Switch Stock Forecast 2025: A Comprehensive Analysis

Related Articles: Switch Stock Forecast 2025: A Comprehensive Analysis

- IR 2025 G1: A Revolutionary Advancement In Infrared Technology

- 2025 Jeep Gladiator: The Ultimate Adventure Machine

- Chinese Year Of The Snake 2025: Year Of Transformation And Renewal

- L And G Fund Factsheets: Unlocking Investment Insights

- The Lunar New Year Animal Of 2025: The Green Wood Snake

Introduction

With great pleasure, we will explore the intriguing topic related to Switch Stock Forecast 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Switch Stock Forecast 2025: A Comprehensive Analysis

Switch Stock Forecast 2025: A Comprehensive Analysis

Introduction

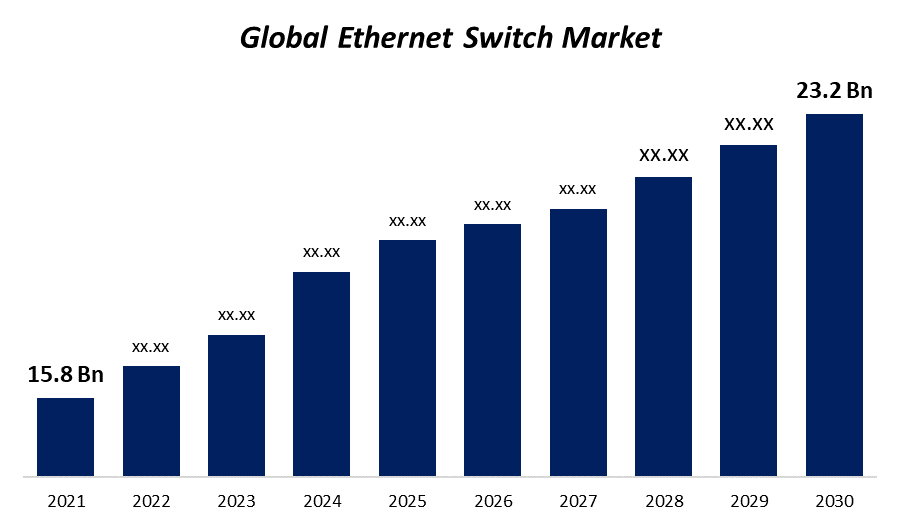

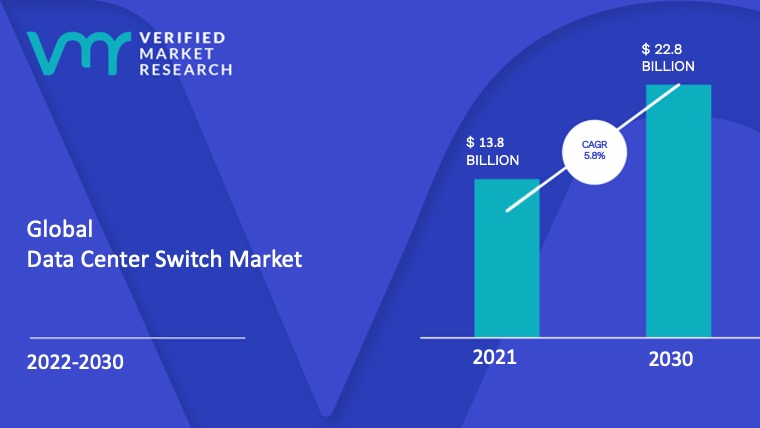

Switch, Inc. (NYSE: SWCH), a leading provider of data center and cloud infrastructure solutions, has emerged as a formidable player in the rapidly evolving technology landscape. With its innovative approach to data center design and operations, the company has gained significant traction in recent years. This article aims to provide a comprehensive analysis of Switch’s stock forecast for the year 2025, exploring key drivers, potential risks, and expert insights.

Key Drivers of Growth

Data Center Demand Surge: The global demand for data center services is projected to witness a substantial surge in the coming years, driven by the proliferation of cloud computing, big data analytics, and artificial intelligence (AI). Switch is well-positioned to capitalize on this growing demand with its extensive network of data centers across the United States and Europe.

Innovative Data Center Design: Switch’s data centers are designed with a focus on sustainability, efficiency, and scalability. The company’s patented modular data center design allows for rapid deployment and expansion, meeting the evolving needs of its customers.

Cloud Interconnection Services: Switch offers a comprehensive suite of cloud interconnection services, enabling customers to connect their on-premise infrastructure to multiple cloud providers seamlessly. This service is expected to drive significant growth for the company as organizations increasingly adopt hybrid cloud strategies.

