W-9 Form 2023: A Comprehensive Guide for Independent Contractors and Businesses

Related Articles: W-9 Form 2023: A Comprehensive Guide for Independent Contractors and Businesses

- Lithium Battery 2016 Vs 2032

- 20254 Old Dewdney Trunk Rd. Pitt Meadows Bc

- Best 2024 SUVs For The Money: Top Picks For Value And Performance

- 2025 Canada Election Polling: A Comprehensive Overview

- Virginia Governor’s Election 2025: A Preview

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to W-9 Form 2023: A Comprehensive Guide for Independent Contractors and Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about W-9 Form 2023: A Comprehensive Guide for Independent Contractors and Businesses

W-9 Form 2023: A Comprehensive Guide for Independent Contractors and Businesses

Introduction

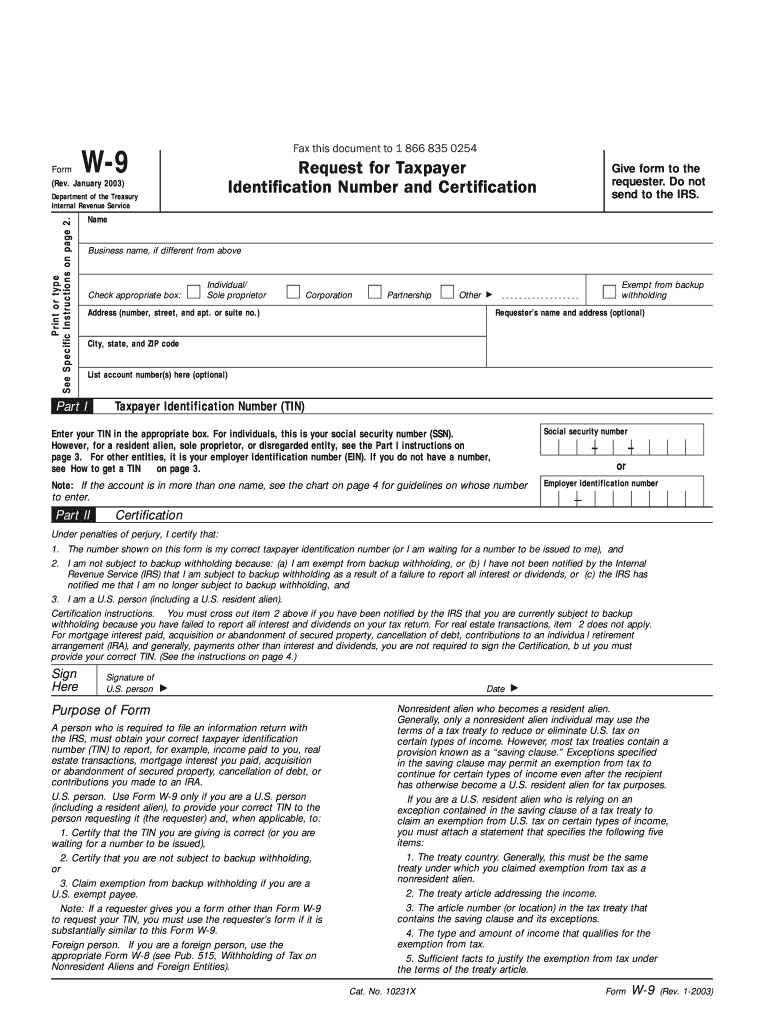

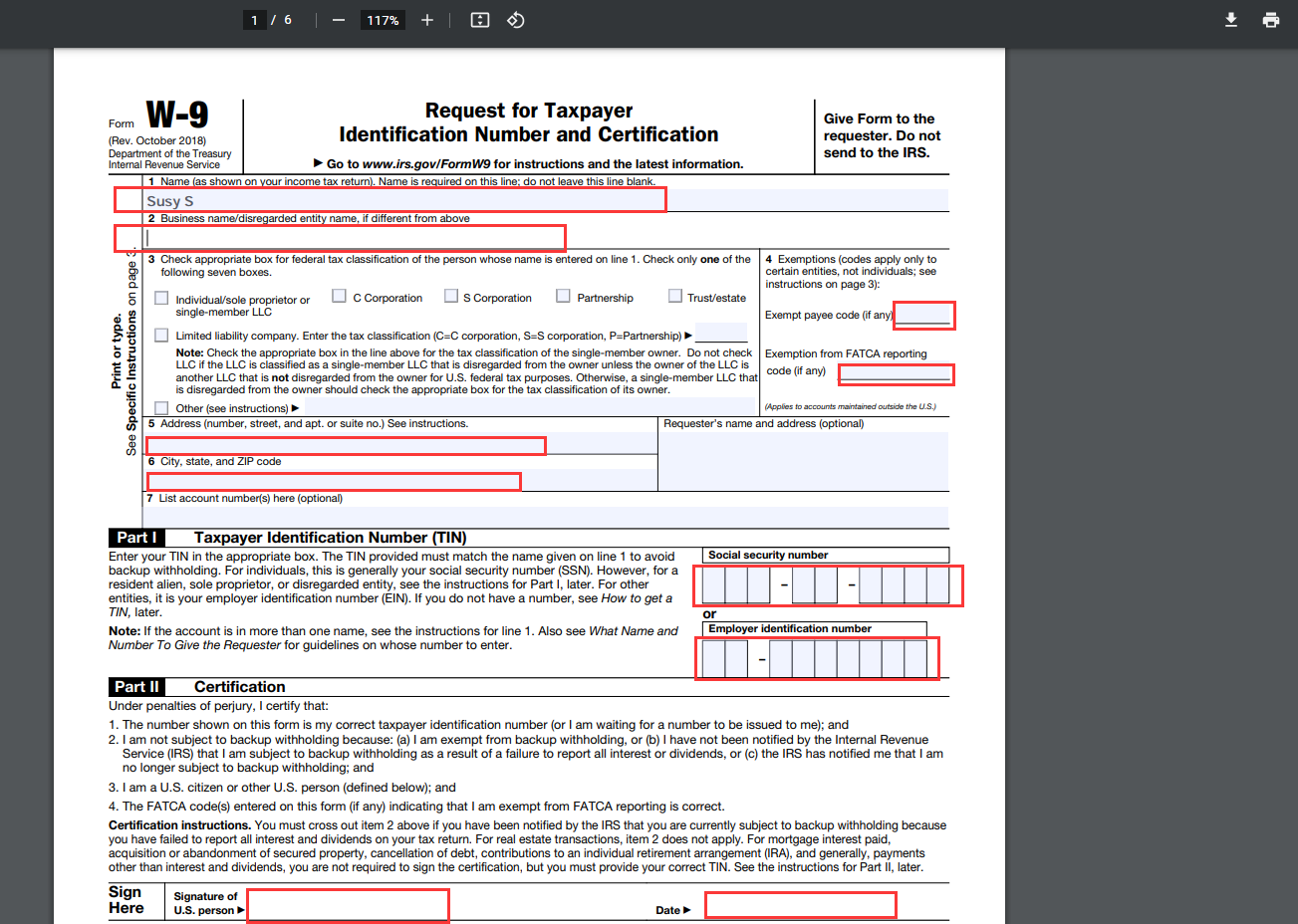

The W-9 form, formally known as the Request for Taxpayer Identification Number and Certification, is a crucial document used by businesses and independent contractors in the United States. It serves as a means for businesses to gather essential information from individuals or entities they engage with for services, allowing them to report these payments accurately to the Internal Revenue Service (IRS).

Purpose of the W-9 Form

The primary purpose of the W-9 form is to collect the following information:

- Taxpayer Identification Number (TIN): This is the Social Security Number (SSN) for individuals or the Employer Identification Number (EIN) for businesses.

- Name: The legal name of the individual or business.

