Standard Deduction for Taxpayers Age 65 or Older in 2025

Related Articles: Standard Deduction for Taxpayers Age 65 or Older in 2025

- Big Ten Football Schedules 2025: A Comprehensive Guide To The Upcoming Season

- Number Of Working Days In 2025: A Comprehensive Analysis

- Fan Expo 2025: A Celebration Of Pop Culture Extravaganza

- Friday, December 12, 2025: A Glimpse Into The Future

- Athletics World Championships 2025: Results And Highlights

Introduction

With great pleasure, we will explore the intriguing topic related to Standard Deduction for Taxpayers Age 65 or Older in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Standard Deduction for Taxpayers Age 65 or Older in 2025

Standard Deduction for Taxpayers Age 65 or Older in 2025

The standard deduction is a specific amount that you can subtract from your taxable income before calculating your income tax liability. It is a dollar-for-dollar reduction, meaning that it directly reduces the amount of income that is subject to taxation. The standard deduction varies depending on your filing status and age.

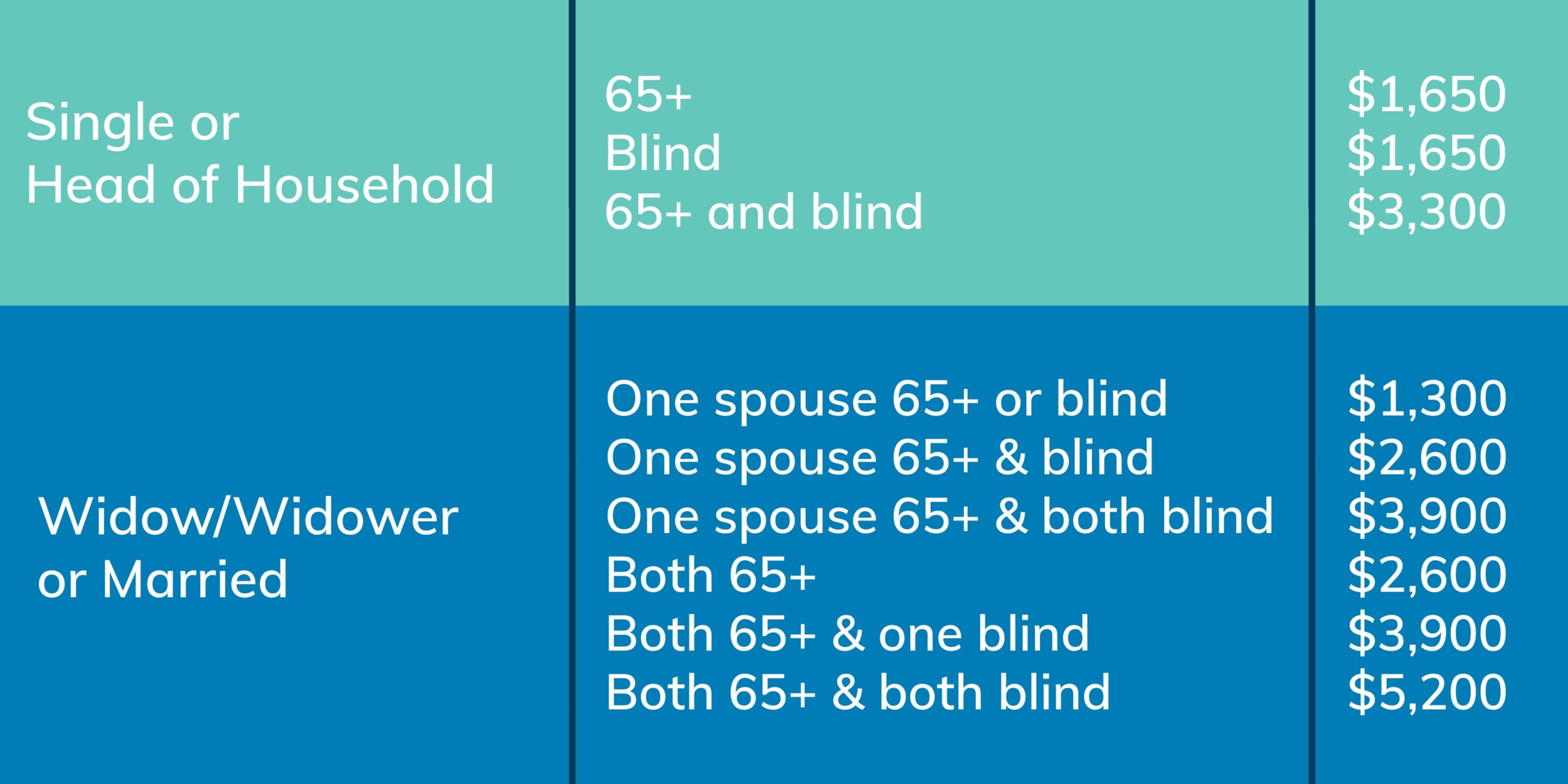

For taxpayers who are age 65 or older in 2025, the standard deduction amounts are as follows:

- Single: $14,250

- Married filing jointly: $27,700

- Married filing separately: $13,850

- Head of household: $20,800

These amounts are slightly higher than the standard deduction amounts for taxpayers under age 65. The additional deduction for seniors is intended to help offset the increased expenses that come with age, such as medical expenses and long-term care costs.

How to Claim the Standard Deduction

You can claim the standard deduction on your tax return by completing the appropriate line on the tax form. If you are filing Form 1040, you will enter the standard deduction amount on line 12. If you are filing Form 1040-EZ, you will enter the standard deduction amount on line 4.

Itemizing Deductions vs. Taking the Standard Deduction

In addition to the standard deduction, you may also be able to itemize your deductions. Itemizing deductions allows you to deduct certain expenses from your taxable income, such as medical expenses, charitable contributions, and mortgage interest.

If you itemize your deductions, you will need to compare the total amount of your itemized deductions to the standard deduction amount. You should choose the option that results in the lower taxable income.

For most taxpayers, the standard deduction is a better option than itemizing deductions. This is because the standard deduction is a flat amount that is not subject to any limitations. Itemized deductions, on the other hand, are subject to various limits and phase-outs.

Additional Considerations

- Blindness: If you are blind, you are entitled to an additional standard deduction amount of $1,500.

- Dependent: If you are claimed as a dependent on someone else’s tax return, you are not eligible to claim the standard deduction.

-

Phase-out: The standard deduction is phased out for high-income taxpayers. For 2025, the phase-out begins at the following income levels:

- Single: $54,250

- Married filing jointly: $108,500

- Married filing separately: $54,250

- Head of household: $82,250

Conclusion

The standard deduction is a valuable tax break that can help you reduce your taxable income. If you are age 65 or older in 2025, you will be eligible for a higher standard deduction amount. Be sure to consider your options and choose the deduction method that results in the lowest tax liability.

Closure

Thus, we hope this article has provided valuable insights into Standard Deduction for Taxpayers Age 65 or Older in 2025. We hope you find this article informative and beneficial. See you in our next article!