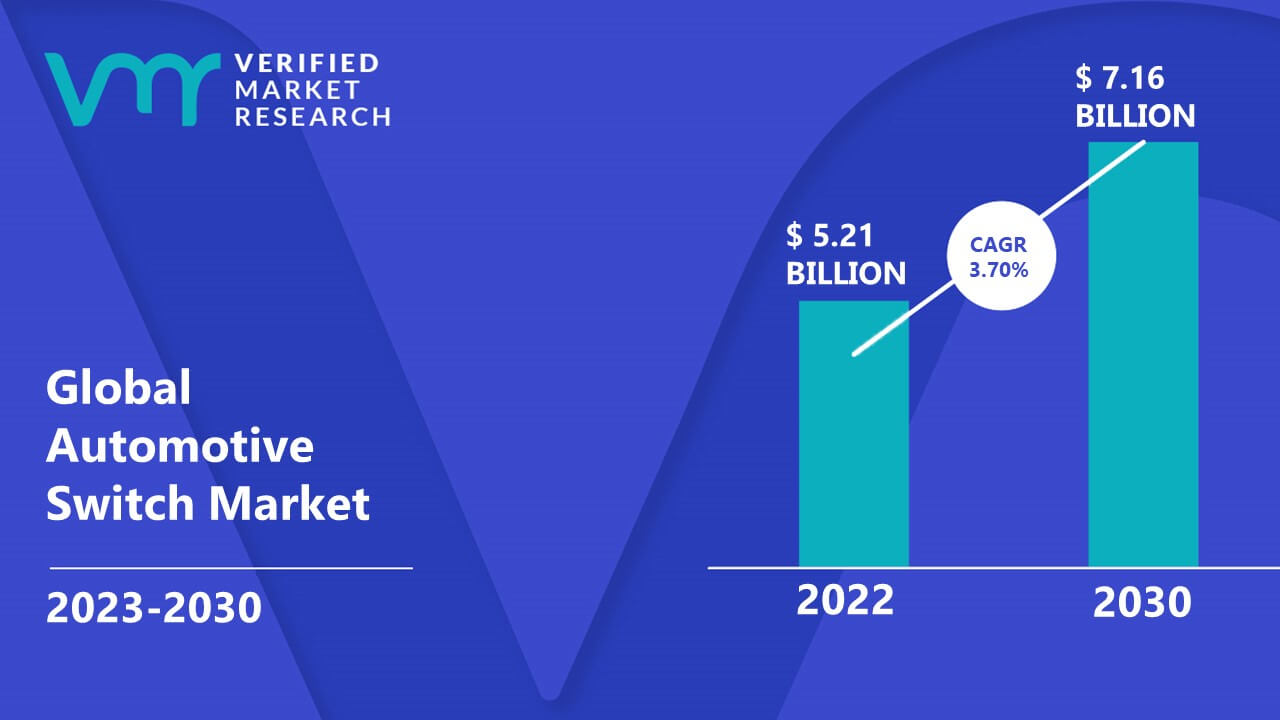

Edge Computing Expansion: Edge computing is gaining momentum as a solution for latency-sensitive applications and IoT devices. Switch’s investment in edge computing infrastructure is expected to create new revenue streams and enhance its competitive advantage.

Potential Risks

Competition: The data center industry is highly competitive, with established players such as Equinix, Digital Realty, and NTT Global Data Centers. Switch faces intense competition in securing new customers and maintaining market share.

Economic Downturn: Economic downturns can negatively impact the demand for data center services, as businesses may reduce their technology spending. Switch’s revenue and profitability could be affected by macroeconomic conditions.

Technological Disruption: The rapid pace of technological innovation poses a risk to Switch’s business model. The emergence of new technologies, such as cloud-native computing and quantum computing, could disrupt the traditional data center market.

Expert Insights

Analysts’ Consensus: According to a consensus estimate from leading analysts, Switch’s stock is expected to reach a target price of $30.00 by 2025, representing a potential upside of approximately 40% from its current price.

Bullish Outlook: Bullish analysts believe that Switch’s strong competitive position, innovative data center design, and growing cloud interconnection business will drive significant revenue growth in the coming years. They expect the company to continue expanding its market share and generate strong cash flows.

Bearish Outlook: Bearish analysts express concerns about the intense competition in the data center industry and the potential impact of economic downturns. They argue that Switch’s valuation is currently stretched, and a correction may be on the horizon.

Stock Forecast Methodology

The Switch stock forecast for 2025 presented in this article is based on a combination of fundamental analysis, technical analysis, and expert insights. The following factors were considered in developing the forecast:

- Historical financial performance

- Market demand for data center services

- Competitive landscape

- Technological trends

- Analyst consensus estimates

Conclusion

Switch’s stock forecast for 2025 presents a compelling opportunity for investors seeking exposure to the growing data center market. The company’s strong competitive position, innovative data center design, and expanding cloud interconnection business are expected to drive significant revenue growth in the coming years. However, investors should be aware of the potential risks associated with the data center industry and the broader economic environment. By carefully considering these factors and monitoring market developments, investors can make informed decisions regarding Switch’s stock.

Closure

Thus, we hope this article has provided valuable insights into Switch Stock Forecast 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!