025: A Comprehensive Forecast

- The Toyota Stout: A Resurgence In Australia For 2025

- World Teachers’ Day 2025: Celebrating The Transformative Power Of Educators

- Standard Deduction For Taxpayers Age 65 Or Older In 2025

- 2025 Mack MD6 Dump Truck: A Powerhouse For Construction And Mining

Introduction

With great pleasure, we will explore the intriguing topic related to Prediction for Interest Rates 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Prediction for Interest Rates 2025: A Comprehensive Analysis

Prediction for Interest Rates 2025: A Comprehensive Analysis

Introduction

Interest rates play a pivotal role in shaping economic activity and financial markets. Predicting their future trajectory is crucial for businesses, investors, and policymakers alike. This article provides a comprehensive analysis of the factors that will likely influence interest rates in 2025, offering insights into their potential direction and implications.

Factors Affecting Interest Rates

Several key factors influence interest rates, including:

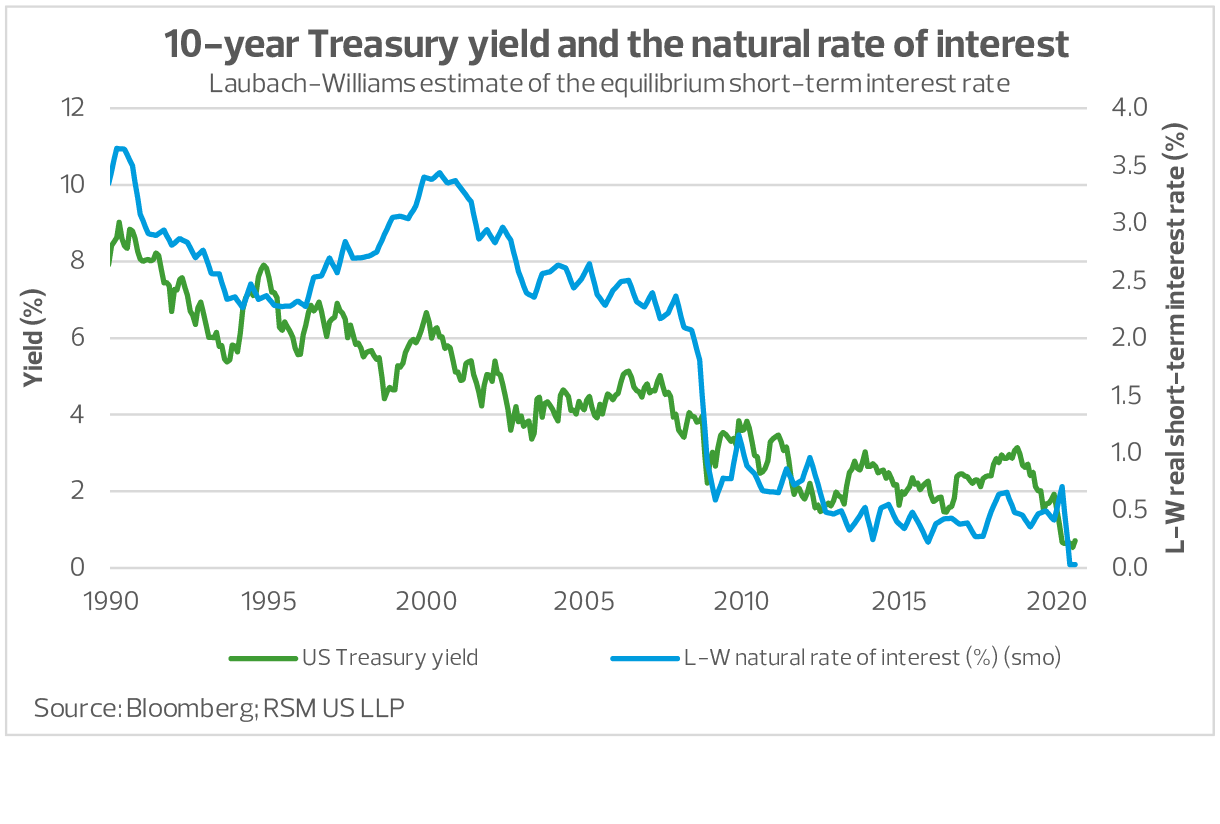

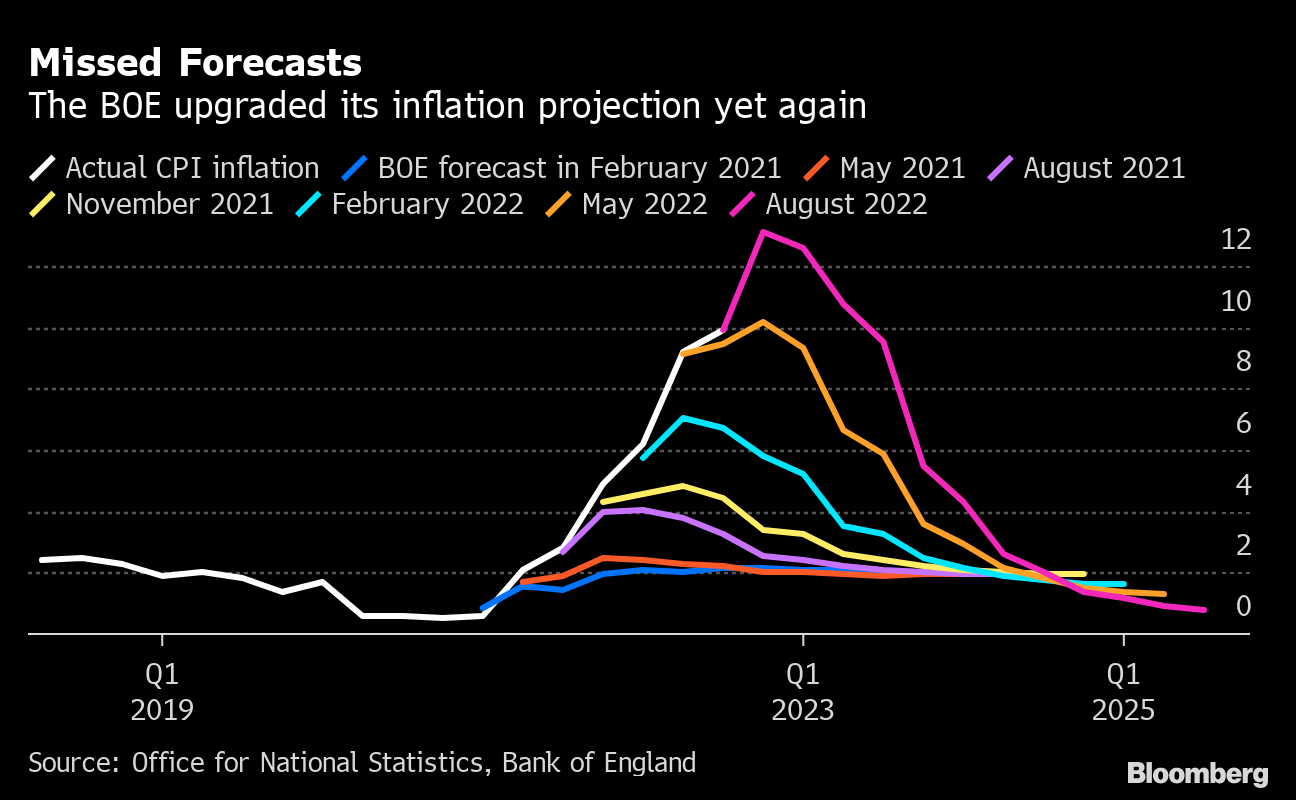

- Inflation: Rising inflation typically leads to higher interest rates as central banks aim to curb inflationary pressures.

- Economic Growth: Strong economic growth tends to push interest rates higher due to increased demand for borrowing.

- Fiscal Policy: Government spending and tax policies can impact interest rates by influencing the supply and demand for loanable funds.

