ZOM Stock Predictions 2025: A Comprehensive Analysis

Related Articles: ZOM Stock Predictions 2025: A Comprehensive Analysis

- Events In San Francisco Next Month: 2025

- The 2025 Dodge Ram 3500: A Titan Of Towing And Capability

- 2025 Honda Prelude: A Resurgence Of Sporty Elegance

- Embark On A Soulful Odyssey With The 2025 Soul Train Cruise

- 2025 Hyundai Santa Fe Interior: A Sophisticated And Spacious Haven

Introduction

With great pleasure, we will explore the intriguing topic related to ZOM Stock Predictions 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about ZOM Stock Predictions 2025: A Comprehensive Analysis

ZOM Stock Predictions 2025: A Comprehensive Analysis

Introduction

Zomedica (ZOM), a veterinary health company, has gained significant attention in the stock market due to its innovative diagnostic platform, TRUFORMA. As investors seek to evaluate the company’s future prospects, this article provides a comprehensive analysis of ZOM stock predictions for 2025, examining various factors that may influence its performance.

ZOM’s Business Overview

Zomedica is a pioneer in the field of veterinary diagnostics, developing rapid and accurate diagnostic tests for animal diseases. Its flagship product, TRUFORMA, is a point-of-care analyzer that enables veterinarians to perform in-clinic blood tests with results in as little as 20 minutes. This technology has the potential to revolutionize veterinary care, improving diagnostic accuracy and reducing turnaround time.

Financial Performance and Market Share

ZOM’s financial performance has shown steady growth in recent years. In 2022, the company reported revenue of $28.9 million, an increase of 26% year-over-year. The company’s gross profit margin has also improved, reaching 52% in 2022. Zomedica holds a significant market share in the veterinary diagnostics market, with its TRUFORMA platform gaining traction among veterinary clinics.

Industry Trends and Competitive Landscape

The veterinary diagnostics market is expected to grow significantly in the coming years, driven by increasing pet ownership and demand for advanced diagnostic technologies. However, ZOM faces competition from established players such as IDEXX Laboratories and Abaxis. To maintain its competitive edge, Zomedica is investing in research and development, expanding its product portfolio, and pursuing strategic partnerships.