- Address: The current mailing address.

- Certification: The individual or business certifies that the TIN provided is correct and that they are not subject to backup withholding.

Who Needs to Complete a W-9 Form?

Any business or individual that makes payments to independent contractors or other non-employees for services rendered must obtain a W-9 form from them. This includes payments for:

- Freelance work

- Consulting services

- Professional fees

- Commissions

- Rent or royalties

Instructions for Completing the W-9 Form

The W-9 form is straightforward to complete. Here are the step-by-step instructions:

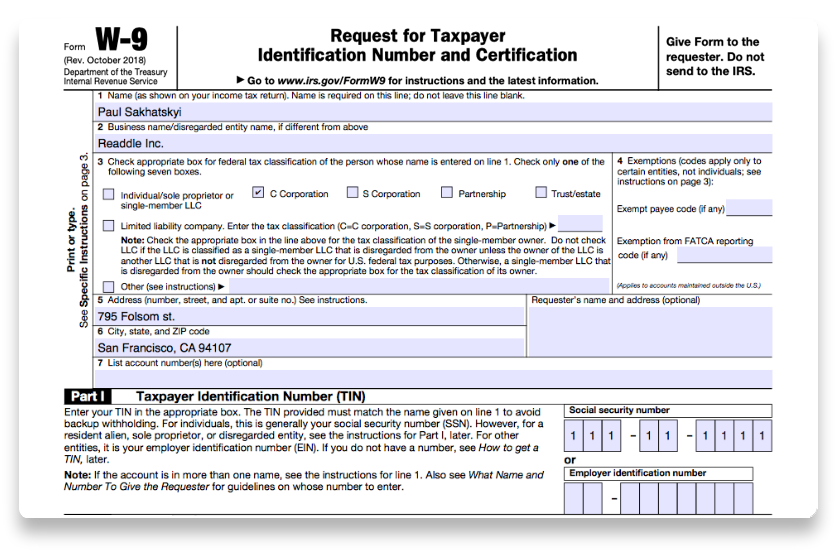

Part I: Taxpayer Information

- Name: Enter your legal name as it appears on your tax return.

- Business Name (if applicable): If you operate a business, enter your business name.

- Address: Provide your current mailing address.

- City, State, and Zip Code: Enter your city, state, and ZIP code.

Part II: Certification

- Taxpayer Identification Number (TIN): Enter your SSN or EIN.

- Certification: Check the appropriate box to certify that the TIN provided is correct and that you are not subject to backup withholding.

- Signature and Date: Sign and date the form.

Important Notes

- Use black ink to complete the form.

- Do not use abbreviations or special characters.

- If you are an individual, do not enter your spouse’s SSN.

- If you are a non-resident alien, follow the specific instructions provided in the form.

When to Provide a W-9 Form

Businesses should request a W-9 form from independent contractors before making any payments. This allows them to have the necessary information to report the payments accurately on Form 1099-MISC.

Consequences of Not Providing a W-9 Form

If a business fails to obtain a W-9 form from an independent contractor, they may be subject to a backup withholding penalty of 24%. This means that the business will be required to withhold 24% of the payments made to the contractor, which can result in significant financial penalties.

Reporting Requirements

Businesses are required to report payments made to independent contractors on Form 1099-MISC. This form must be filed with the IRS and provided to the contractor by January 31st of the following year.

Changes to the W-9 Form in 2023

There are no significant changes to the W-9 form for 2023. However, the IRS recommends that businesses and individuals use the most recent version of the form to ensure compliance.

Conclusion

The W-9 form is an essential tool for businesses and independent contractors in the United States. By understanding its purpose, instructions, and reporting requirements, both parties can avoid potential penalties and ensure accurate tax reporting. Remember to always keep a copy of the W-9 forms for your records.

Closure

Thus, we hope this article has provided valuable insights into W-9 Form 2023: A Comprehensive Guide for Independent Contractors and Businesses. We appreciate your attention to our article. See you in our next article!