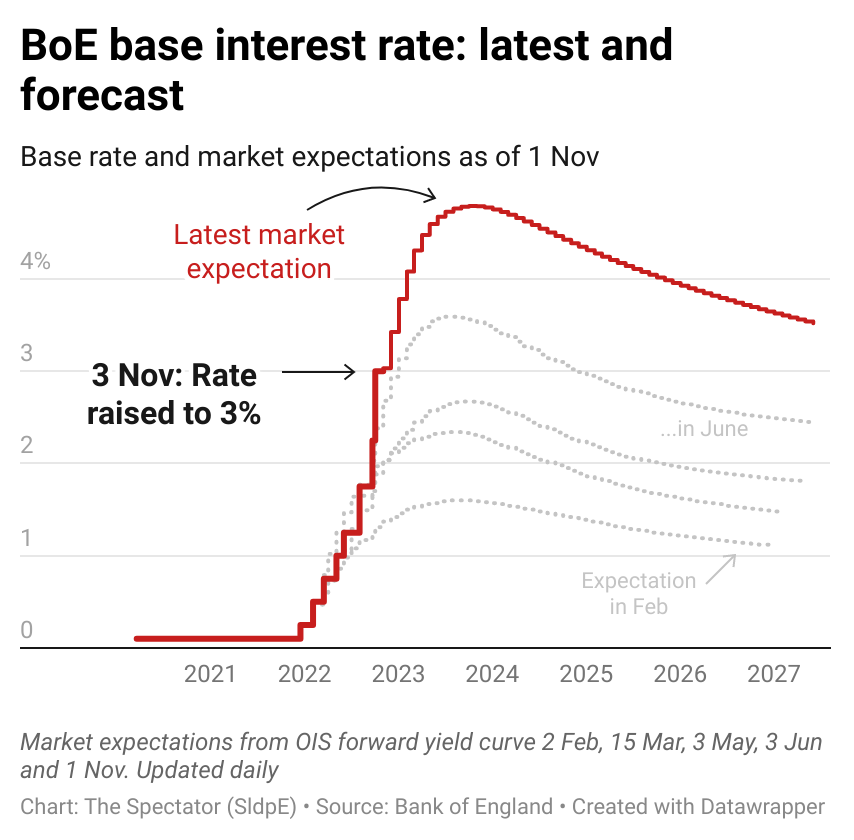

- Monetary Policy: Central banks’ decisions on interest rate levels directly determine the cost of borrowing and lending.

- Global Economic Conditions: International economic developments, such as growth rates and inflation, can influence interest rates in domestic markets.