ZOM Stock Price Analysis

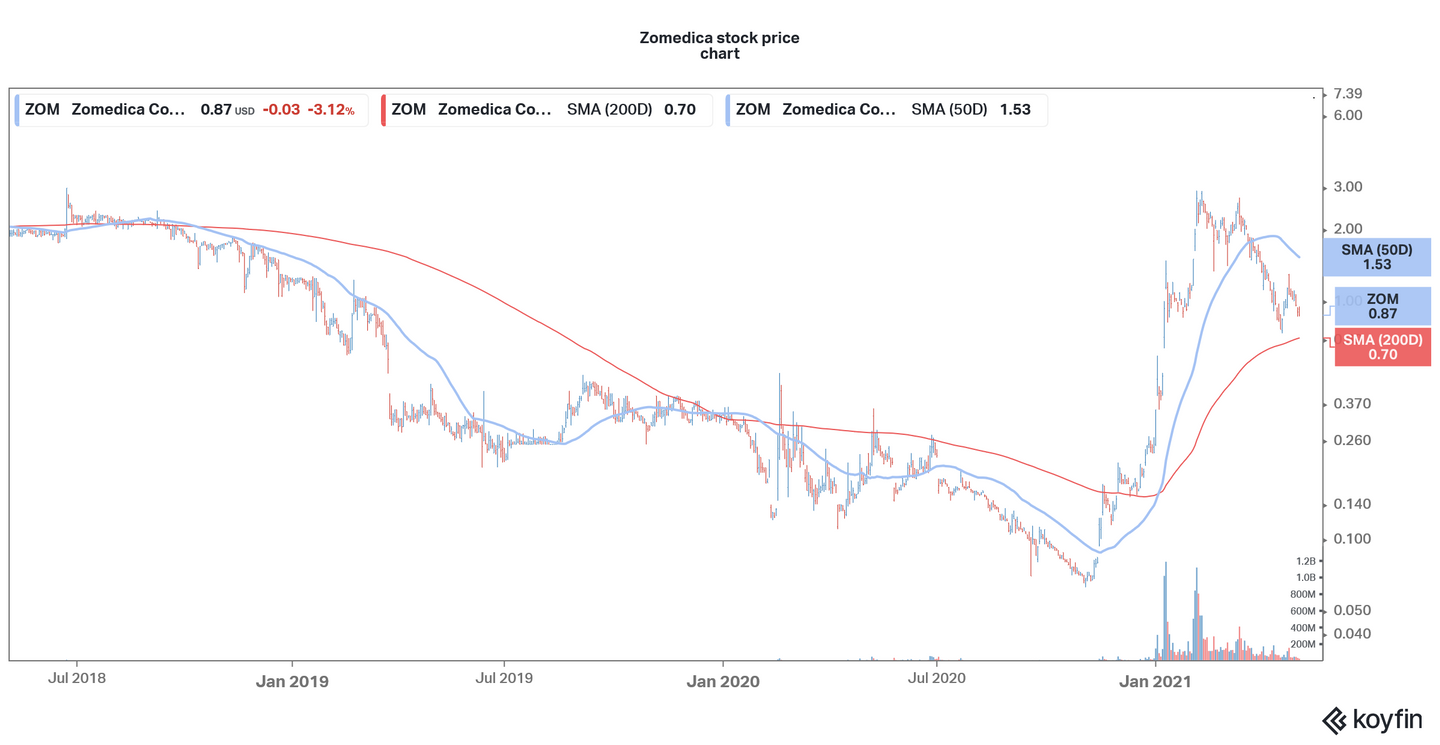

ZOM’s stock price has experienced significant volatility in recent years, influenced by factors such as financial performance, industry trends, and investor sentiment. In 2022, the stock reached a peak of $3.36 before declining to its current level of around $0.50.

Analysts’ Predictions for 2025

Analysts’ predictions for ZOM stock in 2025 vary widely, reflecting the uncertainties surrounding the company’s growth trajectory. Some analysts are optimistic about the company’s long-term prospects, citing its innovative technology and growing market share. They predict that ZOM stock could reach $2.00 or higher by 2025.

Other analysts are more cautious, highlighting the competitive nature of the industry and ZOM’s need to demonstrate consistent profitability. They forecast that the stock could trade in a range of $0.50 to $1.00 by 2025.

Factors Influencing ZOM Stock Performance

Several factors may influence ZOM stock performance in the coming years:

- TRUFORMA Platform Adoption: The adoption of Zomedica’s TRUFORMA platform by veterinary clinics will be crucial for the company’s revenue growth.

- Market Penetration: ZOM’s ability to penetrate new markets and expand its customer base will drive its market share and revenue potential.

- Competition and Innovation: The competitive landscape in the veterinary diagnostics market will impact ZOM’s ability to maintain its market share and develop new products.

- Financial Performance: ZOM’s financial performance, including revenue growth, profitability, and cash flow, will influence investor sentiment and stock price.

- Regulatory Environment: Changes in the regulatory environment for veterinary diagnostics could affect ZOM’s operations and product development.

Risks and Considerations

Investors should be aware of the following risks associated with investing in ZOM stock:

- Market Competition: Zomedica faces intense competition from established players in the veterinary diagnostics market.

- Product Development Delays: The development and commercialization of new diagnostic tests can be complex and time-consuming.

- Regulatory Hurdles: Zomedica’s products must meet regulatory requirements, which can be challenging and costly.

- Financial Dependence: ZOM is heavily dependent on revenue from TRUFORMA, which could expose the company to risks if the product fails to gain market acceptance.

Conclusion

ZOM stock predictions for 2025 vary widely, reflecting the uncertainties surrounding the company’s growth trajectory. Analysts’ estimates range from $0.50 to $2.00 or higher, depending on factors such as TRUFORMA platform adoption, market penetration, competition, and financial performance. Investors should carefully consider the risks and potential rewards before making investment decisions. While Zomedica has the potential to be a significant player in the veterinary diagnostics market, the company’s success will depend on its ability to execute its business strategy and overcome industry challenges.

Closure

Thus, we hope this article has provided valuable insights into ZOM Stock Predictions 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!