Will Interest Rates Fall in 2025?

Related Articles: Will Interest Rates Fall in 2025?

- 2025 Canada Election Polling: A Comprehensive Overview

- 2025 Lexus RX 350: An Autotrader Exclusive Preview

- Disney Holidays 2025: A Magical Extravaganza Awaits

- Dr In Kaufman Tx

- 2025 WBC Qualifiers: Road To The Premier International Baseball Event

Introduction

With great pleasure, we will explore the intriguing topic related to Will Interest Rates Fall in 2025?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Will Interest Rates Fall in 2025?

Will Interest Rates Fall in 2025?

Introduction

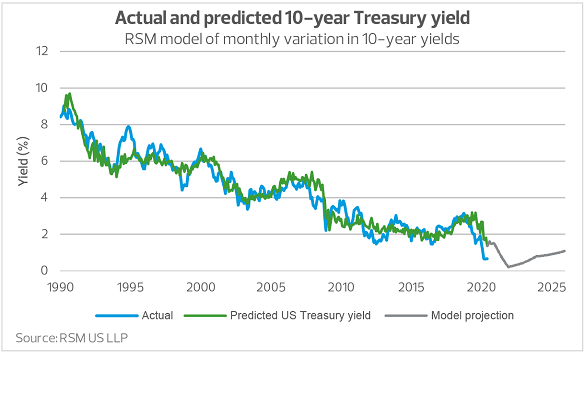

Interest rates have been a major topic of discussion in recent years, as central banks around the world have been raising them to combat inflation. However, some economists believe that interest rates may start to fall again in 2025.

Factors that could lead to falling interest rates

There are a number of factors that could lead to falling interest rates in 2025.

- Inflation could start to moderate. Inflation has been rising in many countries around the world, but it is expected to start to moderate in 2023 and 2024. This is because the global economy is slowing down and supply chain disruptions are easing.

- The Federal Reserve could start to cut interest rates. The Federal Reserve has been raising interest rates in an effort to combat inflation. However, it is possible that the Fed could start to cut interest rates in 2025 if inflation starts to moderate.

- The global economy could slow down. The global economy is expected to slow down in 2023 and 2024. This could lead to lower demand for borrowing, which could in turn lead to lower interest rates.

Factors that could prevent interest rates from falling

There are also a number of factors that could prevent interest rates from falling in 2025.

- Inflation could remain high. If inflation does not start to moderate, the Federal Reserve may be reluctant to cut interest rates.

- The global economy could recover more quickly than expected. If the global economy recovers more quickly than expected, this could lead to higher demand for borrowing, which could in turn lead to higher interest rates.

- The Federal Reserve could raise interest rates more aggressively than expected. If the Federal Reserve believes that inflation is not moderating quickly enough, it could raise interest rates more aggressively than expected.

Conclusion

It is difficult to say with certainty whether interest rates will fall in 2025. There are a number of factors that could lead to falling interest rates, but there are also a number of factors that could prevent interest rates from falling. The most likely scenario is that interest rates will remain relatively stable in 2025.

Implications for businesses and consumers

Falling interest rates can have a number of implications for businesses and consumers.

- Businesses may be able to borrow money at lower rates. This could lead to increased investment and job creation.

- Consumers may be able to get lower rates on their mortgages and other loans. This could free up more money for spending and investment.

- Falling interest rates can also lead to higher stock prices and other asset prices. This could benefit investors.

Overall, falling interest rates can have a positive impact on the economy and on businesses and consumers. However, it is important to note that there are a number of factors that could prevent interest rates from falling in 2025.

Closure

Thus, we hope this article has provided valuable insights into Will Interest Rates Fall in 2025?. We hope you find this article informative and beneficial. See you in our next article!