Inflation Outlook

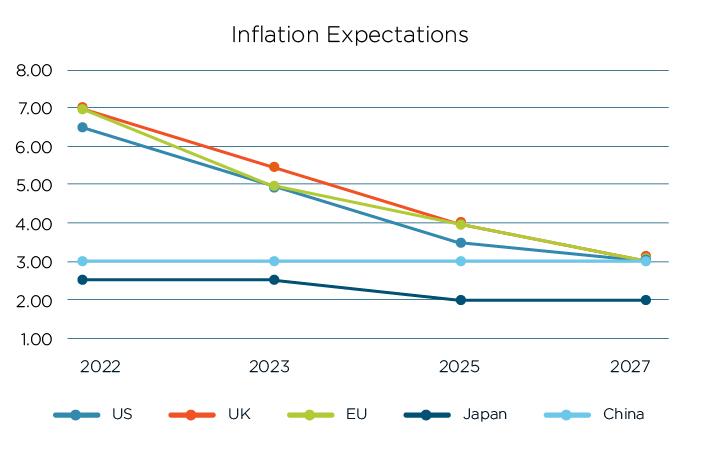

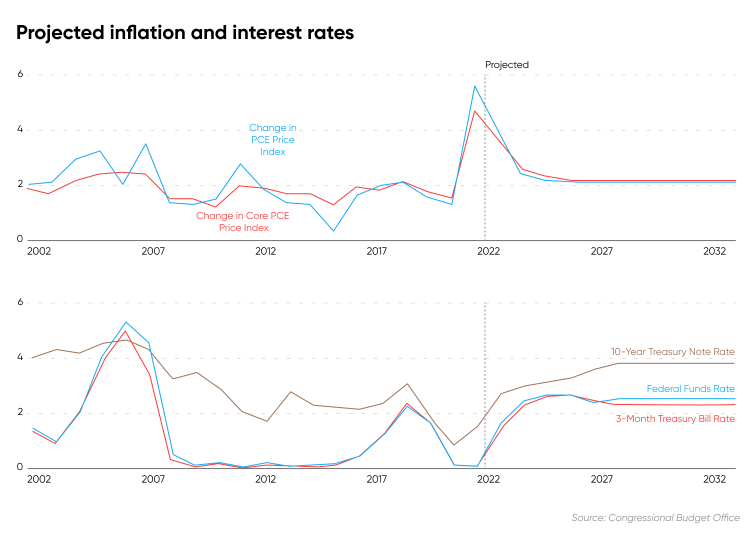

Inflation has been a major concern in recent years, with many countries experiencing elevated inflation rates. Central banks have responded by raising interest rates to bring inflation under control. However, geopolitical uncertainties, supply chain disruptions, and labor shortages continue to pose inflationary risks.

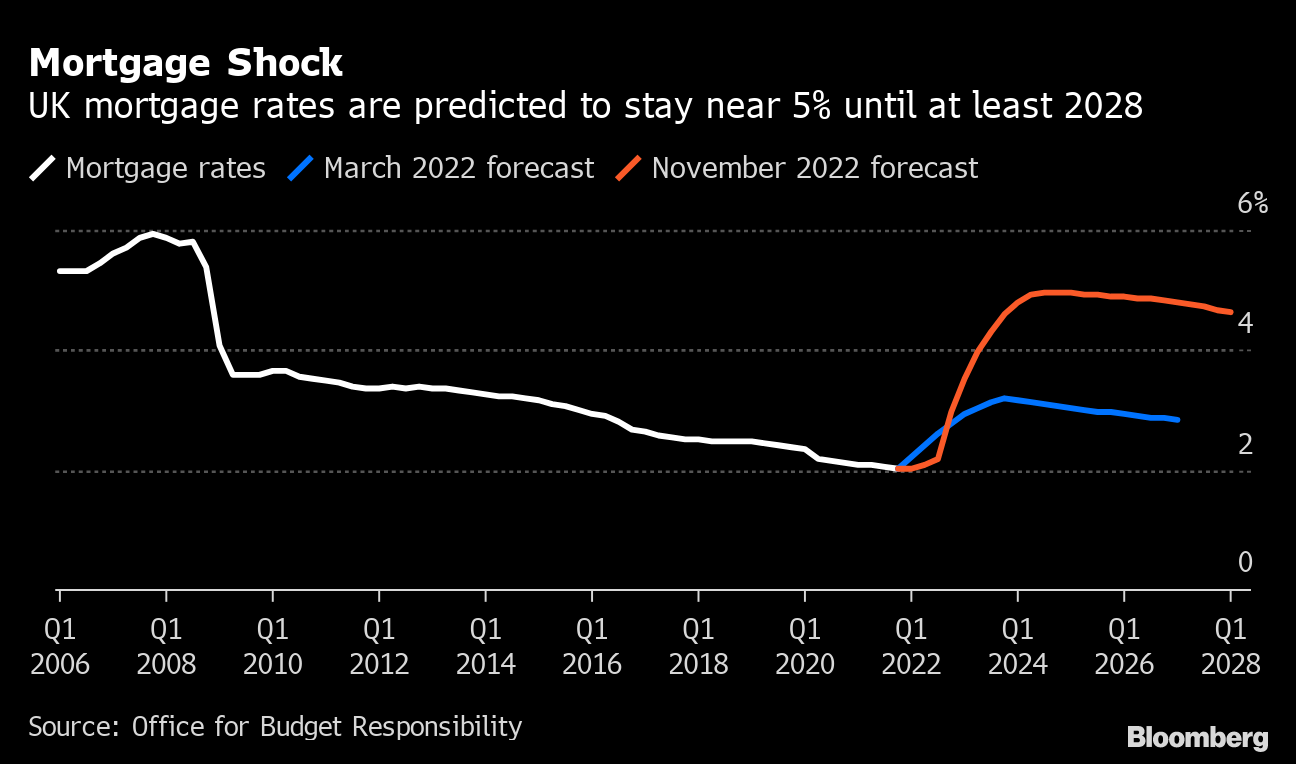

Looking ahead to 2025, it is likely that inflation will remain elevated, albeit at a more moderate level than in 2023-2024. Central banks will continue to monitor inflation closely and adjust interest rates accordingly.

Economic Growth Projections

Economic growth is expected to slow in 2025 as the global economy adjusts to post-pandemic conditions. However, growth is still projected to be positive, supported by ongoing technological advancements and consumer spending.

The strength of economic growth will influence interest rates. If growth exceeds expectations, central banks may need to raise interest rates more aggressively to prevent overheating. Conversely, weaker-than-expected growth could lead to lower interest rates to stimulate economic activity.

Fiscal Policy Considerations

Fiscal policy can impact interest rates by influencing the supply and demand for loanable funds. Governments that run large budget deficits may need to borrow more, putting upward pressure on interest rates.

In 2025, it is expected that fiscal deficits will gradually decline as economies recover from the pandemic. However, geopolitical uncertainties and the need for continued government spending on infrastructure and social programs could still affect interest rates.

Monetary Policy Outlook

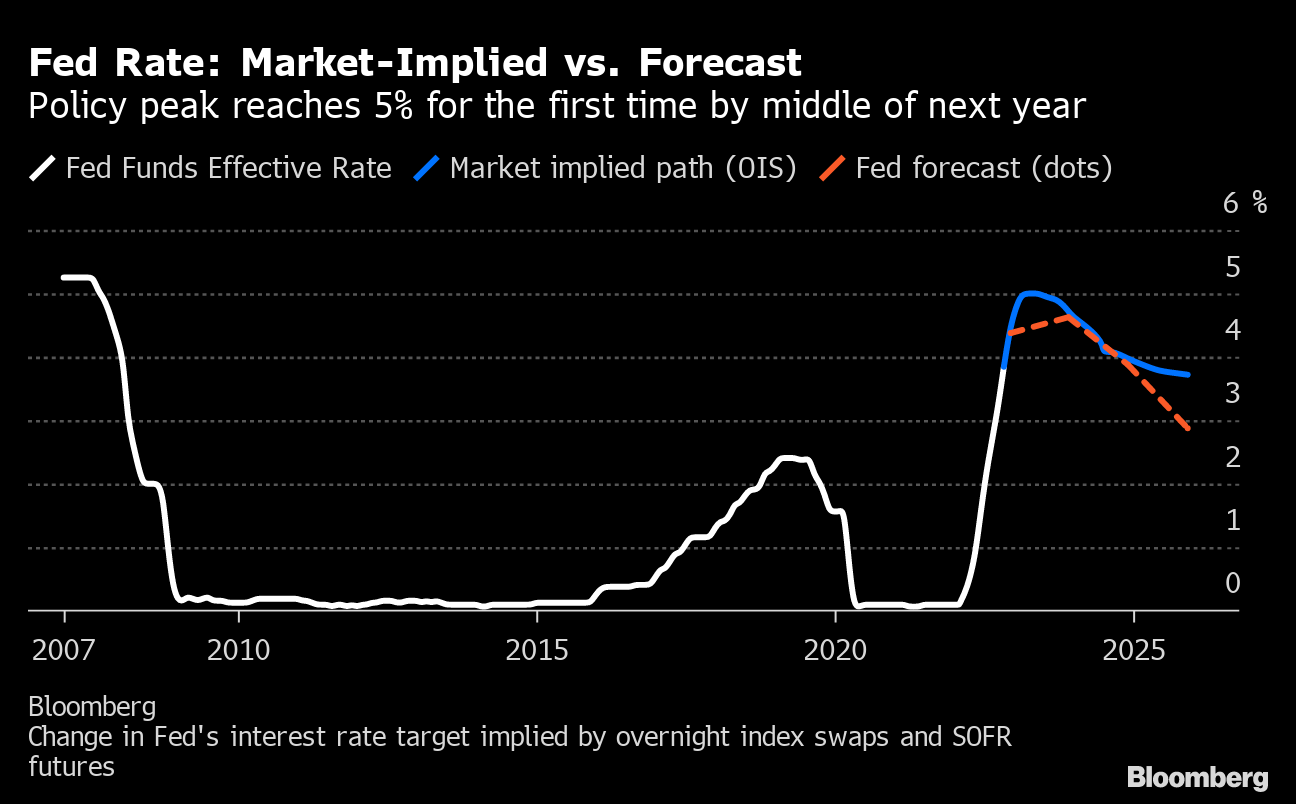

Central banks will continue to play a crucial role in shaping interest rates in 2025. The Federal Reserve (Fed) has signaled that it intends to keep interest rates elevated until inflation is brought under control. Other central banks are also expected to follow suit, although the pace and magnitude of rate hikes may vary depending on country-specific circumstances.

Global Economic Conditions

Global economic conditions can influence interest rates in domestic markets. A strong global economy typically leads to higher interest rates in developed countries as investors seek higher returns. Conversely, a weak global economy can put downward pressure on interest rates.

In 2025, the global economy is expected to face challenges, including geopolitical tensions, supply chain disruptions, and the ongoing impact of the pandemic. These uncertainties could create volatility in financial markets and impact interest rates.

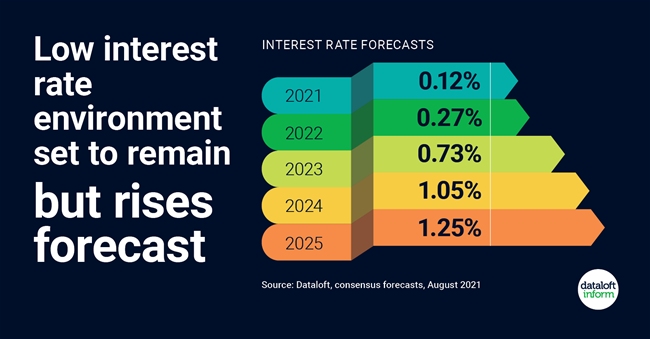

Predicted Interest Rate Range for 2025

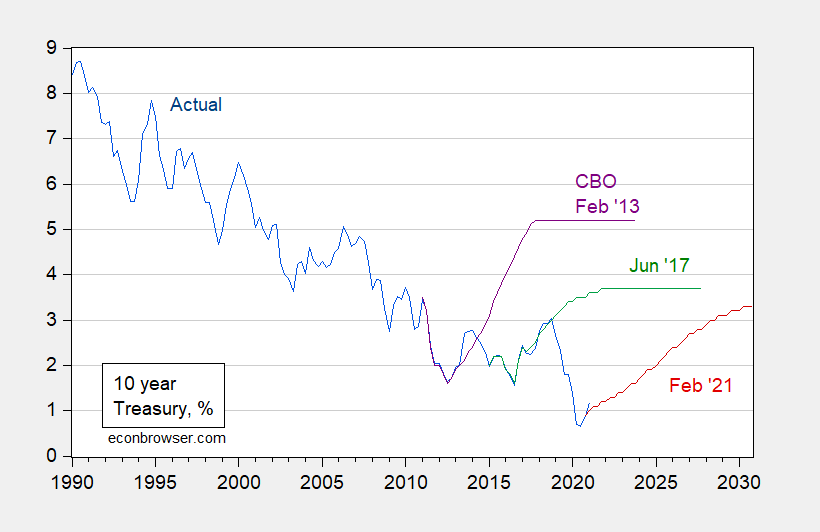

Based on the aforementioned factors, it is predicted that interest rates in 2025 will remain elevated, although they are likely to be lower than in 2023-2024. The predicted range for the benchmark interest rate in the United States is 3.5% to 4.5%, while the eurozone is expected to see interest rates between 2.0% and 3.0%.

Implications for Businesses and Investors

The predicted interest rate trajectory has several implications for businesses and investors:

- Businesses: Higher interest rates can increase borrowing costs for businesses, potentially impacting their profitability and investment decisions.

- Investors: Elevated interest rates can make fixed-income investments more attractive, while also increasing the risk of stock market volatility.

- Homebuyers: Mortgage rates are directly linked to interest rates, so higher interest rates can make it more expensive to purchase a home.

Conclusion

Predicting interest rates is a complex task, and the outlook for 2025 is subject to uncertainties. However, by carefully analyzing the factors that influence interest rates, it is possible to make informed predictions and prepare for potential scenarios.

In 2025, interest rates are expected to remain elevated but moderate, as central banks continue to balance the need to control inflation with supporting economic growth. Businesses and investors should monitor interest rate developments closely and adjust their strategies accordingly.

Closure

Thus, we hope this article has provided valuable insights into Prediction for Interest Rates 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!